Summary

We introduce and test a novel design and assessment framework for climate policy mix pathways and use it to construct and assess alternative policy pathways offering increased ambition of Greenhouse Gas (GHG) abatement in Germany’s light duty vehicle (LDV) sector. The main novelty of the approach is a strong focus on temporality, starting from the observation that net zero GHG transitions undergo different stages with different challenges, and therefore different policy approaches are needed as the transitions in different sectors mature. We emphasise policies which not only support the emergence of novel technologies, but also phase out GHG-intensive technology stocks. We focus on the transition from internal combustion engine (ICE) to battery-electric vehicles (BBEV) (“Antriebswende”) to keep the analysis tractable, but recognize the need for a broader mobility transition including e.g. modal shift.

Our approach is dynamic, with the temporality of policy mix design at the core of its logic. Our first temporal design element is that transitions undergo different phases requiring different types of policy interventions. As a transition shifts from an emergence to the diffusion phase (as we argue currently applies to the LDV sector in Germany), policy support needs to shift from fostering the development of new technologies to enabling significantly increased diffusion rates. This includes increasing the stringency of climate policies (e.g. level and rate of increase of carbon pricing) in line with GHG and other related targets, and addressing relevant externalities in this phase (e.g. in the expansion of public charging infrastructure). Policy interventions also need to increasingly foster the phasing out of ICE vehicles from the overall fleet, through regulating or pricing of carbon intensive fuels or the existing ICE stock. We utilize a comparative policy stringency approach, which allows us to characterize dynamic sequencing of the policy pathway designs, as they co-evolve with the changing transition dynamics.

We highlight the need to actively phase out existing carbon emitting technologies, along with supporting diffusion of emergent sustainable alternatives. We argue that in order to meet ambitious environmental targets, policy pathways need to include instruments which actively place pressure on the existing carbon emitting technologies, to accelerate the rate at which the overall stock turns over. This can be achieved through stringent pricing or regulation, or hybrid combinations of the two (instruments with regulatory and pricing components). This becomes increasingly important as the transition is in the diffusion stage, but these kinds of policies are commonly met with more resistance since they change asset (vehicle) values and force behavioural change and may induce socio-economic impacts which could be regressive if not addressed though anticipatory design.

We identify key intertemporal challenges for LDV transitions that policy mix pathways need to address. Policy mix design needs to address six key challenges to successfully drive the LDV sector transition: Environmental effectiveness, cost effectiveness, fiscal costs, distributional effects, political feasibility and governance requirements. We unpack these challenges into sub-components, and related key considerations, drawing on evidence from relevant transport policy literatures. These challenges also serve as ex ante assessment criteria in iteratively designing and evaluating alternative future policy mix pathways.

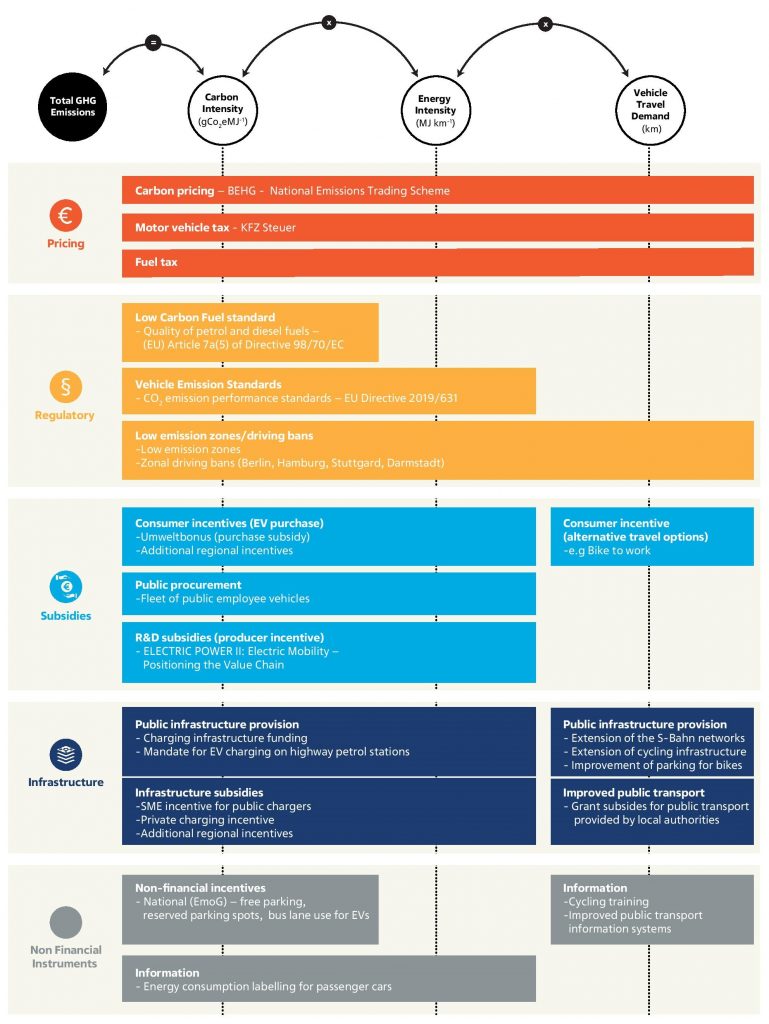

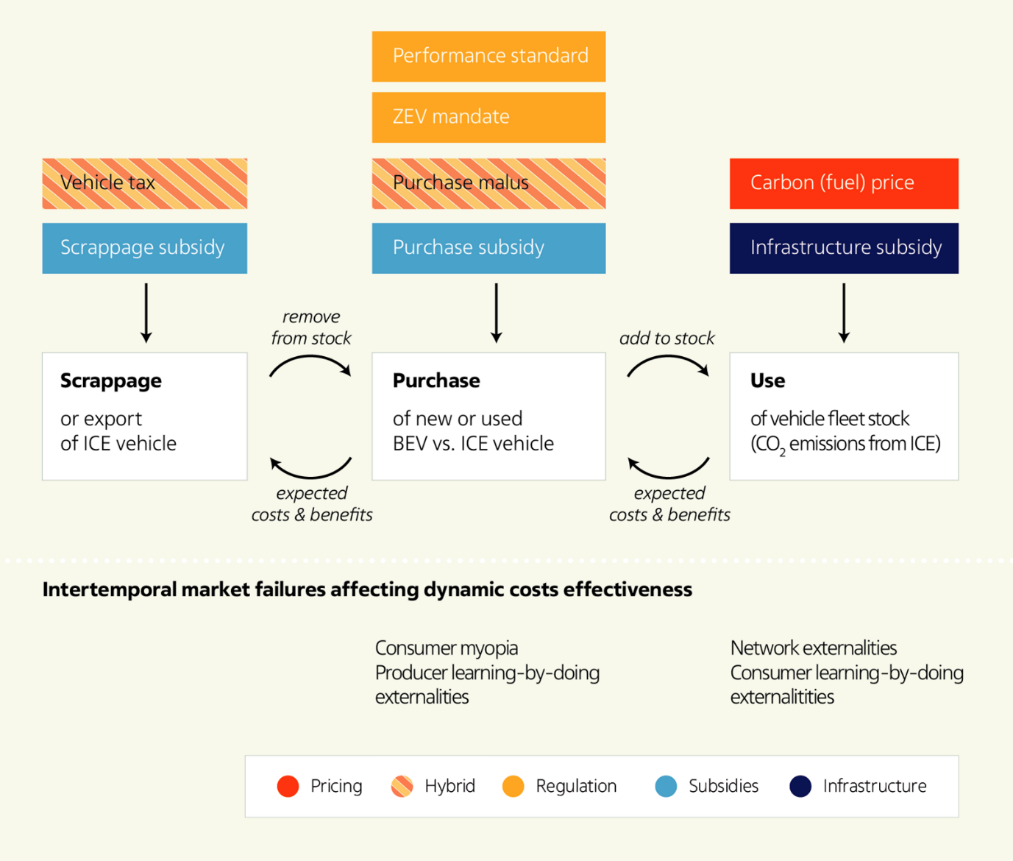

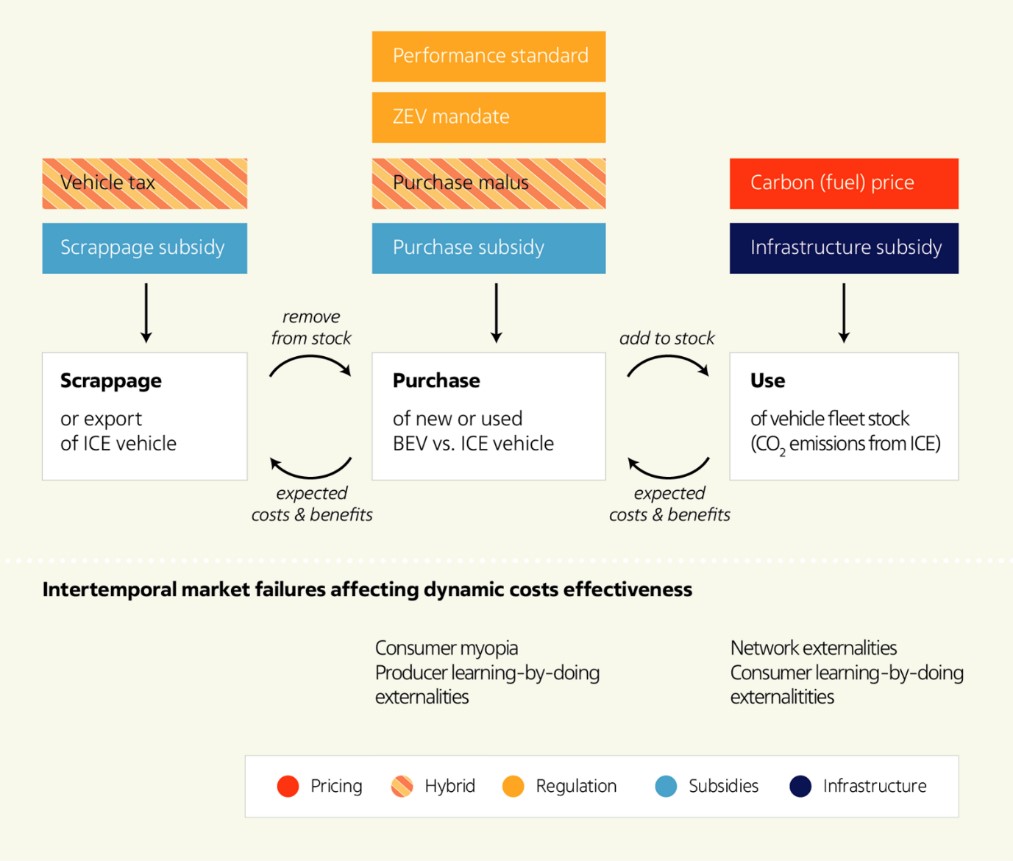

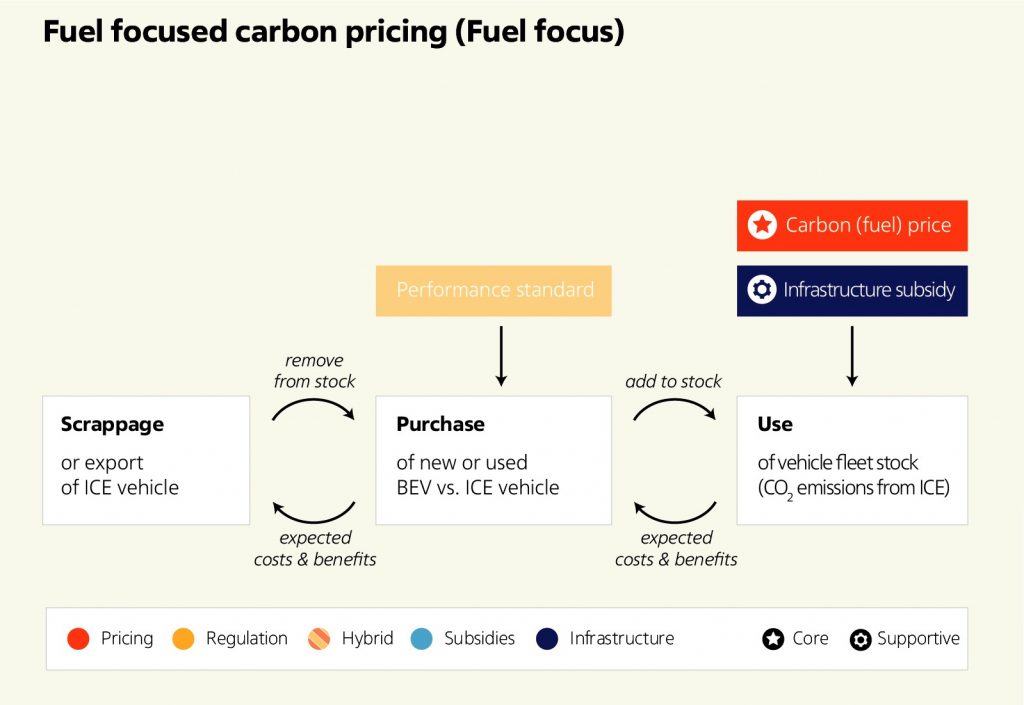

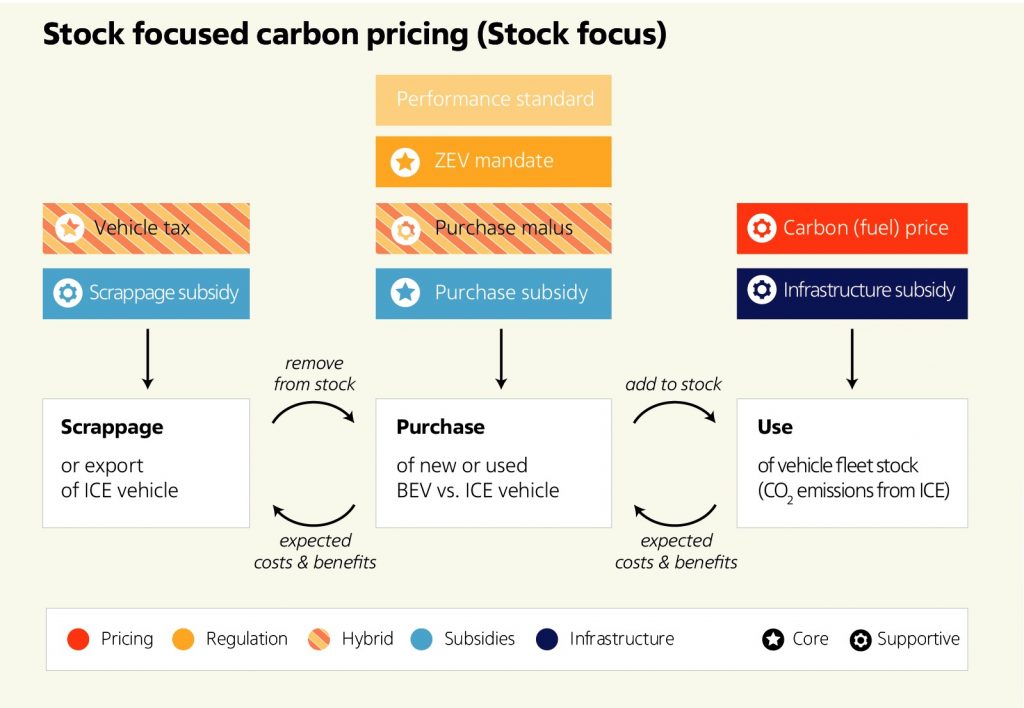

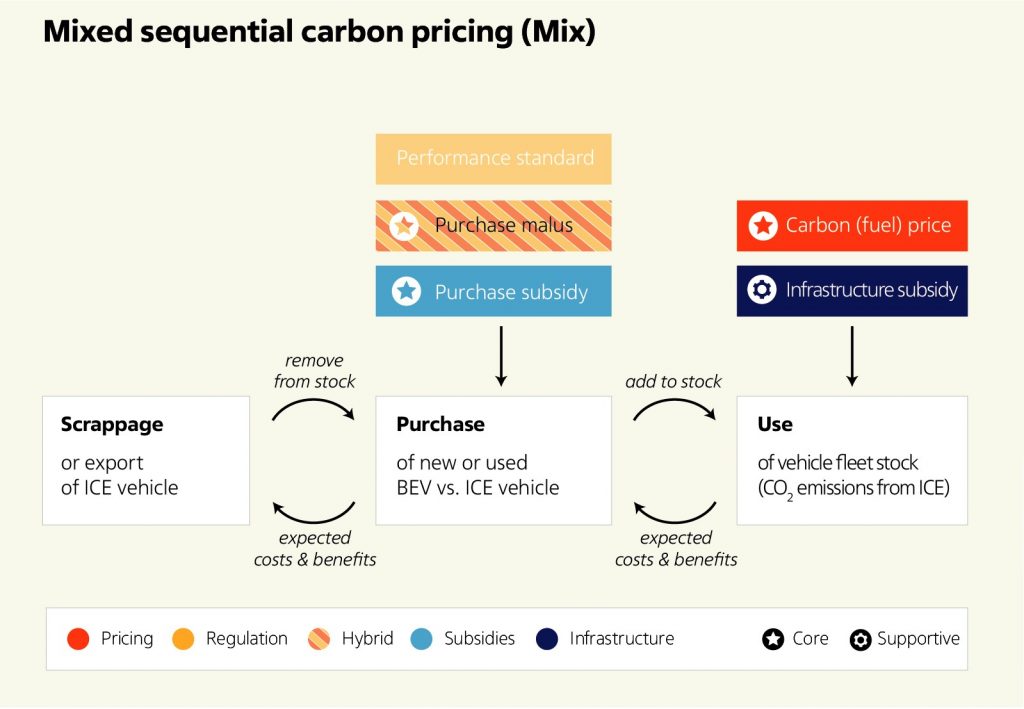

We focus on climate policy instruments that can affect three key consumer decisions driving the LDV transition: scrappage of ICE vehicles, new LDV purchases, and the use of the existing (ICE) vehicle stock. The transition dynamics towards less GHG emissions can be disaggregated into stock turnover (ICE vehicle scrappage and introduction of new BEV) and changes in the use of the existing ICE vehicle stock. Policy instruments can target these dynamics either directly (first order effect) or indirectly (second order effect). Second order effects can refer to expected costs and benefits of vehicle use which incentivize behavioral change, thus influencing purchase/scrappage decisions. Similarly, more availability of charging infrastructure directly affects the usage of existing stock, but also has learning and spillover effects which influence consumer choices for BEV purchases and scrappage of ICE. Second order effects can also refer to manufacturers investment decisions in developing new model generations, which in turn lead to changes in prices and performance, and therefore influence consumer purchase/scrappage decisions. Manufacturers’ decisions will be influenced by expectations about consumer behavior and broader market developments (e.g. cost developments of batteries), and the credibility of the policy mix pathway in place. Due to the prevalence of market failures, especially second order effects may not function perfectly, e.g, hinder cost effectiveness, which might in turn require additional instruments. As high complexity of a policy mix bears increased risk such as unexpected outcomes and need for (error-prone) frequent adjustments of the policy mix by policymakers, a key consideration in our dynamic design is striking the right balance between sufficiently targeting market failures and political feasibility challenges, and reducing complexity of the policy mix. Figure 1 displays key consumer decisions related market failures, and key policy instruments.

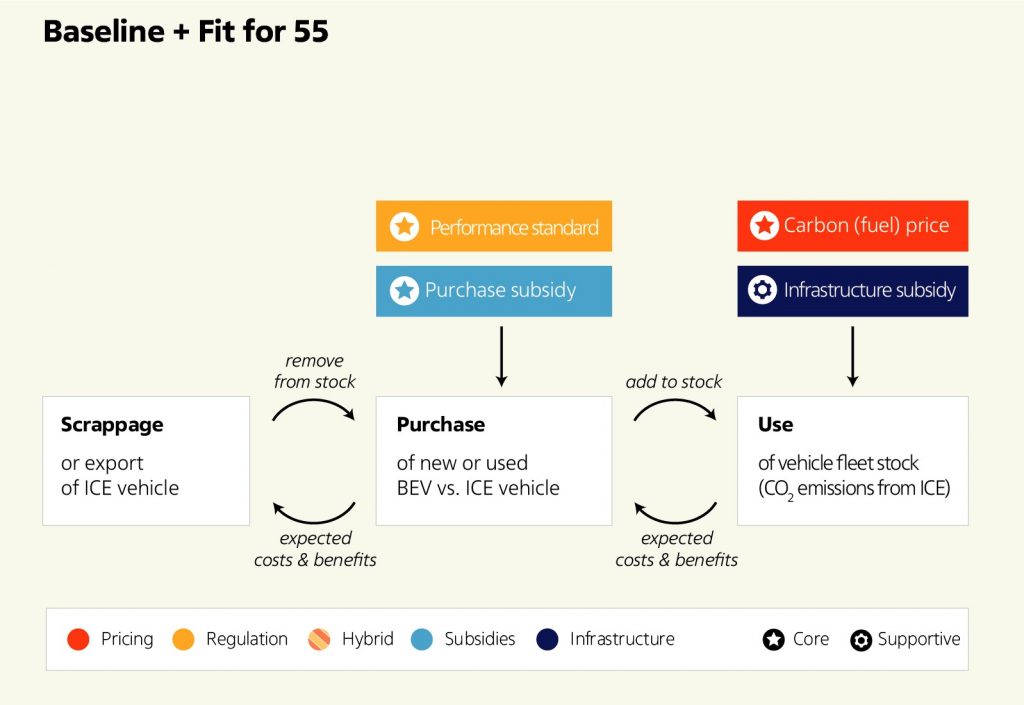

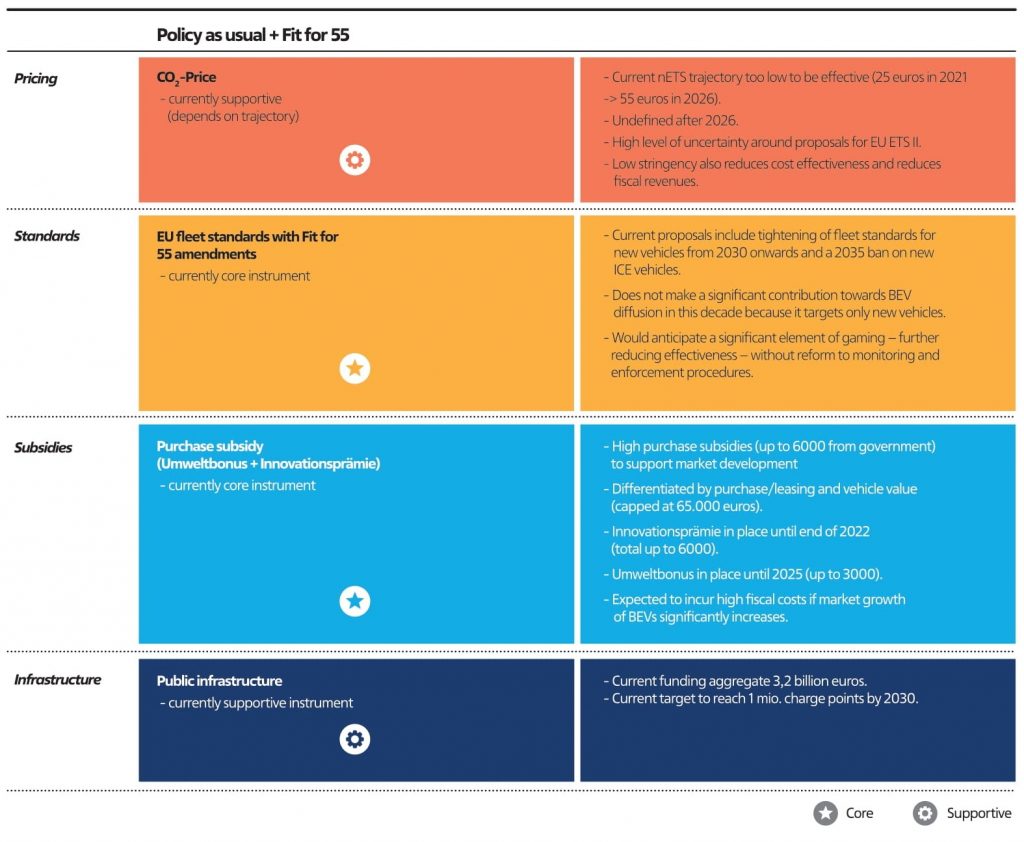

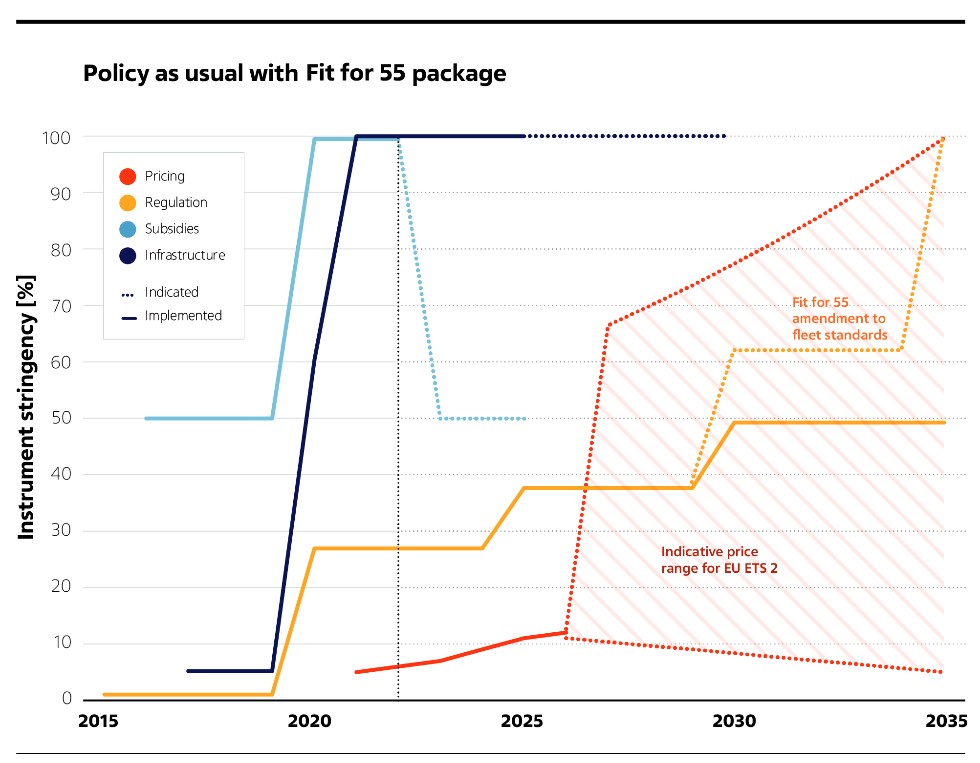

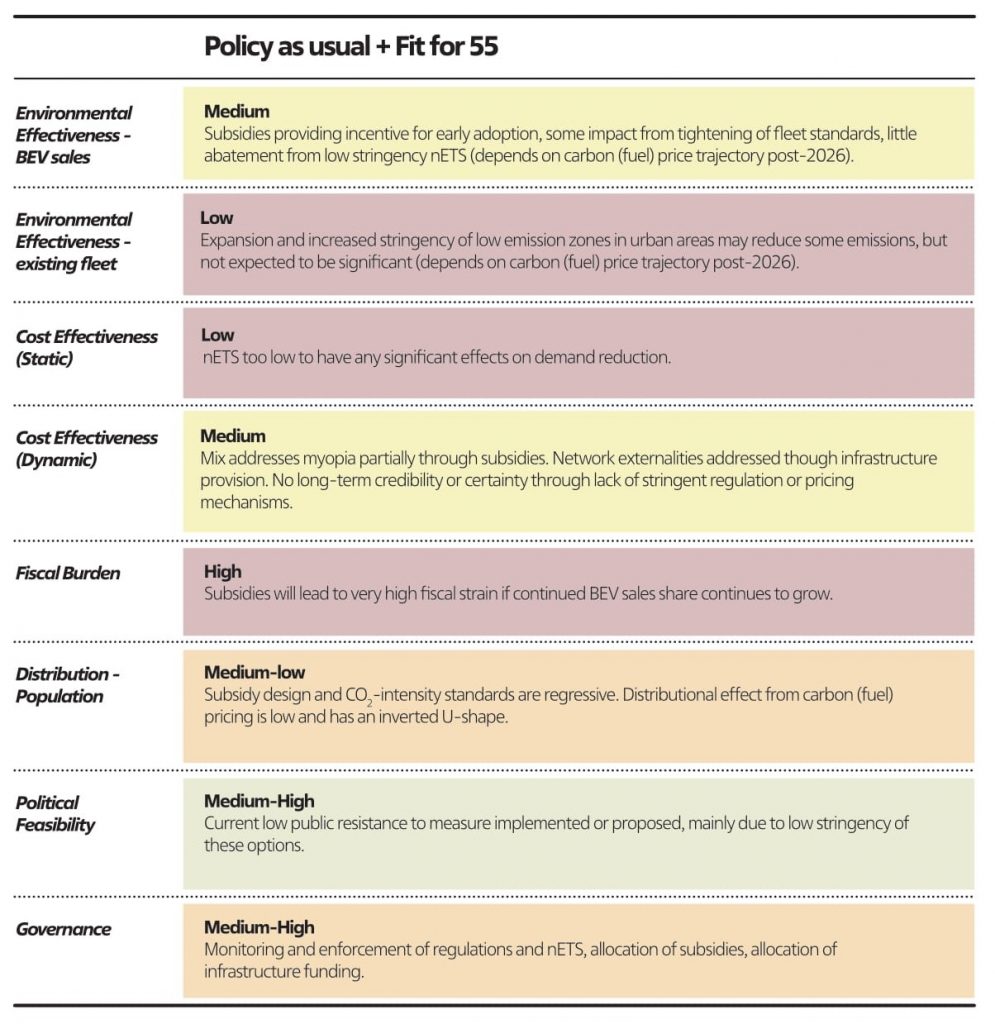

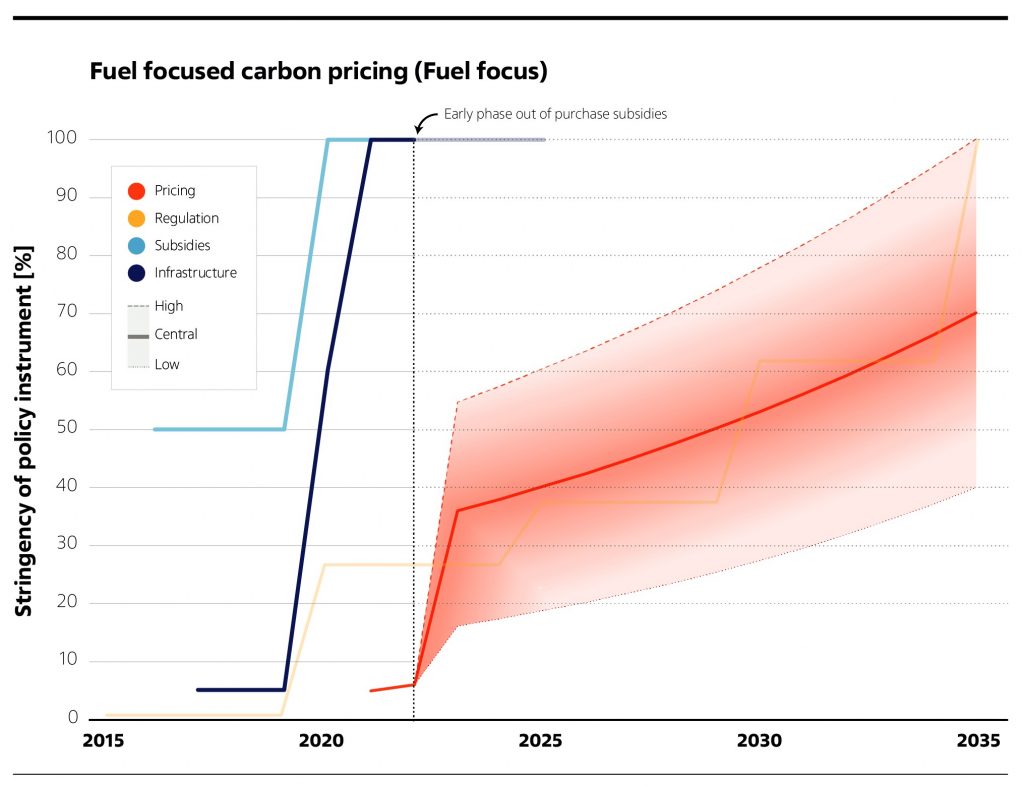

We use our approach to compare the stringency of policy instruments over time across different future policy pathways, first reconstructing the status quo policy pathway in Germany, including the EU commissions’ Fit For 55 proposals. We identify the main components of the current policy mix pathway for LDVs in Germany. We represent the stringency of each policy instrument over time in a way that is comparable across different policy instrument pathway scenarios.

Our qualitative assessment suggests that the status quo policy mix pathway in Germany is likely insufficient to contribute to delivering the 2030 transport sector greenhouse gas and BEV targets. The current policy mix is not suited to supporting the required next steps of the large-scale transformation, as the market share of BEVs needs to increase substantially. The current policy mix relies mostly on purchase subsidies which have been associated with an increase in market adoption of BEVs. Continued reliance on this policy mix to support the transition would be expensive in fiscal terms though. The current carbon (fuel) price level and trajectory as well as vehicle fleet CO2-efficiency standards are relatively unambitious, and unless scaled up and/or reformed, it is not plausible that sector GHG targets up to 2030 will be achieved.

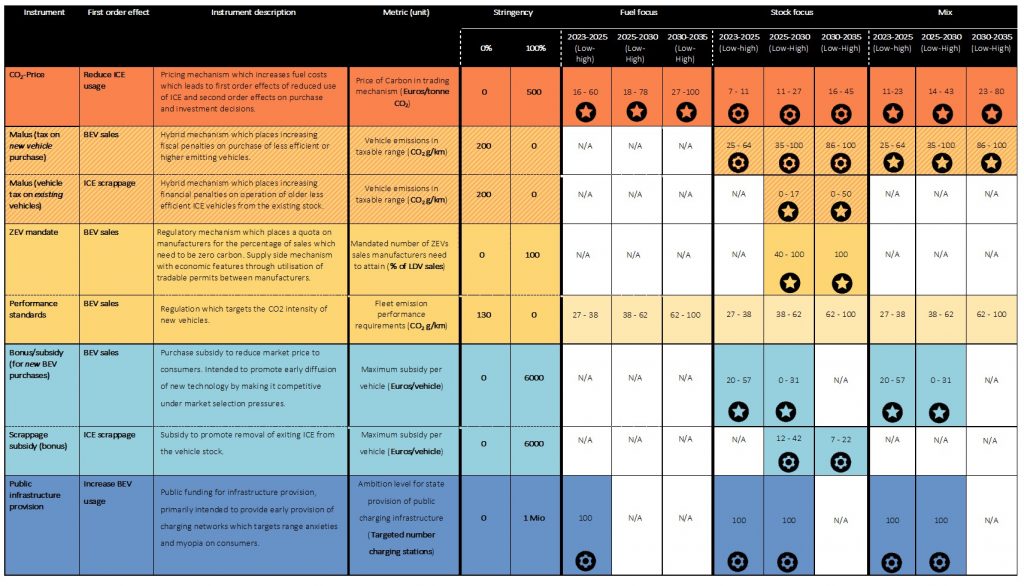

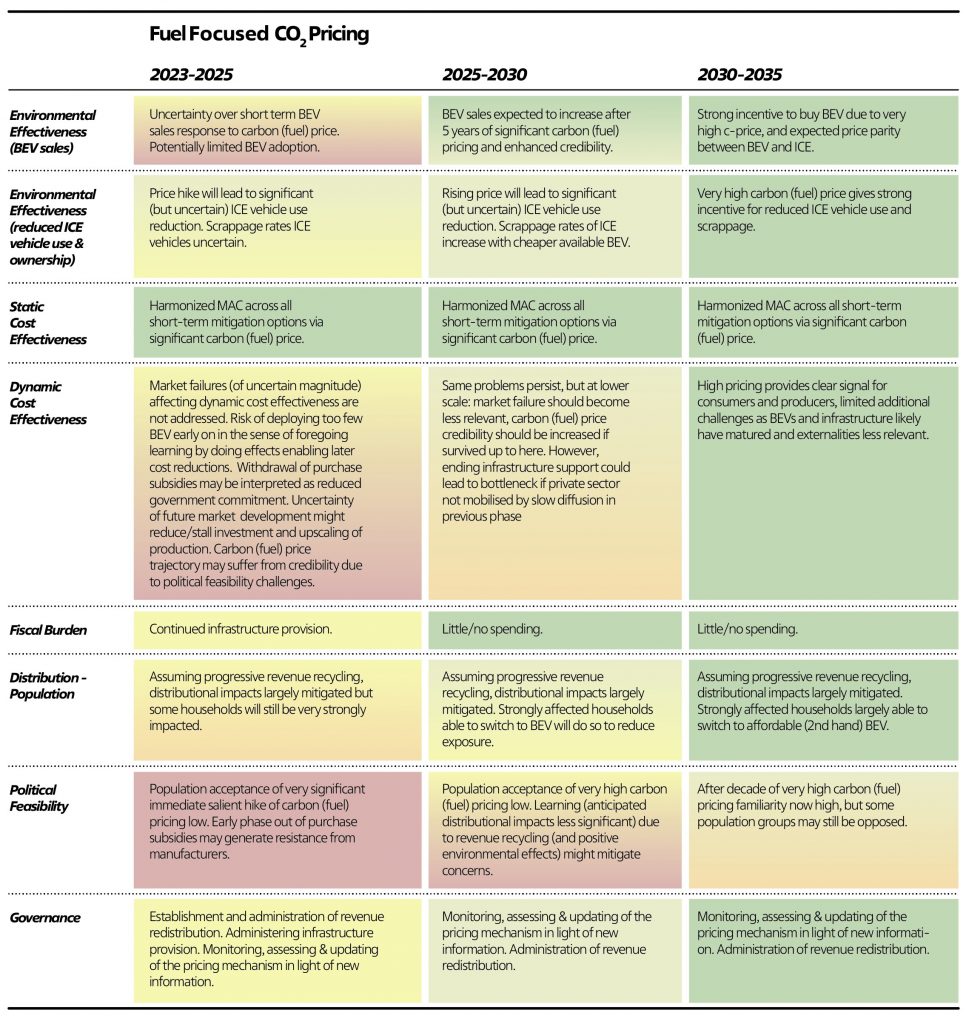

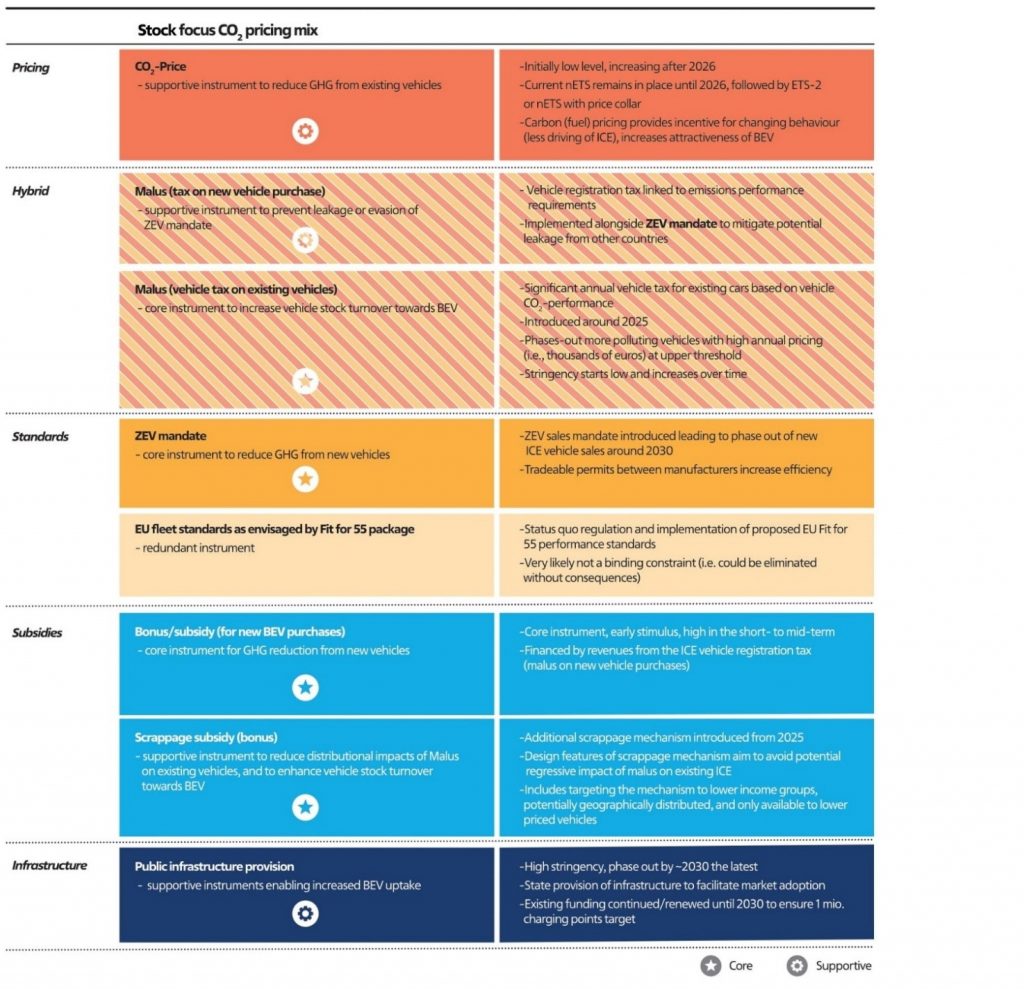

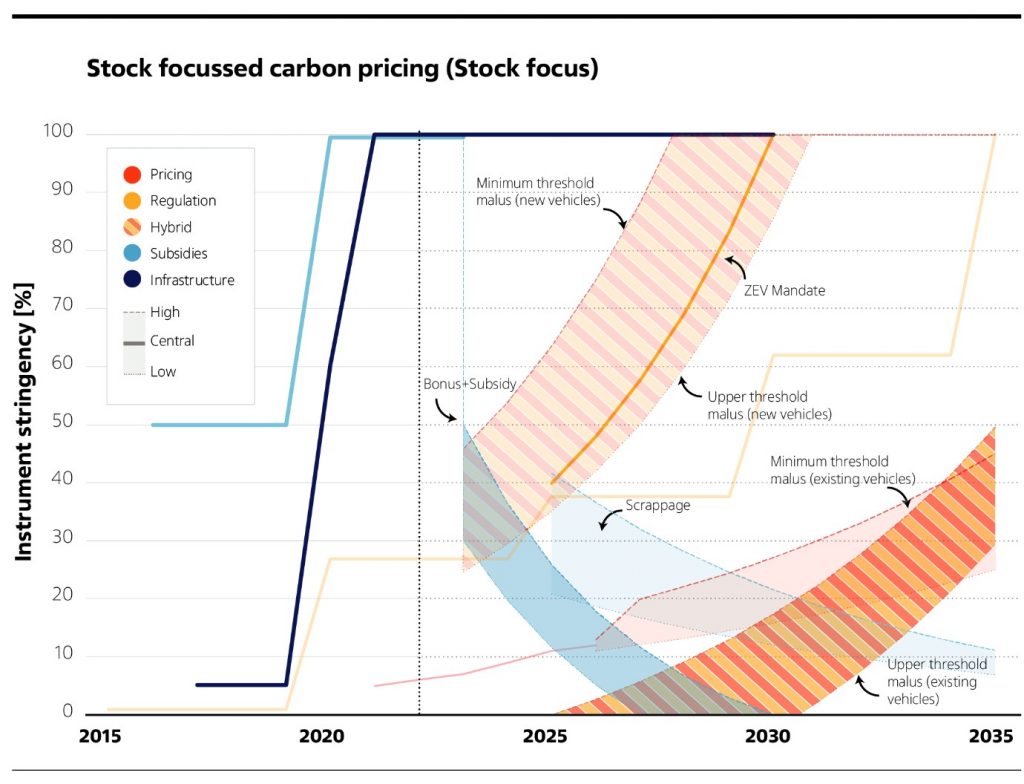

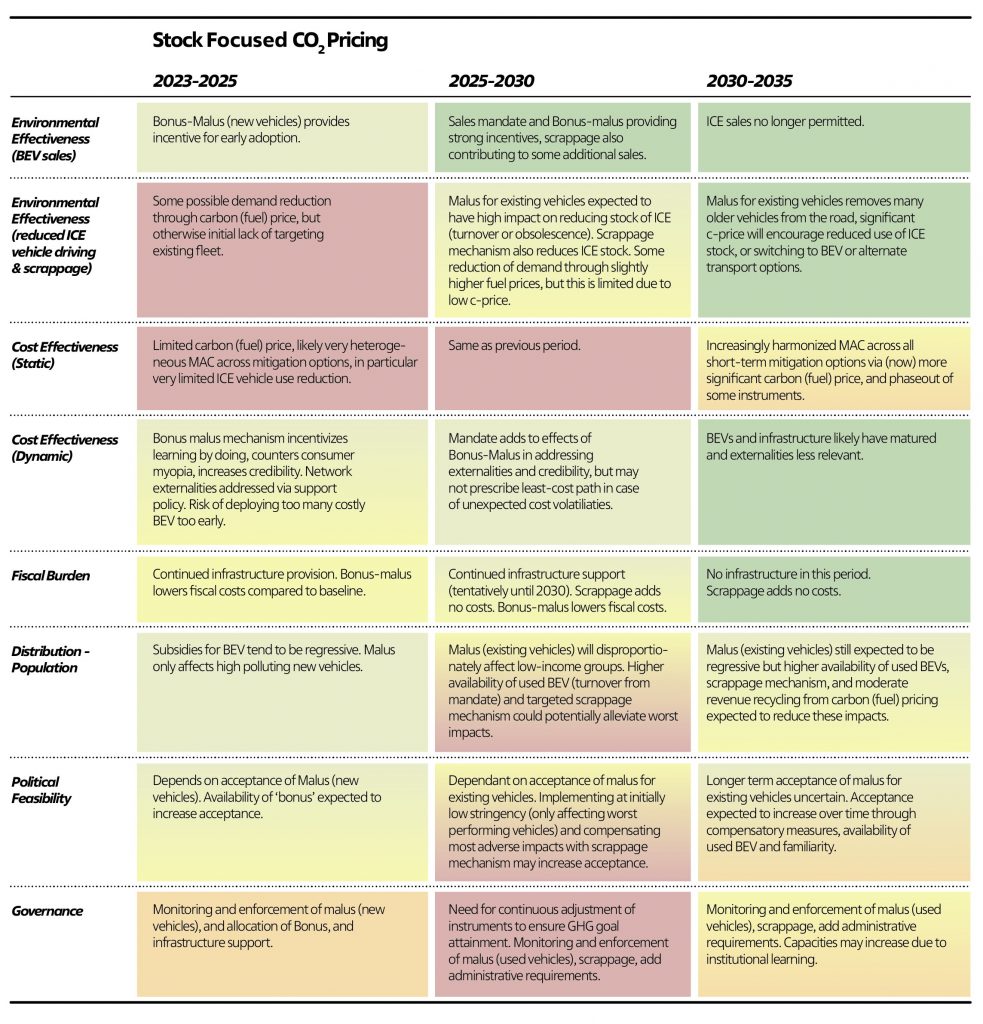

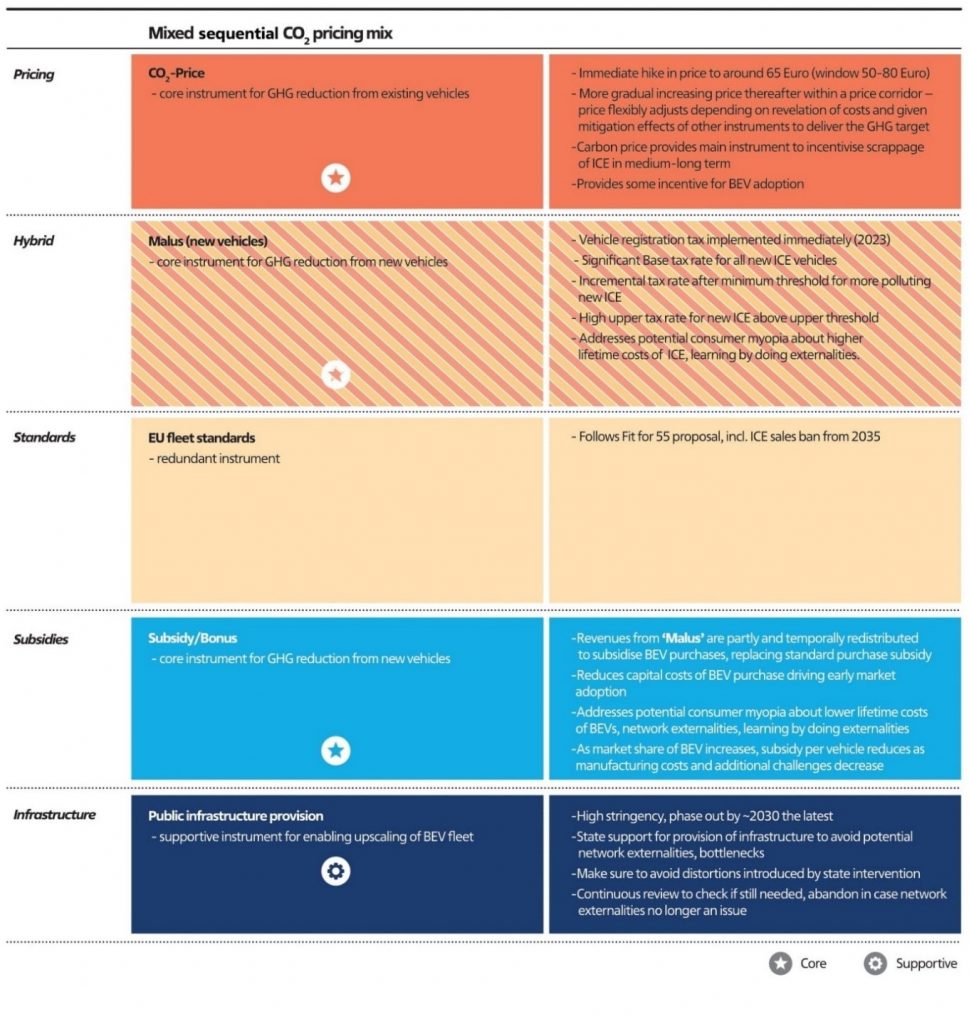

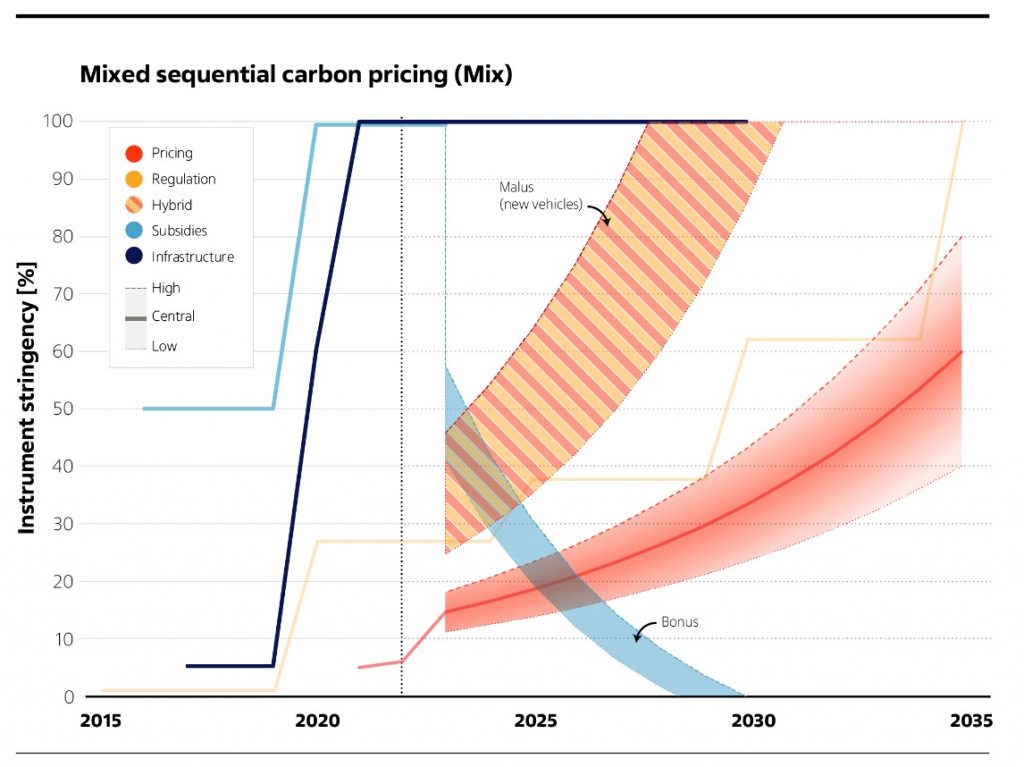

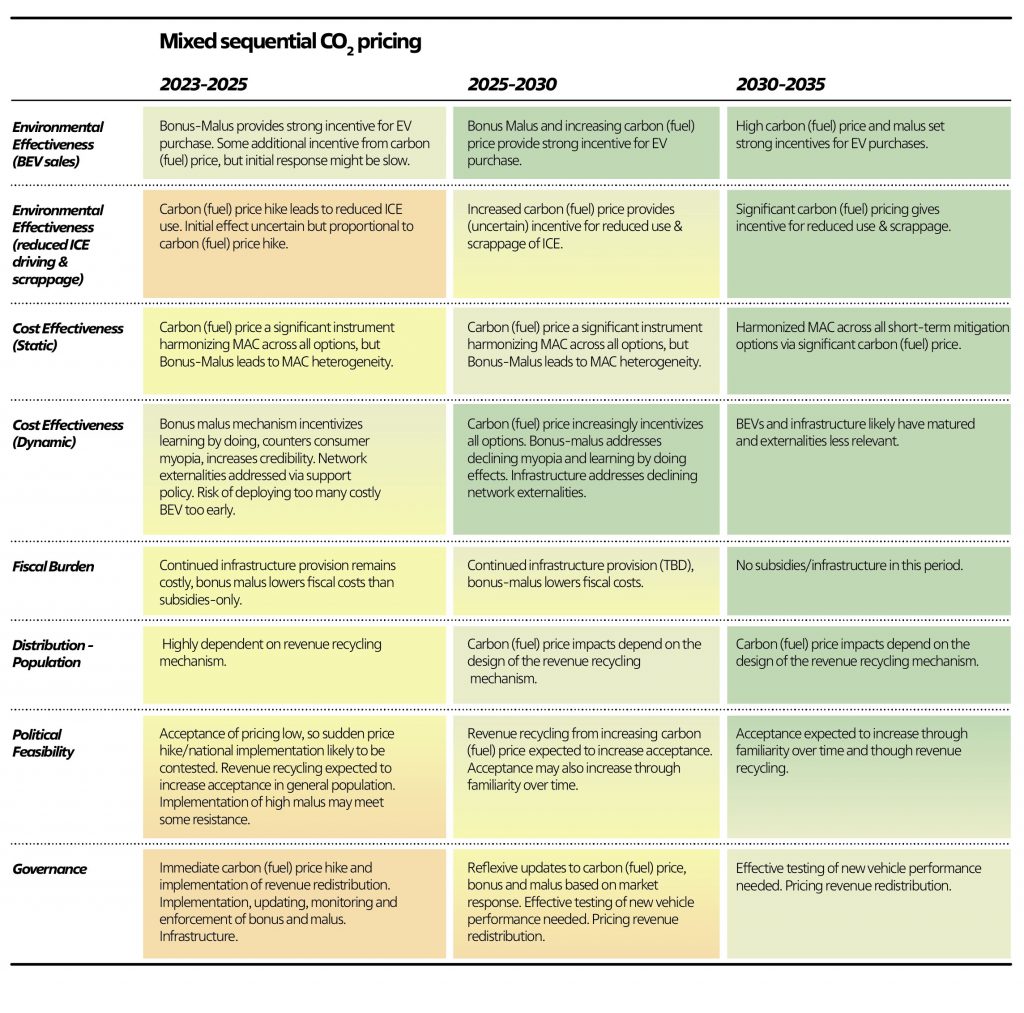

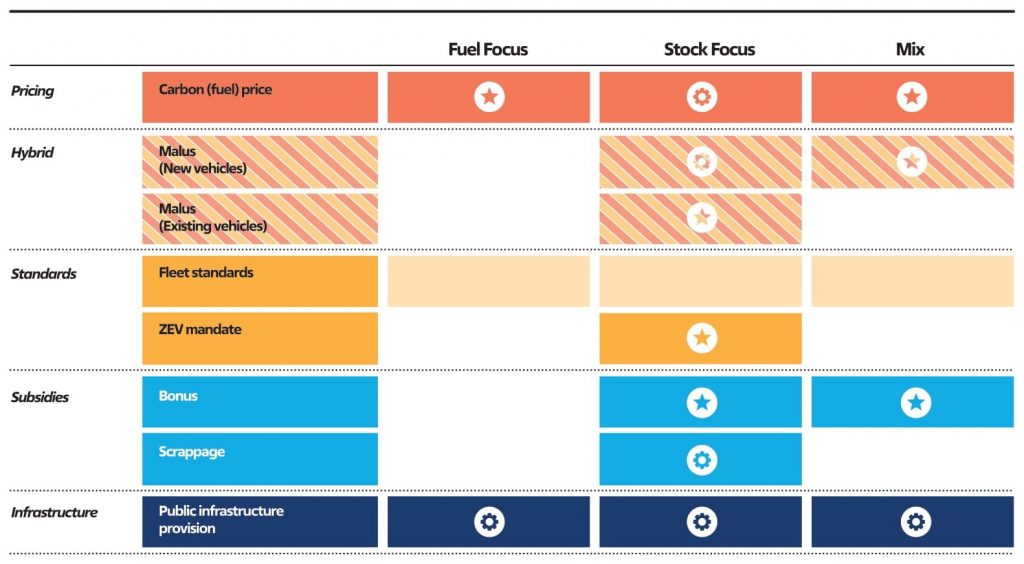

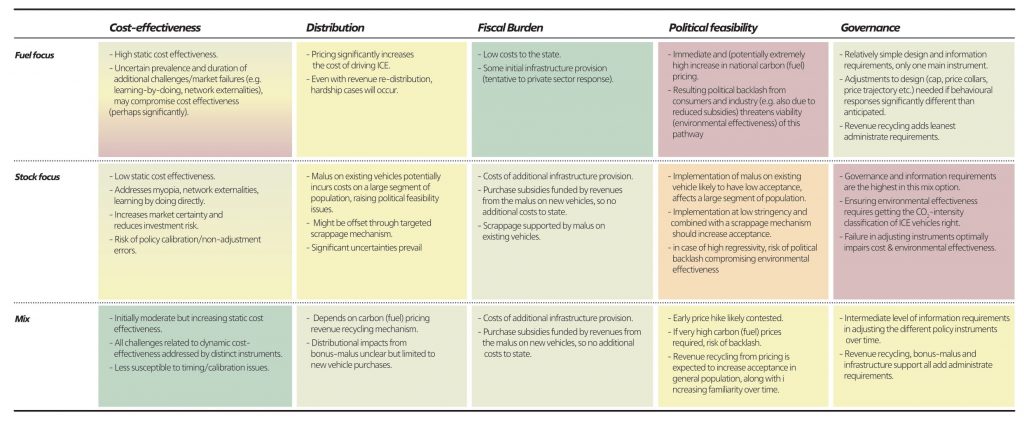

We then propose and qualitatively assess three alternate policy mix pathways which promise to enable the achievement of 2030 GHG and BEV targets. We label these pathways “Fuel focused carbon pricing (fuel focus)”, “Stock focused carbon pricing (stock focus)” and ”Mixed sequential carbon pricing (Mix)”. They assume identical GHG mitigation and BEV target attainment towards 2030, and identical uncertainties over cost developments of BEV and ICE but differ in the means to achieve the GHG targets. While we construct these pathways with a view to reflecting stylized positions in the policy debate, we suggest designs that based on transport policy and economics literature would be optimal in terms of maximizing attainment of the different evaluation criteria (e.g. minimize costs and expected political opposition over time).

While the pathways differ in their focus on and timing of using pricing instruments either for the GHG contained in fuels, or the GHG intensity of new and existing vehicle technologies, they have in common a utilisation of mainly pricing instruments rather than direct regulation as core instruments in the mix. Prices have the advantage of setting direct economic incentives for changing behaviour in scrappage, purchase and use decisions, while offering flexibility in policy design (e.g. differentiating Malus payments by GHG intensity) and for producers and consumers of vehicles. They also raise revenue, and therefore each alternate policy mix pathway involves a considerably lower fiscal burden than the baseline, with the main costs associated with infrastructure provision.

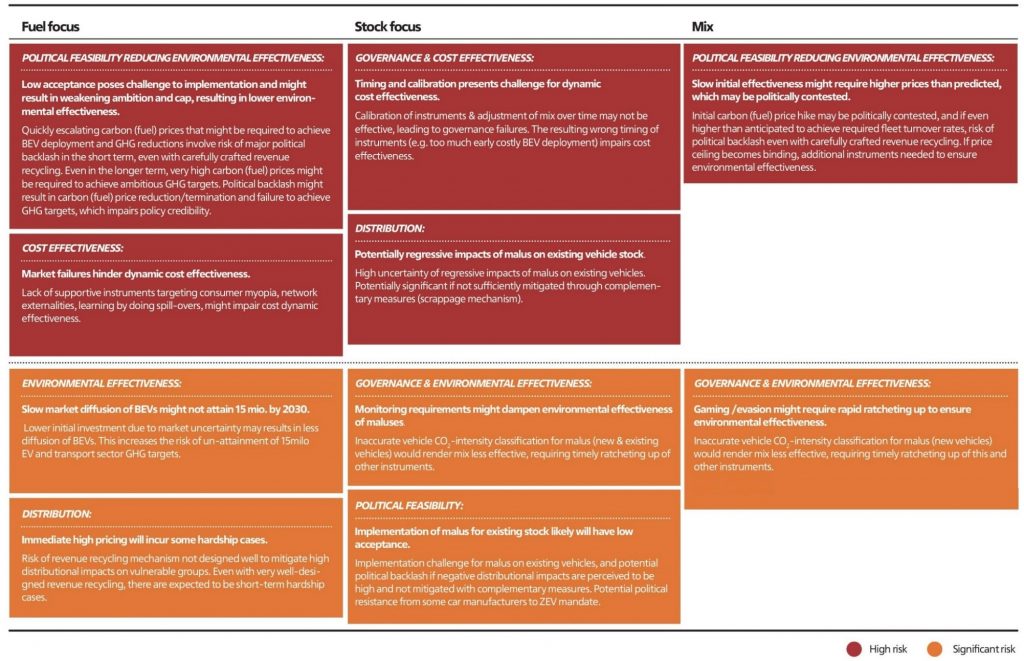

Each of the alternate pathways carries different trade-offs and risks among LDV transition challenges. More specifically, key design logics of and risks associated with each pathway are:

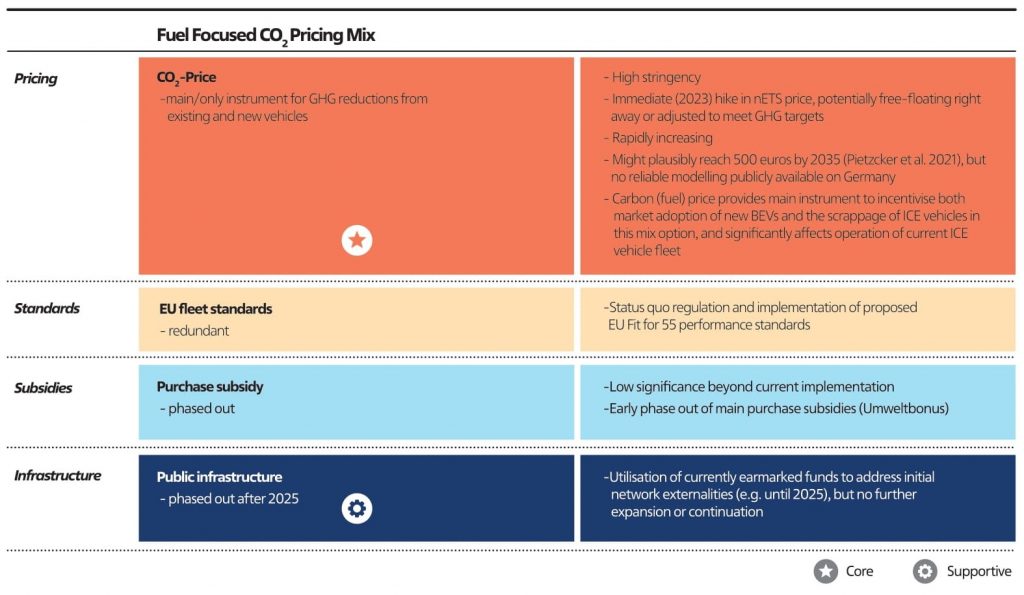

The “fuel focused carbon pricing” pathway relies almost exclusively on fuel carbon pricing to drive the transition. It foresees an immediate and significant gasoline and diesel carbon (fuel) price hike, followed by continuous price increases to internalize the CO2 emissions externality and reduce ICE vehicle use and purchases while stimulating ICE vehicle scrappage and a shift towards BEV. Purchase and charging infrastructure subsidies are phased out quickly and the EU vehicle fleet CO2-performance standard becomes non-binding. This pathway faces significant risk of political backlash, e.g. in case low-price elasticities necessitate very high carbon (fuel) prices to achieve targeted emission reductions. Such backlash might lead to a relaxation of GHG targets (or price interventions), thus undermining environmental effectiveness. The current energy price crisis appears to illustrate limited current political acceptance of significantly and rapidly escalating fossil fuel prices, which would very likely be required. In addition, the pathway’s logic relies on limited prevalence of additional challenges such as EV charging network externalities, consumer myopia and learning-by-doing effects. If these effects exist at significant scale, the intertemporal cost effectiveness of this pathway may be hampered, since challenges are not directly addressed by complementary policies like the alternative pathways.

The “stock focused carbon pricing” pathway focuses on policies directly affecting vehicle purchase and scrappage decisions while fuel carbon pricing plays a limited role. This pathway envisages phase-in of an increasingly stringent Zero Emissions Vehicle (ZEV) mandate, a complementary Bonus-Malus policy for new vehicle purchases to mitigate leakage effects under the ZEV mandate, an increasing Malus (annual vehicle tax) on existing ICE vehicles to push these out of the stock over time, as well as sustained EV charging infrastructure support policy. Modest carbon (fuel) pricing has a supportive complementary role to reduce use of the existing internal combustion engine (ICE) vehicle fleet, but this instrument is under-utilized compared to the other pathways. This pathway faces significant governance challenges for achieving dynamic cost effectiveness, requiring correct calibration and repeated dynamic adjustments of a wide range of policy instruments necessitating accurate information and reform decisions on behalf of policymakers. While the instruments targeting scrappage and purchase decisions can internalize several relevant market failures, their primary raison d’etre is achieving emissions reductions. Distributive effects are highly uncertain.

The “mixed sequential carbon pricing” pathway seeks to reduce the main challenges associated with the other two policy pathways by combining a carbon (fuel) price trajectory starting at a moderate level but rising significantly over time with complementary targeted instruments addressing market failures and regulatory challenges initially, which are phased out over time. This pathway follows a sequencing design logic, starting with an initially moderately rising fuel carbon pricing trajectory (thus increasing political feasibility) which scales-up relatively quickly making carbon (fuel) pricing the core instrument in the overall policy mix. Additional instruments aim at curing specific market failures in a targeted way and foster increased BEV diffusion via diverse policy instruments (rather than a single one). These are mainly a Bonus-Malus on new vehicle purchases to address consumer myopia and learning by doing externalities, and by public EV infrastructure (charging stations) policy support to target the potential network failures. The relevance of these companion policies declines as additional market failures become less relevant in future more advanced stages of the LDV transition, and as the carbon (fuel) price increases. The central risk is low initial environmental effectiveness, in particular little initial use reduction of the existing ICE vehicle stock.

Our assessment indicates that combining carbon (fuel) pricing with sufficient complementary instruments to overcome temporary market failures improves dynamic cost effectiveness, and probably also enhances political feasibility. We find that combining carbon fuel pricing with complementary instruments which are sequentially calibrated to the magnitude and timing of market failures likely increases efficiency over a high carbon price alone, depending on the (unknown) magnitude of market failures.

We argue that in addition to market failures, political feasibility is a key consideration in policy pathway design. The sequencing logic combines more accepted instruments to drive BEV purchase decisions, which allows for scaling of less accepted reforms, which target use and scrappage decisions. This logic aims at increasing acceptance of these more controversial policy reforms, particularly an initial substantial hike of carbon (fuel) pricing, which currently is met with significant political resistance. We argue that combination of supportive instruments in the near term allows scaling of carbon (fuel) pricing more gradually, and helps increase acceptance though familiarity and compensation measures, while likely mitigating short term adverse distributional impacts. Accordingly, there are welfare benefits from designing a more politically feasible policy pathway, as having ambitious climate policy enacted yields greater benefit than pursuing the most cost effective option not implemented due to lack of supporting political coalition. A major challenge of this approach is to correctly empirically specify which policy mix options and instrument stringencies will be feasible, given the multiple and highly uncertain factors determining this important variable.

We identify key current uncertainties and gaps in existing research, which are important areas for further research. More research is needed to help further develop policy pathway construction and assessment in the LDV sector (and in other sectors). First, both ex post and ex ante impact assessments of past and existing future single instruments and pathways are needed to remove uncertainties over e.g. environmental effectiveness, the magnitude and potential for removing market failures via policies, or the magnitude of distributional impacts. Second, dynamic design and governance over time should be further developed combining conceptual and empirical work, and integrated into future modelling work. Finally, understanding of political dynamics of stringent climate policy implementation and feedback over time requires improvement as significant uncertainties prevail. More robust research in these areas would help mitigate the risk of governance failures in the design and calibration of ambitious climate policy pathways.

This report provides a framework, proposals and qualitative assessments of ex ante policy pathways for the net zero transition in the German LDV sector, which we hope can help stimulate similar analyses in other sectors. We acknowledge significant limitations, arising due to the quality and availability of data in terms of both ex ante modeling and ex post empirical analysis of individual instruments as well as complete alternative pathways. Partially these uncertainties arise from current models not accounting for many of the challenges and considerations we highlight in our approach, and from empirical analyses offering limited insights on the precise magnitude of externalities and price elasticities of policy instruments within mixes. Therefore, we emphasize the importance of collaboration across expert communities including, e.g. modelers, econometricians and political scientists to more comprehensively and systematically analyze pathways in the LDV and broader mobility transition, and in other sectors including buildings, industry and agriculture. More generally, we hope our approach can succeed in integrating insights from different academic disciplines (e.g. engineering, economics, political science) and bridging different communities (e.g. academia, applied policy analysts, policymakers, public), and help stimulate similar analyses climate policy mix pathways in other sectors and regions.

(e.g. engineering, economics, political science) and bridging different communities (e.g. academia, applied policy analysts, policymakers, public), and help stimulate similar analyses climate policy mix pathways in other sectors and regions.

1. Introduction

Implementation and reform of stringent policy instruments is key to attaining climate mitigation goals in Germany. In line with the Paris Agreement, the European Union and Germany have committed to the goal of achieving greenhouse gas neutrality by 2050 and 2045, respectively. The German Climate Change Act envisages ambitious greenhouse gas (GHG) emission reduction objectives for all sectors, and reduction of 40% below 2020 levels by 2030 for transport (85Mt CO2). An emission projection report commissioned by the German government finds that the 2030 transport sector target will be missed by approximately 50% (projected emissions in 2030: 126 MtCO2, Climate Change Act sector target: 85 MtCO2) (Repenning et al. 2021). The current government has also set a target of deploying 15 mio electric vehicles (EV) in Germany by 2030 (Scholz et al. 2021). What is missing is a strategic discussion on the design of alternative dynamic climate policy mix pathways that meet these challenging targets. These must address how the interplay of different instruments with varying significance over time can ensure the achievement of GHG reductions and eventually climate neutrality towards 2045. Also, they must successfully address various challenges related to transport sector decarbonization (including distributional, political, governance) along the way.

This report aims to qualitatively explore a conceptual approach for ex ante construction and assessment of alternate climate policy instrument mix pathways. Advances in the analysis of single climate policy instruments and of policy mixes have been made in energy system modelling (Koller et al. 2020), in conceptual work (Axsen et al. 2020, Bhardwaj et al. 2020) and in empirical ex post analyses (Koch et al. 2019; Anderson and Sallee 2016). Political science and innovation studies analyses offer broad conceptualizations of designing policy mixes (Del Rio 2014; Howlett and Del Rio 2015) and to enhance policy mix characteristics (Rogge and Reichardt 2016) and their evolution over time (Meckling et al. 2017, Pahle et al. 2019). However, a conceptualization of dynamic climate policy pathways that can integrate insights from engineering, economic, and political science perspectives is still missing.

This report aims at better integrating concepts and assessment methods for climate policy instrument mix pathways across disciplines. Our approach aims to help establish a “common language” across different communities and perspectives to facilitate exchange. This not only includes different academic disciplines (e.g. engineering, economics, political science, legal analysis) and epistemic communities (e.g. modelers, sector experts, climate policy generalists) engaged in climate policy analysis, but also policymakers and stakeholders (e.g. ministerial bureaucrats, politicians, business, NGOs). Doing so aims to facilitate precise (yet sufficiently general) deliberations about the design and assessment of alternative policy mix pathways informing political decision-making (Edenhofer and Kowarsch 2015) at an intermediate level of analysis, bridging highly detailed sector expertise on the one hand with a broad generalists’ perspective on the other. Our aim is to develop this approach in future analyses, by integrating it more closely with quantitative modelling exercises specifically designed to support assessment of alternative policy pathways – with legal analyses –and across sectors relevant for the transition to net zero emissions.

A fundamental notion of our approach is that climate policy mixes need to evolve and change over time. Technological system transitions undergo different stages: emergence, diffusion and saturation (or re-configuration) of zero GHG technologies and associated behavioural and normative, political, legal, economics and business transformations. Scholars have argued that policy mixes need to evolve to address the inter-temporal challenges associated with each of these phases, and to enable these complex processes to unfold within the very short time spans of envisaged net zero transitions (Kivimaa and Kern 2016; Kivimaa et al. 2019; Köhler et al. 2019).

Early policy interventions focus on supporting new emerging technologies to break into a competitive market. Emerging sustainable technologies often struggle to become competitive for example due to learning-by-doing externalities and opposition to regulatory changes by vested interest groups (e.g. ICE vehicle manufacturers). A broad literature has addressed the potential and means to develop niche technologies that can later be upscaled (Köhler et al. 2019). Policy makers can assist emergent clean technologies through subsidies that internalize positive externalities and by pricing incumbent carbon-intensive technologies to internalize their negative externalities. Both policy options can help green industries to become competitive over time, but carbon (fuel) pricing is often controversial if low carbon alternatives are not readily available. If distributional effects are not carefully managed, “punishing” existing high-emission capital stocks (ICE vehicles, gas or oil boilers for heating, coal plants etc.) and making related services less affordable while incurring regressive distributional outcomes by reducing accessibility of lower income groups will likely create political opposition. Therefore, carbon (fuel) prices appear to remain low in initial phases of transitions while other instruments such as targeted subsidies and standards are more widely employed to create market niches for low carbon options.

In Germany the net zero transition is now moving into different phases of transition in several sectors, which requires adjustments in the policy mixes. We suggest that the transport (similar to the building) sector is moving from the emergent phase into diffusion stage (the power sector is already at a more advanced stage). Alternative low-carbon technologies such as BEV are becoming more broadly available at significantly reduced costs. In this phase environmental and cost-effective policy mixes involve actively placing pressure on existing polluting technologies to displace them, rather than simply supporting the emergence and addition of clean alternatives (Kivimaa and Kern 2016). This might be achieved by implementing stringent carbon (fuel) pricing making polluting technologies more expensive to buy and use; or stringent regulation which actively phases out polluting technologies.

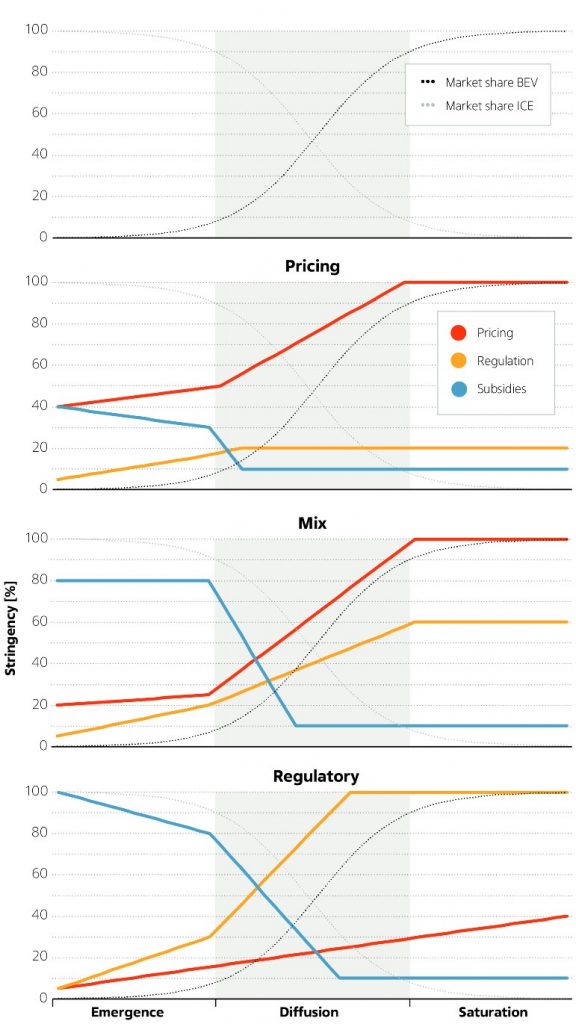

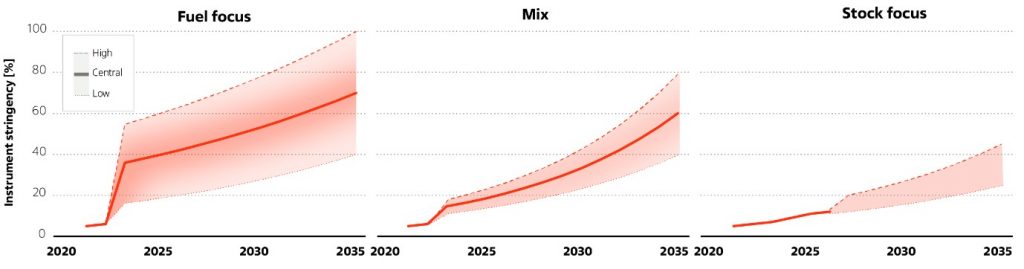

To achieve ambitious GHG mitigation targets, increasingly stringent climate instruments are required over time. If some types of policy instruments – e.g. carbon (fuel) pricing – are implemented at a lower level of stringency, others need to be deployed at higher stringency to ensure goal attainment. Figure 1 illustrates three policy pathways often employed in the climate policy discussion, e.g. in the EU Commission Impact Assessment preparing the EU Green Deal decisions (EU Commission 2020, see also Knodt et al. 2020). A “Pricing” mix mainly relies on carbon (fuel) pricing, a “Regulatory” mix utilizes mostly regulation and subsidies, while “Mix” combines all instruments. We employ this basic approach to devise alternate policy mix pathways for the German road transport sector and specifically the LDV transition that are often suggested in the policy debate.

The approach for policy pathway construction and assessment in this report combines this broader logic of net zero technology transitions with sector specific challenges in economic, political, and governance dimensions. It proceeds as follows: (1) First, we characterise the current phase of transition in the sector of analysis – in this study, road transport LDV – based on available modelling and other relevant data. (2) Second, we aim to anticipate and characterize key sectoral challenges relevant to future phases of the transition, building on academic and policy literature and the climate policy discourse. (3) We then assess how the current (status quo) policy mix pathway addresses the identified intertemporal challenges in that sector. (4) Finally, we construct alternative policy pathways based on our observation of policy debates, academic and policy literature, taking a policy mix ‘patching’ (Howlett and Rayner 2013) approach (drift, conversion and addition/termination of instruments) to provide and assess options of how the current policy mix can evolve over time to best meet intertemporal challenges. Specification of these alternative policy pathways is not fixed but intended to inform deliberation processes in different contexts, including policymaker deliberations, citizen fora and expert community discussions in different sectors and regional contexts.

We use instrument stringencies as a conceptual comparative approach to represent different sequencing logics, within and across pathways. Instrument stringency refers to the level of environmental ambition in a policy instrument’s calibration, e.g. a higher fuel carbon price is more stringent than a lower one. We ensure instrument stringency metrics are consistent across pathways so that design logics can be compared, both with respect to scaling of the different instruments within a pathway over time, and how these design logics compare across pathways. For example, the maximum stringency (100%) for carbon (fuel) pricing applies to the pathway which relies heavily on that instrument to drive the transition (Fuel focus). The other pathways’ use of carbon (fuel) price is represented on the same relative stringency scale, to indicate that the instrument does not reach as high price, and scales more gradually over time.

We test our approach by applying it to emission abatement of light duty vehicles (LDVs) in Germany. A workable conceptualization of climate policy instrument mixes needs to demonstrate its usefulness in application to a specific sector, otherwise it is at risk of remaining too broad and superficial. We focus on LDVs because of their central importance in the German transport sector transition. In particular, we focus on the expansion of full BEVs as the currently most prominent candidate in terms of expected emission reduction potential and costs (Koller et al. 2021). We are aware that other mitigation options (modal shift, avoiding transport) are important for decarbonising the transport sector, but choose to constrain the analysis to keep it tractable.

We qualitatively consider pathways that promise to enable GHG abatement from LDVs in line with the GHG reduction and EV deployment targets for transport in 2030. We explicitly discuss the risks of failing to meet the defined GHG targets for different pathways, but our guiding principle is to consider pathway designs that promise to deliver the same necessary emission reductions (identical environmental effectiveness to ensure comparability). We aim at identifying how each pathway addresses sector transition challenges, and key associated risks, to identify trade-offs related in choosing among policy pathways. In doing so we also identify several areas of uncertainty or gaps in current knowledge which should form the basis of future research. The report proceeds as follows: First, we characterise the ongoing transition for LDVs in Germany (Section 2). Next, we evaluate anticipated challenges relevant for policy design for the LDV transition in Germany (Section 3). We then illustrate and assess the status quo future policy pathway, incorporating the EU commission’s Fit for 55 proposals (Section 4). Section 5 constructs, assesses, and compares three alternative future policy mix pathways. Section 6 concludes.

2. State and trends of the LDV transition

We briefly assess the state and expected trends and uncertainties of the LDV transition to net zero emissions in Germany. Doing so will help us define key policy challenges for linked to this specific and the following phases of the transition (section 3), and to assess how the current policy mix addresses these challenges and supports the transition both now and in the near future (section 4).

Sales costs of new BEVs have been declining significantly and are projected to match ICE vehicles within the decade. BloombergNEF (2021) forecast that pre-tax retail prices of BEVs will become cheaper than ICE vehicles in Europe as soon as 2027. These predictions critically depend on assumptions about future battery cost reductions. Resource availability and prices as well as technological advances in battery technology (e.g. saving on resource needs) are key determinants of these cost reductions.

Life cycle costs today are already lower for many BEV than ICE, across different vehicle categories, in particular if taking current support policies into account (Agora Verkehrs-wende 2022). Many BEV already offer lower total costs of ownership than ICE vehicles because BEV fuel costs for electricity are much lower per km compared to ICE vehicles. Overall, maintenance costs of BEVs are roughly 40% lower per km than those for ICE vehicles (Burnham et al. 2021). In addition, current subsidies reduce the costs of new vehicle purchases (Agora Verkehrswende 2022). However, issues around range anxiety, consumer myopia, high upfront cost, limited ownership duration of initial buyers and uncertainty about future resale prices have tended to impede uptake of BEVs in the past (Pevec et al. 2019).

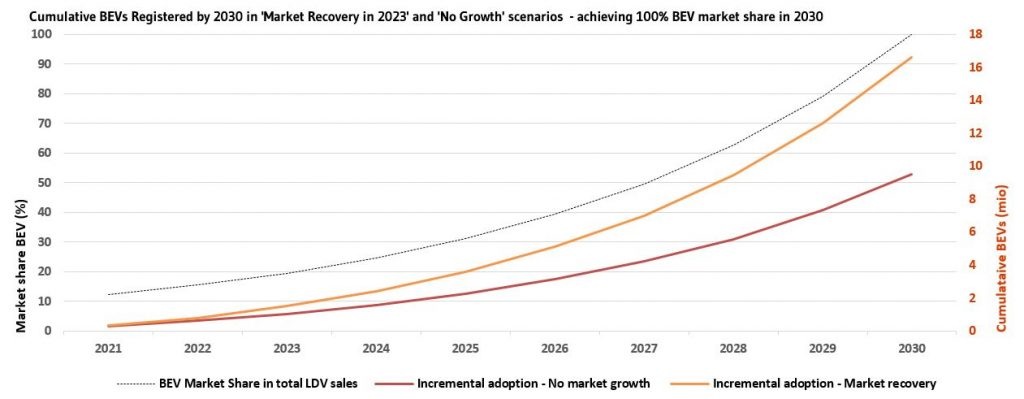

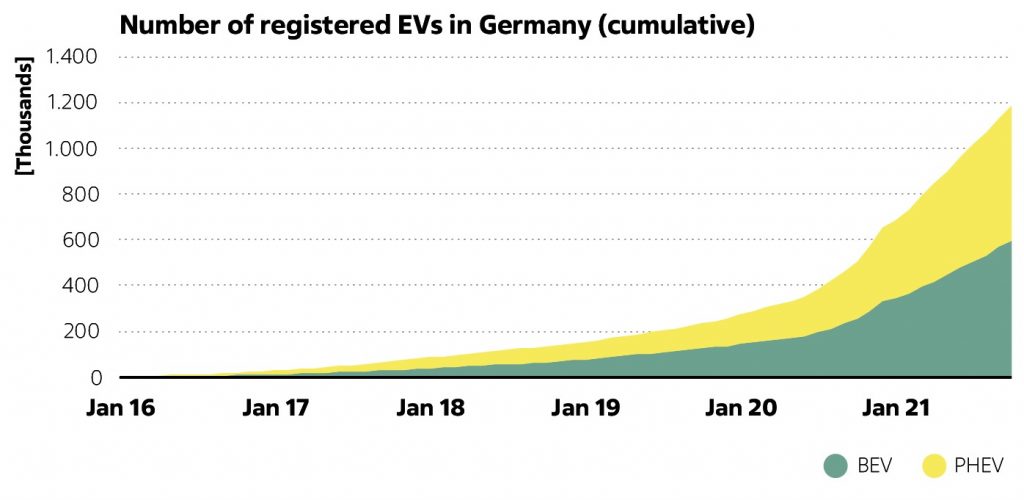

Germany’s market for BEVs has expanded rapidly in recent years. Being among the laggards by international comparison in the past, lately Germany’s BEV market has seen the largest growth in Europe with a BEV sales share of 14% on average in 2021 (KBA 2022). Strong EV sales likely resulted from enhanced range (i.e. new models or existing models with larger battery size), changed purchase subsidies (see Section 4.3), and compliance requirements with EU vehicle fleet CO2-intensity standards (Agora Verkehrs-wende 2022). No econometric analysis of the individual contributions of these and other factors is available though, to our knowledge. Figures 2 and 3 display the monthly and cumulative registrations of BEV and PHEV.

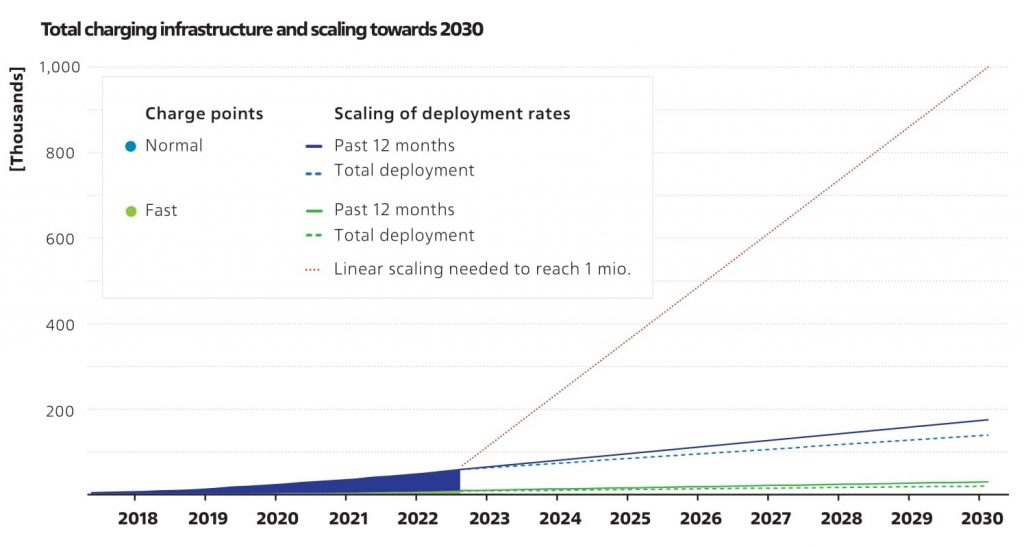

Public charging infrastructure has expanded significantly in recent years. As of January 2022, ~52.000 public charging points were in operation, including ~44.000 standard charging points and ~8.000 fast charging points (Bundesnetzagentur 2022). At current deployment rates (scaling of rates over the past 12 months) around 180,000 chargers will be installed by 2030. To attain the new coalition target of 1mio public chargers by 2030, almost 10.000 public charging points need to be installed per month on average (Figure 6). There is some uncertainty over how many charging points will be needed by 2030, with estimates around 1:10 (charger: vehicle) for urban areas and around 1:20 for suburban areas (Nicholas and Wappelhorst 2020). There is also debate over how long the state should subsidize installation, before market actors take over. Irrespective of these uncertainties, the observed current deployment rates are rather low.

Costs of public charging infrastructure have remained relatively constant. While costs of EVs have continued to decline, the costs of public charging infrastructure have remained constant or even increased in some instances (new designs of fast chargers). For example, total costs (material and labour) of a 150kw fast charger for public use are currently around $103k, and is only estimated to decrease to $100k by 2030 (Bauer et al. 2021), partly due to increasing labour costs. Other research is more optimistic about the potential for cost reductions of fast charging infrastructure (Funke et al. 2019).

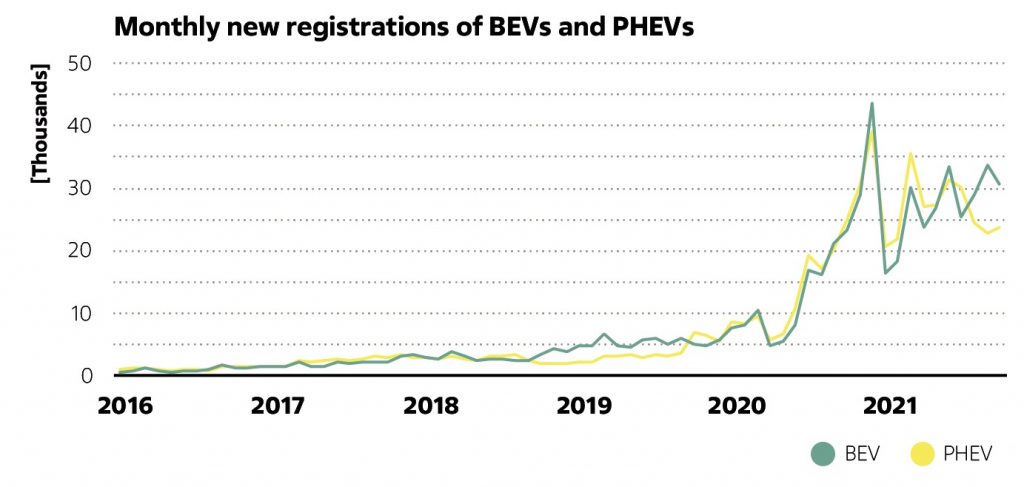

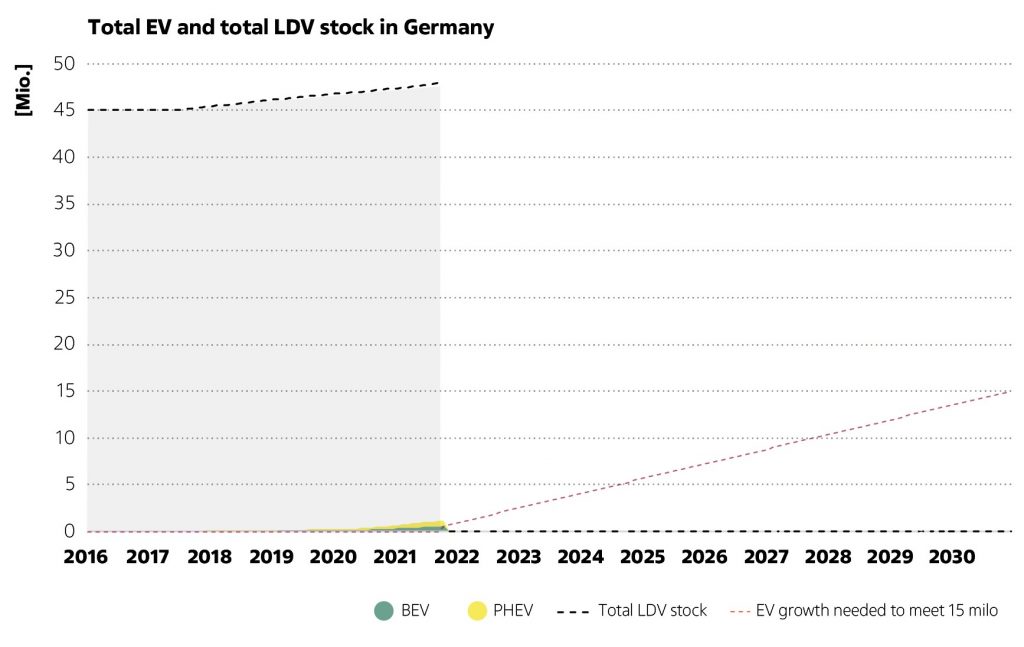

In terms of technological transition stages, the LDV transition in Germany currently is in the early diffusion stage. Despite the recent increase in EV market share, the cumulative total in comparison to the existing number of vehicles registered in Germany (48.5 mio.) is still less than 2% (Figure 4). BEVs are only beginning to become competitive with ICE vehicles in terms of costs and convenience (e.g. availability of charging infrastructure).

Upscaling deployment of BEV is key towards attainment of 2030 GHG and BEV deployment targets. For example, Gimbert (2021) anticipates that 60% of new registrations need to be BEVs by 2025, and 95% by 2030 to attain the 2030 GHG targets. Compared to the previous government which aimed at 7-10 mio. EVs on the road by 2030, the new government envisages 15 mio. The new target requires adding an average of 130.000 BEV per month up to 2030 (Schill 2022), whereas average sales in 2021 were 29.633 BEV per month (KBA 2022). While the actual adoption pattern can be expected to follow an S-shaped curve rather than a linear trend (Figure 6), this illustrates the significant scale of the challenge.

Surprises will occur and need to be anticipated in policy design and governance. Given the scale and complexity of the LDV and broader mobility transition, surprises about technological developments, behavioural change or policy performance will emerge and the governance of public policy should be set up anticipating this. How will BEV costs evolve with surging global demand for required basic resources – will material supply or technological developments adjust to demand rapidly and enable declining battery prices? Will crises like the pandemic or geopolitical tensions disrupt supply chains and drive up prices? How will the petrol and diesel station market develop when facing tumbling volumes of ICE vehicles on the road by the end of the 2020s – will declining economies of scale accelerate ICE vehicle phaseout? Governance of policymaking needs to be adaptative, continuously monitoring trends and adjusting the policy mix as challenges escalate (Flachsland et al. 2021). One way in which we aim to integrate such uncertainties in our analysis of policy mix pathways is by considering the possibility of both very high and very low costs of switching to BEVs (for whichever reason). The second way is by assessing how different policy pathways will perform with respect to the road transport transition challenges identified in the following section, notwithstanding the significant ex ante uncertainties about their realization. The third way is to assess the complexity of governing (here including: monitoring, assessing, and adjusting) the different policy mixes.

3. Policy mix design challenges and ex ante assessment criteria for the LDV transition

This section identifies key challenges for achieving the ambitious 2030 road transport emission reduction and BEV targets envisaged by Germany. Based on a review of peer-reviewed academic literature and policy papers (see Annex II), we particularly focus on identifying intertemporal challenges of the sector’s transition. We will employ these challenges as assessment criteria for different pathway options in Sections 4 (baseline) and 5 (alternative policy pathways).

3.1. Environmental effectiveness

Environmental effectiveness is our primary focus when designing policy pathways. To ensure attainment of environmental effectiveness, each pathway uses a combination of instruments following its respective design logic, implemented at stringencies capable of delivering the 2030 transport sector targets. This allows for comparison across pathways with respect to the other design challenges, given that they all attain the same level of GHG abatement by 2030. Accordingly, market failures for example are conceptualised as only affecting dynamic cost effectiveness, since even with persistence of these failures, the pathway designs are capable of delivering GHG abatement, albeit at significantly higher costs (low cost effectiveness).

There is no explicit emission reduction pathway for the LDV sector in Germany, but the alignment of LDV fleet emissions with the 2030 GHG transport sector target and 2045 GHG emission neutrality in Germany requires deep structural change. The revised Bundes-Klimaschutzgesetz (KSG 2021) envisages an overall transport sector GHG reduction from 139 MtCO2eq in 2022 to 85 MtCO2eq in 2030 (~40% below the 2022 level), with linear annual reduction targets in between. By 2045, Germany aims at achieving GHG emissions neutrality, which we interpret to imply zero CO2 emissions from the stock of passenger road vehicles in Germany. While the KSG does not specify an LDV GHG target (with transport comprising also heavy-duty vehicles (HDV) and other modes), LDVs currently contribute roughly 2/3 of total direct GHG emissions from transport and thus need to be reduced significantly by 2030. This extremely challenging set of GHG targets requires a fundamental transformation of the sector. Unlike a transport system modelling exercise, we do not assume or derive a numeric target for LDV sector GHG emissions since we perform a qualitative analysis. Also, different policy pathways in different sectors might imply different optimal GHG levels in the LDV sector (depending on interaction with emission reduction in other sectors).

We focus on two key options for achieving the envisaged LDV emission reductions: Expanding BEV sales and reducing the stock of ICE vehicles. With our focus on LDVs, GHG emission reductions can generally result from five interacting aspects: (1) reducing the carbon intensity of new cars with internal combustion engines (i.e. incremental ICE vehicle innovation, shift in purchase behaviour towards more efficient cars); (2) reducing the GHG content of fuels used by ICE vehicles (e.g. low GHG bio- and e-fuels); (3) reducing the use of ICE vehicles by shifting to other modes or reducing travel; (4) removing ICE vehicles from the fleet by scrappage or export; and (5) adding new BEVs to the fleet instead of ICE vehicles while decarbonizing electricity generation. In our pathways, we focus on options 3-5, i.e. expanding the sales of new BEVs, phasing out the existing ICE vehicle stock, and reducing use of ICE vehicles. We do not consider policies explicitly aiming at options 1&2. The rationale is that (a) we expect the bulk of emission reductions to result from ICE vehicle phase-out and BEV phase-in, and (b) we aim at keeping our analysis as simple and tractable as possible.

3.2. Static and dynamic cost effectiveness

We adopt a broad notion of costs. We define “costs” as the societal resources in terms of opportunity costs (e.g. foregone consumption) required to achieve a given GHG reduction target in the LDV sector. In a quantitative modelling analysis, different indicators for costs might be employed (e.g. total transport system expenditure). To simplify analysis, we do not consider co-benefits of the LDV transition such as improved air quality, reduced noise and resulting positive health effects. Cost effectiveness is defined as minimizing the costs of attaining a given GHG reduction target. Cost effectiveness defined as such (e.g. IPCC 2014) is desirable because it (a) frees up resources to pursue more ambitious emission reduction targets and/or other important societal targets (e.g. health care, education), and (b) minimizes the overall cost burden to be distributed across different actor groups, thereby reducing political challenges (see below). Conversely, cost-ineffectiveness can undermine acceptance by reducing available societal resources and aggravating distributional conflicts, thereby increasing political challenges of attaining GHG targets. It is useful to distinguish between (a) the costs and (b) the cost effectiveness of policy mix pathways. The total costs of GHG reduction pathways are determined both by factors within and beyond the control of policymakers. Our approach to policy mix pathway analysis focuses on those challenges that policymakers (in our case: in Germany and the EU) can address: Market failures, political and governance challenges, and other obstacles to cost effectiveness. We turn to these obstacles in more detail below. However, even when designing policy mix pathways to maximize cost effectiveness, costs of the LDV roll-out are still influenced by factors outside the control of German and EU policymakers. For example, prices and access to basic resources on world markets are only partly or not at all influenced by domestic policies or multilateral policy (e.g. geopolitical shocks or pandemics disrupting supply chains). Technological progress reducing the costs of battery technologies is partly shaped by policies and institutions in Germany and the EU, but it also involves exogenous uncertainty about physical and chemical engineering constraints. When we refer to (maximizing) cost effectiveness of policy mixes and pathways, we are interested in how policy instrument mixes can minimize overall cost given these exogenous factors. In our assessment of pathways, we also consider cost uncertainty to the extent it might affect the calibration of policy instruments, such as the level of carbon (fuel) pricing required to achieve given environmental targets under varying cost scenarios.

| Challenges | Components | Key Aspects/indicators |

|---|---|---|

| Environmental Effectiveness | BEV sales | Number of new BEV vehicles sold (market share) |

| GHG from existing fleet | Demand reduction (reduced use of existing ICE stock or switching from ICE to other modes of transport).Retirement of existing ICE vehicles from fleet | |

| Cost Effectiveness | Static cost effectiveness | Harmonizing marginal abatement costs across all short-term mitigation options |

| Dynamic cost effectiveness | Achieving least-cost timing of BEV deployment over time: neither too little (foregoing learning by doing effects) nor too much (costly) BEV deployment early on (and vice versa too much/little later)Addressing all market failures affecting dynamic cost effectiveness, including consumer myopia, learning by doing spillovers, R&D spillovers, network externalitiesEnsuring policy credibility to avoid investment hold-up by firmsRequiring limited information by policymakers and low costs of adjusting policy mix under uncertainty (see also “Governance” below) | |

| Fiscal burden | Costs & revenues to state | Fiscal costs/revenues generated from policy mix Higher fiscal cost places higher strain on government finance, and more susceptible to contestation/opposition |

| Distribution | Impacts on population groups | How policy mix distributes costs among the population Policy mixes differ in salience of costs (e.g. higher for carbon (fuel) pricing, lower for subsidies and standards) |

| Political Feasibility | Population | Acceptance among population groupsInfluenced by factors including trust in government, political preferences, ideologies, values, knowledge and perceived intrusiveness of instrumentsClosely linked to perceived distributional impacts across population groups |

| Firms | Acceptance among industry interest groups/stakeholdersLinked to distribution of costs (incl. competitiveness) and benefits on incumbent car manufacturers and new firms | |

| Governance | Administrative/ information requirements | Demands on the state to monitor, evaluate, and update policy mix over timeInformation, administrative and enforcement requirements are higher for some instrument optionsComplexity increases with more instruments, increases interaction effects and likelihood of unintended consequences |

Static cost effectiveness is desirable but not a sufficient criterion for assessing policy pathways. Static cost effectiveness refers to minimizing short-term mitigation costs by harmonizing marginal costs of mitigation options within and across sectors and regions over a brief period of time (e.g. a year). By ensuring that all actors face the same GHG price signal across all their available mitigation options, they will consistently choose those short-term mitigation options in producing, purchasing and operating passenger vehicles that are cheaper than this explicit or implicit price, unless inhibited by market failures or other barriers (Staub-Kaminski et al. 2014). Carbon (fuel) pricing is considered an ideal instrument from a static cost effectiveness perspective because it incentivizes all available short-term mitigation options (particularly use, but also scrappage and purchase). By contrast, policies such as CO2-intensity standards for new vehicles do not incentivize reductions in vehicle use. However, the concept of static cost effectiveness ignores market failures that relate to mitigation cost reductions over time.

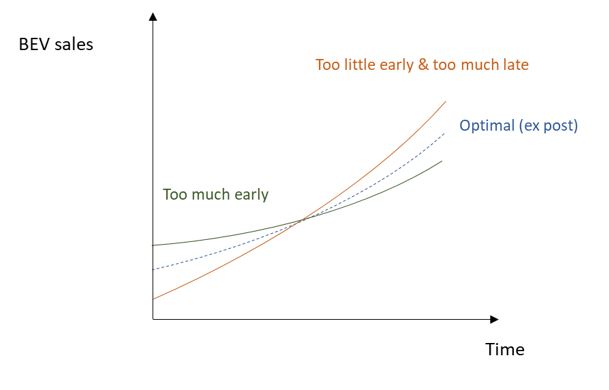

Dynamic (or intertemporal) cost effectiveness is essential for analysing policy mix pathways. Dynamic cost effectiveness refers to minimizing mitigation costs of achieving environmental targets over a longer period such as one or several decades, and can be expressed in terms of cumulated mitigation costs. It particularly requires taking into account reductions in mitigation costs (e.g. conceptualized as marginal abatement cost curves) due to technological progress over time. Also, how policy addresses market failures affecting the speed and scale of technological progress is important to assess dynamic cost effectiveness of policy pathways. For the case of BEV, optimizing dynamic cost effectiveness refers to promoting a deployment pathway that balances early deployment of higher cost BEV to facilitate further cost reductions via learning by doing effects with later deployment of then cheaper BEV (e.g. due to technological progress in battery production and expansion of global raw materials mining capacities; see Figure 7 for illustration). We are here particularly interested in the risk of and ways to avoid major “policy errors” that would entail large scale dynamic cost ineffectiveness, i.e. of a magnitude that would lead to emission reduction targets being violated or even explicitly reduced because they become politically unacceptable. This might be the case e.g. with massively subsidizing relatively expensive BEV early on and thus vastly expanding their deployment, instead of waiting for scaling up of deployment until cost reductions are realized. Conversely, very low early adoption rates e.g. due to lack of short-term policy stringency might lead to less-than-optimal learning by doing and resulting delays of possible cost reductions, and may later also necessitate extremely high deployment (and ICE vehicle scrappage) rates, which might be particularly costly e.g. in case of production bottlenecks (Figure 7).

Market failures impairing dynamic cost effectiveness need to be addressed using targeted policy instruments. In a simple textbook setting with perfectly informed rational producers, consumers and omnipotent governments imposing a cumulative carbon budget as well as lack of additional market failures, a carbon (fuel) price increasing at some optimal discount rate is the only required climate policy instrument to maximize both static and dynamic cost effectiveness. However, additional market failures and governance challenges such as consumer myopia, EV charging infrastructure network externalities, positive learning-by-doing externalities in the deployment of BEVs, or lack of credible government commitment to a given policy, mean that even a perfect carbon (fuel) price cannot alone implement the maximally cost-effective outcome (Fischer and Newell 2008, Vogt-Schilb and Hallegatte 2014). The theoretically perfect carbon (fuel) price trajectory (derived ignoring market failures) would in this case lead to a shortfall of cumulated mitigation if implemented via a fixed carbon tax. In case of an ETS it might lead to an initially low and then steeply increasing and overly costly (i.e. dynamically cost ineffective) allowance prices and emission reductions late in the 2020s and beyond if anticipation on allowance markets is imperfect relative to the social optimum (thus also possibly rendering such a pathway politically infeasible and affecting its credibility ex ante, see below). In a perfectly rational allowance market, an unnecessarily high allowance price trajectory might emerge to compensate partly for the non-implementation of additional instruments. Even an “optimised” carbon (fuel) pricing pathway considering these additional challenges (e.g. by way of implementing a higher level of carbon (fuel) pricing early on) would not be optimal, since addressing additional externalities and challenges by separate instruments can implement an overall more cost-effective outcome (Kalkuhl et al. 2012). We next discuss key externalities and market imperfections relevant for dynamic cost effectiveness in the LDV sector transition.

Consumer myopia refers to consumer discounting lifetime costs of vehicles at disproportionately high rates. EVs currently have a higher upfront capital cost than ICE, but lower operational costs, which already makes them have comparable or even lower lifetime costs (Agora Verkehrswende 2022; BloombergNEF 2021). However, a common finding is that consumers under-value long term costs and savings (Allcott and Wozny 2014; Gillingham and Munk-Nielsen 2019; Andor et al. 2020; Wolfram et al. 2021), and due to bounded rationality are more likely to make suboptimal choices.1The magnitude of this effect is disputed, with some research suggesting only limited evidence of consumer myopia (Busse et al. 2013; Sallee et al. 2016). Policy needs to be designed to overcome this behavioural characteristic, otherwise myopic consumers might keep buying overly costly cars, in terms of lifetime costs. A related issue concerns whether consumers are able to make rational decisions, due to a lack of ‘perfect’ information (Safarzyńska and van den Bergh 2018). For example, Plug-in Hybrid Electric Vehicles (PHEVs) are widely perceived as delivering GHG abatement and offering lower fuel costs, yet evidence suggests a significant performance gap between real-world emission reductions and those suggested by lab testing (Tietge et al. 2019; Plötz et al. 2020). On average, real-world fuel consumption and CO2 emissions of PHEVs for private drivers in Germany are over twice as high as in official test procedures, and up to four times higher for company cars. Policy can help shape cognitive expectations through provision of accurate information about life-cycle costs of vehicles, and by implementing registration or purchase taxes based on accurate performance data of new vehicles. The rationale would be to raise upfront costs of more expensive (life-cycle) options and/or reduce costs of lower life-cycle cost options to correct the distortion raised by consumer myopia and bounded rationality. However, there is significant uncertainty about the size of this potential effect, and thus optimal policy design and calibration.

Knowledge production spillovers resulting from learning-by-doing in the development, production and use of BEV can be important for dynamic cost effectiveness. Basic Research & Development spillovers between firms (Jaffe et al. 2005) and learning effects within firms and tacit knowledge production (Nelson and Winter 1982; Nightingale 2003) reduce costs of BEV over time. Learning effects can also apply to consumers, locally through positive spillovers as the number of adopters of the new technology increases, and collectively as cognitive views and values shift as the new technology becomes culturally and symbolically embedded in normative views. Consumer learning effects therefore not only reduce the effects of myopia by providing information and helping guide behaviours which leads to increased diffusion of BEVs, but also therefore increase market-pull dynamics, incentivising increased firm innovation, which can create a self-reinforcing virtuous cycle (Aravena and Denny 2021). From a societal perspective, in absence of policy interventions these learning-by-doing dynamics lead to market failures since car manufacturers and consumers will underinvest relative to the societally dynamically cost-effective level particularly in earlier phases of production of BEV, when these spillover effects are particularly high but cannot be fully appropriated by firms (e.g. due to reverse engineering) or consumers. This justifies additional policy instruments supporting early deployment to realize these learning effects, which would be phased out over time as the magnitude of these effects decline.

Network externalities can inhibit or slow down adoption of BEV. For BEVs, the initial build-up of charging infrastructure involves potential network externalities (Zhou and Li 2018; Springel 2021). Private actors may be less willing to invest in infrastructure at the beginning of the transition, as the investment is under-utilised. However, for BEVs to be an attractive alternative to ICEs, there needs to be sufficient infrastructure available. As diffusion of BEVs increases the private sector is expected to increase investment in charging infrastructure as risk is reduced and expected revenues increase. Research suggests that although the incidence of charging points in Germany already exceeds the EU’s recommended minimum ratio of one point to ten EVs, inadequate infrastructure coverage remains a binding constraint on EV uptake and the continuation of public support hence appears warranted (Sommer and Vance 2021). Public support of infrastructure extension also has indirect effects on BEV adoption through targeting range anxieties, increasing convenience, and adding to learning by doing effects as the number of BEVs increase over time. Again, related public policies would be phased out over time as the magnitude of the externalities decline.

Credible government commitment and increased market certainties reduce investment risks, which can lead to more BEV capacity investment by manufacturers and higher cost reductions. High political commitment to policy mix pathways delivering transition targets reduces investment risk, and firms have a higher incentive to invest in low carbon options (Newell and Goldsmith 2001; Brunner et al. 2012). This relates to the interpretive effects of policy mix change (Pierson 1993; Edmondson et al. 2019) – the information that formalised or informal policymaking outcomes provide to actors, thereby shaping expectations and directing investment and innovative activities (Edmondson et al. 2019). Also, if firms observe lack of credible commitment – for example when experiencing unexpected dismantling of support policies – they are more likely to direct more attention towards lobbying and rent-seeking in order to maintain the status quo or to steer the transition in a direction that suits their interests, rather than fully committing resources to radically changing their business models and supply chains (Roberts and Geels 2019).

Credibility can be increased by targeting investments over emissions, and through policies which establish a forecasted trajectory. Instruments which target investments can reduce time inconsistency problems, which reduces uncertainties (Kalhuhl et al 2020). This is typically more common with regulations and subsides which target investments (stocks) but can also be achieved through investment taxes. Increased certainty can also be provided through implementing commitments to a transition pathway. Subsidies and possibly regulation anchored in legislation (creating enforceable property rights) can provide more certainty (Brunner et al. 2012). Technology specificity of the policy mix can also increase market certainty, leading to increased investment in innovation, upscaling and infrastructure provision for specific technologies (Bhadwaj et al. 2020), but there is a potential trade-off with government potentially making errors in picking winners and foregoing innovation in non-considered technologies.

Governing policy pathways that achieve dynamic cost effectiveness under uncertainty is a major challenge. Numerically characterizing the optimal sequence of technological (e.g. optimal timing of ramping up BEV vehicles) and behavioural mitigation (e.g. car retirement and purchase decisions) using models is challenging even using numerical models. Modelers, policymakers, and firms all face (different) information constraints and irreducible uncertainties, including about the precise magnitude of externalities discussed above and corresponding optimal policy design and calibration. These only taper off as the transition advances and as rigorous ex post research develops and provides more and more empirical evidence about the size of externalities, cost reductions and elasticities. The realized cost effectiveness of a policy mix path is also affected by the extent to which the governance challenges can be managed by policymakers, especially with regards to information requirements and dynamic adjustment needs. Differences in information requirements and readjustment needs must therefore be taken into account as relevant elements in assessing alternate policy mix pathways. However, operationalizing this criterion is challenging as well. As one proxy, we consider information requirements and needs for dynamic updating (and its complexity) by policymakers for the different pathway options in the evaluation category “governance”, but highlight that further work e.g. on the institutional setup for governing policy mixes over time would be useful.

Trade-offs exist for dynamic cost effectiveness relating to uncertainties and the level of market intervention. Less interventionist approaches (e.g. pricing only) with greater degrees of flexibility can allow the market to adapt more easily to exogenous shocks to the system, such as large fluctuations in price of components and materials. However, such an approach is susceptible to market failures, which may lead to slower BEV diffusion, which incentivises less investment, hampering dynamic cost effectiveness and in a worst case scenario may under-attain 2030 targets for diffusion. Conversely, a highly prescriptive approach which attempts to direct the trajectory and target all failures to accelerate transition, is potentially more susceptible to dynamic cost ineffectiveness in presence of exogenous uncertainties. If supply chain costs turn out to be much higher than anticipated (due to crises, material and component shortages etc.), then mandated proxy targets for BEV diffusion rates might result in much higher costs. In a worst-case scenario, high costs and supply shortages might result in political pressure to relax ambition, which could undermine credibility. Consequently, striking the right balance between targeting market failures and providing policy credibility (via directionality), while also allowing enough flexibility to adapt to uncertain conditions and allow market mechanisms to optimise price performance improvements is at the core of intertemporal cost effectiveness. A policy mix that induces increased use of alternative abatement options (e.g. ICE vehicle use reduction) and a temporal shift in the BEV deployment schedule minimizing costs over time while preserving the environmental targets is desirable. Credible empirical scientific studies further clarifying and preferably quantifying these uncertainties in the specific EU and German context (and beyond) would be extremely valuable.

3.3. Distributional effects

We focus on the distributional effects across population groups. Policy mixes that bestow resources on target groups are more likely to produce/maintain their political support over time (Campbell 2012). Policy mixes can either bestow resources or incur costs and loses on target groups (Pierson 1993; Edmondson et al. 2019). How visible and traceable benefits/costs are (Pierson 1993), and to what extent these are dispersed or concentrated within the population will affect the strength of these ‘resource effects’. Resource effects can affect interest groups and stakeholders, but we do not consider the distributional impacts on business here as it is difficult to identify asymmetries in how firms would be differently affected across our alternative policy pathways below. Our alternative pathways achieve the same volume of BEVs deployed by 2030 (by assumption), providing equivalent market challenges and opportunities to manufacturers. We also do not engage in questions around national component requirements and industrial policy, which would require dedicated cost-benefit analysis. Further work addressing the distributional politics for car manufacturers and firms more broadly across alternate policy mix pathways would be useful.

The LDV transition will likely have different impacts across income groups. To the extent poorer households in Germany own cars (relatively few do in the poorest deciles, Kalkuhl et al. 2022), increasing the costs of operating existing ICE vehicles (e.g. via carbon (fuel) pricing) or of purchasing new vehicles (e.g. possibly via ICE vehicle standards, BEVs) might hit them disproportionally hard since they tend to spend a higher share of their income on LDV-related mobility than richer groups (on higher share of fuel expenditure in household consumption, see Kalkuhl 2022). The related loss in disposable income and reduced mobility opportunities are inextricably linked to social disadvantage and exclusion (Ohnmacht et al. 2009, Lucas 2012; Schwanen et al. 2015; Urry 2016). Particularly affected/vulnerable groups include: elderly people, people with reduced mobility, low-income groups and unemployed people. These effects are more likely to occur in rural and deprived areas with less availability of alternative modes of (public) transport (Caulfield et al. 2022).

While all policy pathways involve costs, the level of total costs (i.e. cost effectiveness) and their salience will differ across policy pathways. Higher dynamic cost effectiveness reduces the overall pie of costs to be distributed across income groups (Section 3.2). The salience of GHG pricing policies (GHG taxes, emission trading schemes) is considered higher than that of standards indirectly changing costs (e.g. of new vehicles, or fuels). This is widely perceived to facilitate political mobilization against carbon (fuel) pricing policies (Douenne and Fabre 2020). In particular, there is significant concern over the political acceptance of very high carbon (fuel) prices (Axsen et al. 2020, see below).

Policy pathways raising significant fiscal revenues offer the opportunity to directly steer distributional outcomes via recycling. Policies generating fiscal income open up opportunities for revenue recycling and thus directly steering the distributional impacts across income groups, e.g. via lump sum recycling anticipated to lead to (on aggregate) progressive outcomes in Germany (Baldenius et al. 2021).

3.4. Fiscal effects

Fiscal effects can refer to the costs incurred on the state associated with supporting the policy mix over time, or conversely if the mix design generates revenues. Policy mix design can incur high strain on state budgets if it relies heavily on subsidies. Conversely, pricing mechanisms can alter the relative purchase costs of BEVs, either directly through registration taxes, or indirectly through carbon fuel pricing, while also generating revenues.

Combining instrument types can reduce fiscal strains on state budget. Policy mix design can combine instrument types to reduce overall fiscal burden. For example, policy designs which involve both revenue-generating and subsidising components (e.g. “Bonus-Malus”) can complement each other to contain fiscal costs. Disincentivising behaviour through pricing can generate revenues while incentivising another behaviour, which also reduces the amount of subsidy needed since the purchase costs of taxable stock (ICEs) increases relative to the non-taxable stock (BEVs).

Fiscal effects are associated with support and opposition from budgetary guardians for climate policy. If policy mixes generate high fiscal costs, they are more likely to raise concerns among budget guardians and those prioritizing other state spending priorities (e.g. health, education), and thus political opposition (Oberlander and Weaver 2015; Edmondson et al. 2019). Reducing the fiscal burden can therefore help shield the policy mix from political contestation, especially in times where state revenues are constrained (e.g. economic recessions, austerity, crises). If policy mixes raise revenues, not only is the policy mix more likely to retain support, but funds can be used for multiple purposes including targeting distributional outcomes, investing in green technologies, or supporting the general budget (Klenert et al. 2018, Kellner et al. 2022).

The envisaged erosion of gasoline and diesel fuel tax revenues raises a challenge for public finance. Phasing out gasoline and diesel use implies gradual loss of ~€36 bn annual fuel tax revenues for the state (Haushaltsgesetz 2021). Other fiscal sources will need to be substituted from within or outside the LDV sector, assuming the state budget will not be reduced accordingly. This challenge equally applies to all policy pathways achieving zero LDV GHG emissions.

3.5. Political feasibility

Political feasibility is a key consideration in policy mix design and relates to the potential for implementation of the policy reform, and its policy durability over time. Whether or not a reform option is possible to be implemented, and if the political support for this is likely to be sustained over time is central concern for policy pathways construction. However, political feasibility is also closely related to other design challenges: cost effectiveness, distributive effects and fiscal effects. Therefore, addressing the previous challenges in pathway design also increases the prospects for acceptance and sustained political support over time of the pathway.

Prospects for policy mix reform depend on party policy platforms and enabling or constraining political coalitions. Instrument selection and stringency can be largely dependent on the strength and size of supportive political coalitions (in particular across parties forming a coalition government) who are needed to enact and support reforms. Given current political conditions some reforms may not be possible until more favorable political coalitions form (Patashnik and Zelizer 2013; Oberlander and Weaver 2015). Conversely, if supportive political coalitions weaken post-enactment, reforms may become increasingly contested over time, leading to dismantling.

Formation of policy platforms and political coalitions is significantly influenced by acceptance and support from (a) voters and (b) industry. Political parties form their climate policy platforms in the context of electoral systems, public opinion and (competing) industry interests. Democratically elected policymakers will avoid being penalized in elections for introducing climate policies that reduce the likelihood of being part of a government coalition, e.g. by losing vote shares (Stokes 2016). Broadly, ambitious climate policies tend to be adopted where public opinion is favorable (Levi et al. 2020). Conversely, a lack of acceptance for policy mixes or its deterioration over time might lead to their watering down or even dismantling, thus putting the attainment of GHG targets in jeopardy. While most German citizens are concerned about climate change and support climate change mitigation, many ambitious policies, especially in the transport sector, remain controversial (Levi et al. 2021). Carbon (fuel) pricing, for example, tends to be one of the least popular climate policies in the transport sector, likely because costs are highly visible and trust in the political implementation of carbon taxation is limited.

Public acceptance of reforms is influenced by a range of factors including distributional impacts, general political preferences, values, trust in government, and perceived policy outcomes (e.g. emission reductions). Research shows the acceptance of specific climate policy instruments is driven by economic self-interest, climate change attitudes, and political trust as well as by perceptions of fairness and effectiveness (Carattini et al. 2019; Douenne and Fabre 2020; Maestre-Andrés et al. 2021). Carbon (fuel) pricing, for example, tends to be more accepted when political institutions are well-governed, when citizens are compensated for the burden of carbon (fuel) pricing, and when social policies are included in the policy mix (Levi et al. 2021). To understand public opinion towards different types of policy instruments, we focus on their (perceived) consequences, notably the extent to which they are regarded as effective, fair, and un-intrusive.

Public acceptance can be increased through a sequencing design logic. Implementing an unintrusive carbon tax initially, and gradually increasing the stringency over time could allow time for initial opposition to policy implementation to stabilise, mitigating provoking public contestation through immediately high pricing. Studies suggest that citizens quickly become accustomed to measures after they have been introduced, especially if perceived burdens turn out to be lower than feared before implementation (Harrison 2013; Jagers et al. 2020; Konc et al. 2022). Initially moderate carbon pricing might also be complemented by other initially moderately stringents instruments yielding additional emissions reduction effects, thus potentially dispersing salience of the intervention across multiple instruments (instead of a single highly visible and potentially politicized instrument with significant hike in stringency). We are not aware of robust evidence on such a potential mechanism though.

Public acceptance can also be increased through use of compensation measures. The particularly salient upfront costs of carbon (fuel) pricing compromise public acceptance of pricing at high stringencies. However, research indicates that implementing revenue redistribution to compensate the public may mitigate opposition. However, this effect is believed to be more pronounced for traceable ‘lump sum’ payments and observed to be low for indirect compensation mechanisms (Baldenius et al. 2021, Mildenberger et al. 2022, Kellner et al. 2022).

Industry and specifically automobile manufacturing interest groups can constrain ambitious policy reforms through lobbying. Interest group’s influence is considered a primary obstacle for climate change policy adoption, especially in the transport sector, where capital is very concentrated (Kornek et al. 2020). Germany is home of some of the world’s largest car companies and in the Southern Bundesländer, car manufacturers and their supplier employ a significant share of the German voter base. Moreover, Germany’s transport ministries have been mostly run by conservative parties who perceive it as their responsibility to protect the German car manufacturing industry (Flachsland and Levi 2021). We consider potential opposition and support by German car manufacturers, noting that more ex ante analysis comparing potential reactions to alternative policy mix pathways in the German corporatist setting would be useful.

Manufacturers’ support of electrification appears to have recently increased (in general). Some manufactures may remain reluctant to rapid electrification of new vehicle sales, but in general preferences have been changing. The German car industry has until recently opposed climate policies in the transport sector, partly because it represents an extremely powerful vested interest group with a highly profitable business model based on the ICE vehicle solidly entrenched in a corporatist governance context (Meckling and Nahm 2018; Flachsland and Levi 2021). This behaviour might be interpreted as producer myopia, discounting policymakers’ announcements of long-term decarbonization efforts. Some companies still lobby for continued production of ICE vehicles and associated use of hydrogen or e-fuels (at least in light-duty vehicles or trucks). However, Germany’s largest carmaker Volkswagen (VW) has invested strongly in electro mobility and is openly supporting stricter climate policies in the transport sector. Currently, almost all German car manufacturers invest in electrifying their product portfolio, but the degree to which they can comply with stricter climate policies and their acceptance of them strongly varies across companies.

Understanding of the formation of political party climate policy platforms in the context of the German (and other) electoral systems, voter preferences and industry interests remains limited. Even while political feasibility is a key consideration in designing and evaluating climate policy mixes ex ante, a conceptually clear and empirically operationalized framework for precise analysis is lacking. Research should advance understanding in this direction given the high relevance for societal decision-making and welfare. In the meantime, predictions about political feasibility need to be treated with care and the significant uncertainties should be clearly communicated. One way of addressing these uncertainties in real world policymaking is via governance provisions that put the option of (non-)incremental ratcheting up of policy stringency of instrument mixes regularly on the agenda (e.g. the German Climate Law’s annual review mechanism, see Flachsland and Levi 2021). Such institutional windows of opportunity might then align with favourable (or unfavourable) changes in policy platforms and political coalitions.

3.6. Governance

Our pathways assume a patching construction logic, which involves amending and reconfiguring the existing policy mix currently implemented. Real world policymaking is messy and often involves patching and layering upon existing polices (Howlett and Rayner 2013). A major consideration is that policymakers do not have a blank slate on which to enact a new package of instruments. Much more commonly adjustments to policy mixes involve patching existing mixes, through layering (adding policies on top of existing mixes), drift (changing the substance of existent policies), and conversion (significant changes in policies; Howlett and Rayner 2007), or addition and termination of instruments. Termination is procedurally more challenging than other procedural interventions. Our pathways accommodate these considerations by building from currently enacted mixes and plans for their reform (i.e. EU Commission Fit for 55 proposal, German coalition treaty).

Governance requirements depend on several factors which relate to pathway design and instrument choice. Governance requirements for pathways depend on: (a) the informational and administrative requirements of selected instruments, (b) their need for recalibration and adjustment over time, and (c) the number of instruments utilised and associated complexity of the pathway design.

Instrument choices have different informational and administrative requirements. Regulatory-based approaches typically have higher administrative requirements, such as robust procedures for monitoring of vehicle emissions intensity which are susceptible to issues of ‘gaming’ and evasion (Reynaert 2021). Technical capabilities are required for monitoring, along with access to accurate information. Absence, or low capacities, of institutions or enforcement agencies make implementing, or updating/adjusting stringent policy (e.g. technology standards) difficult, which can have adverse implications for credibility of the policy mix (Edmondson et al. 2020). Similarly, emissions trading mechanisms and carbon taxation require credible monitoring and other administrative infrastructures. Carbon (fuel) pricing instruments also require updating under learning about their performance and in changing circumstances, as illustrated by the constant flow of EU ETS reforms since its inception. Choosing instruments which have high informational and administrative requirements increase the governance challenge, which may lead to higher likelihood of governance failure and may undermine credibility.

Governance of policy pathways need to be adaptive, so instrument recalibration mechanisms and planned revision steps must be included in the design. Due to the complexity of real-world policymaking, conditions change, and unintended consequences will occur, which will require amendments or subsequent policy patching (Howlett and Rayner 2013). Policy mixes need to co-evolve with changes in the world (Edmondson et al. 2019), both internal system dynamics (e.g. market trends, public acceptance) and external shocks (e.g. sudden changes to international supply chains for components). This requires reflexive and iterative policymaking processes (Hoppmann et al. 2014), and instruments should be designed with mechanisms embodying either automatic or structured discretionary political adjustments, allowing to effectively respond to changing conditions (Jordan and Moore 2020). Some instrument options will require more recalibration, primarily those which need to be adaptive to exogenous trends such as component prices and market prices of BEVs. This comes with a trade-off of increased information and administrative requirements and reduced certainty, which can hamper dynamic cost effectiveness.