From diesel privileges to commuting allowances, there are many reasons for subsidising transport. But when it comes to the climate, not all of them are desirabe. One foot on the throttle, the other on the brake? This contradiction can be expressed in negative CO2 prices.

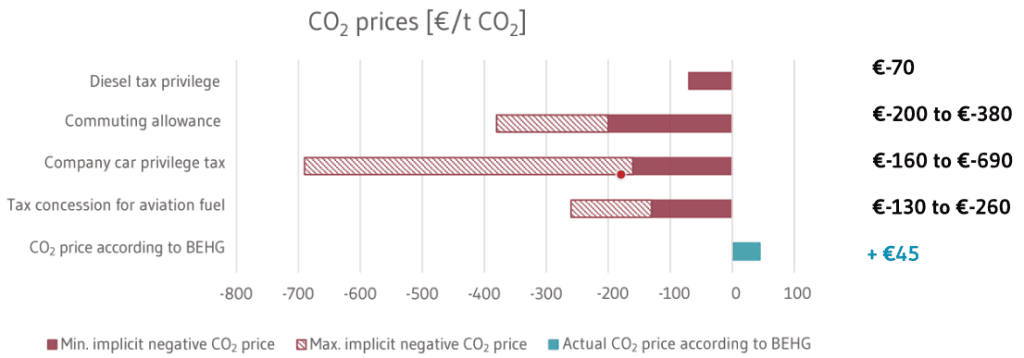

Calculations in a new Ariadne study show that subsidies in the transport sector sometimes correspond to negative CO2 prices of between -€70 and -€690 per tonne of CO2. Germany’s current tax and levy system in the transport sector is still geared towards the use of fossil fuels. Inconsistent price signals between transport subsidies and emis-sions trading hinder the effectiveness of CO2 pricing as an important climate policy instrument.

What do negative prices show?

The long-running debate about climate-damaging subsidies in the transport sector has gained new relevance due to the financial restrictions resulting from the German Federal Constitutional Court’s budget ruling at the end of 2023. Ariadne experts contribute to an objective categorisation and assessment of their significance for climate policy, for the first time converting the amount of significant subsidies in the transport sector into negative CO2 prices.

In emissions trading, the CO2 price is designed to make polluters pay, and thus provides an incentive to reduce emissions. The calculation of implicit negative CO2 prices clearly shows that subsidies reverse this effect: Subsidies indirectly reward CO2 emissions through cost savings. The conversion also allows for a comparison with the actual CO2 price of the German Fuel Emissions Trading Act (BEHG) for transport, putting price signals directly into perspective.

Tax concessions from -€70 up to -€690 per tonne of CO2

Four subsidies relevant to national transport-related CO2 emissions were analysed:

- Diesel privilege (energy tax concession for diesel fuel),

- Commuting allowance,

- Company car privilege (flat-rate taxation of the non-cash benefit of privately used company cars),

- Tax concession for aviation fuel (tax concession for energy products used in domestic air traffic).

The diesel privilege and the tax concession for aviation fuel directly reduce the tax burden on the use of fossil fuels. In the case of the commuting allowance and company car privilege, the effect is more oblique: The tax structure leads indirectly to higher emissions.

Converted into tax concessions per quantity of CO2 emitted, the four subsidies result in implicit negative CO2 prices of -€70 to -€690 per tonne of CO2 – and thus, in some cases, significantly overcompensate for the CO2 price of €45 per tonne of CO2 in 2024 currently set by the BEHG. The calculations show how strongly the current system of taxes and levies continues to favour the use of fossil fuels.

High negative prices: Who benefits?

The distributional effect differs for the four subsidies analysed. High-income households benefit disproportionately in all cases.

The impact of the diesel privilege on the income distribution is moderate for all households, but still noticeable for those affected individually. Ownership of a diesel car increases significantly with in-

come: while only a few households in the lower-income groups own a diesel car, this figure rises to around a quarter in the middle-income groups, and to as much as a third in higher-income groups. However, the few diesel drivers who are in the lower-income groups are significantly better off relative to their income.

The commuting allowance also relieves the burden on middle- and higher-income groups in particular. Lower-income households have fewer employees, who often have shorter commuting distances. The relief effect for these commuters is relatively high at around 0.8% of net income.

The company car privilege mainly favours households with high incomes, as only a few employees with low or medium incomes own a company car. In the few cases of low or medium incomes – such as in field service, care or logistics – the monetary benefits account for a certain proportion of the household income.

The relief effect of the tax concession for aviation fuel is small in macroeconomic terms, as only about 4% of households use domestic flights. Households with higher incomes fly much more often on average.

Reform options

Tax concessions have a varied history and have often been introduced as part of major reforms. In view of the climate targets, they now provoke conflicting objectives. To strengthen the role of carbon pricing, distorting subsidies should be reduced as much as possible or redesigned in a climate-friendly way. The recent protests following the decision to partially dismantle agricultural subsidies underline the importance of predictability, gradual phasing out and clearly communicated compensation measures.

In the short term, a reform of the diesel privilege offers great potential for CO2 reduction, as diesel drivers tend to react immediately to price increases by reducing their consumption. At the same time, higher fuel prices would incentivise a switch to electric cars in the medium term.

In the medium term, a reform of company car privilege could support the expansion of e-mobility. For example, the taxable monetary benefit for internal combustion engines and electric cars could be more differentiated, or it could be reduced in proportion to higher CO2 emissions.

A reform of the commuting allowance can contribute to reducing emissions, especially in the medium and long term, as changes in the choice of place of work and residence are delayed. Short-term effects would only result from the increased use of home offices, which can now be recognised as an income-related expense for tax purposes.

Strengthening the EU-wide price of aviation fuel tax is preferable to domestic taxation due to the low emissions from domestic flights, and the possible effects of fuel evasion.

In a nutshell

- Climate-damaging subsidies in the transport sector imply negative CO2 prices and make it more difficult to achieve climate targets.

- The four selected subsidies correspond to implicit negative CO2 prices of between -€70 and -€690 per tonne of CO2 and thus in some cases significantly overcompensate for the CO2 price of €45 per tonne of CO2 in 2024, currently set by the BEHG.

- High-income households benefit disproportionately from the subsidies.

- The inconsistent price signals weaken the effectiveness of carbon pricing.

- Reforms can strengthen the role of carbon pricing.

- Predictability, gradual reorganisation and clearly defined compensation measures are essential.

Cite this paper:

Nicolas Koch, Patrick Plötz, Niklas Illenseer, Dorothea Kistinger, Katja Treichel-Grass (2024): Making price signals comparable – subsidies as negative CO2 prices – Ariadne brief. Kopernikus project Ariadne, Potsdam.