Table of Contents

Executive Summary

1. The new emissions trading system for buildings and road transport – the so-called ETS2 – proposed by the European Commission in the Fit for 55 package is key for decarbonising these two sectors. But a uniform EU-wide carbon price has important distributional implications – both between EU member states and within them. Managing these implications in a way that ensures solidarity and fairness is of utmost importance to providing the ETS2 and its price signal with the necessary political robustness and enduring credibility.

2. To that end, the Commission has proposed the creation of a Social Climate Fund (SCF).1On 8 June 2022, the European Parliament voted on the SFC proposal as well as proposed amendments. The EP rejected the report on the revision of the EU ETS and referred it back to the ENVI committee. The final vote on the SCF was adjourned until agreement on the ETS review has been achieved. See https://www.europarl.europa.eu/news/en/press-room/20220603IPR32130/fit-for-55-environment-committee-to-work-onway- forward-on-carbon-pricing-laws While this proposal builds on evidence gathered by the Commission for related analysis2See the section titled “Collection and use of expertise” in the SCF proposal (COM(2021) 568 final)., no dedicated impact assessment has yet been conducted. Other studies have analysed some of the design aspects – especially the distributional effects of carbon pricing on households – but key design choices have not yet been systematically explored. In particular there needs to be an understanding of: (1) the advantages and disadvantages of different design options, and (2) interactions with other policies and regulations at EU and memberstate level. This study fills this gap for three particularly important choices that may have far-reaching consequences for the overall policy package:

3. The first design choice is the institutional structure and general governance level of the mechanism to manage the distributional implications. While the SCF seems generally capable of performing its designated function, there are concerns surrounding whether the SCF should be established at EU level or at the member-state level. Against this backdrop, this report compares the SCF with three other design options that differ in terms of how they are situated between national and supranational levels.

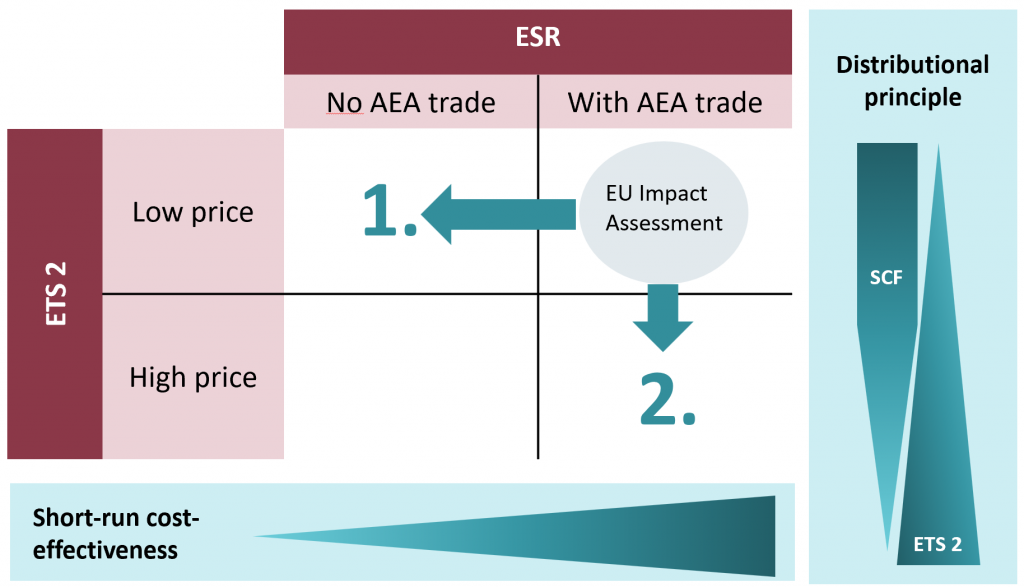

4. The second design choice relates to the interaction between the ETS2 and the Effort Sharing Regulation (ESR). In general, the ETS2 can shift the distribution of emissions reductions away from agreed-upon ESR targets, with consequent welfare effects.3The reason for this possible divergence between the ETS2 and the ESR is the interactive, and not yet fully specified, overlap of a bottom-up and a top-down system: In the “bottom-up” ETS2 system, companies throughout the EU trade allowances for the emission of CO2. The resulting allocation of ETS2 allowances is therefore an emergent market outcome, determined by company-specific abatement costs. In contrast, the “topdown” ESR specifies an allocation of abatement burdens between member states (defined via the “Annual Emission Allocation”, AEA) and provides for the trading of AEA allowances between the member states. In order to maintain a fair effort- sharing between EU member states, it is crucially important to manage the distribution and flow of revenues resulting from the trade of ESR certificates (annual emission allocations, AEAs) and ETS2 certificates. This report uses quantitative modelling to analyse how welfare would change if AEA trade was limited, and/or the ETS2 price was relatively high.

5. The third design choice concerns the financial volume of the SCF (or of an alternative social transfer mechanism): how large does it need to be, in terms of the share of total auction revenues, to ensure fair compensation for households across the EU, given varying criteria for social fairness? This is important because there is a trade-off between using revenues for social compensation on the one hand, or financing green investments and infrastructure on the other. Furthermore, different forms of compensation entail different administrative requirements and specific challenges. This report discusses these issues in light of the SCF spending criteria, specifically with a view to possible adjustments that would make compensation more targeted.

DESIGN CHOICE 1: INSTITUTIONAL STRUCTURE AND GOVERNANCE LEVEL

6. The SCF, as proposed by the European Commission, is only one out of a number of different design options for achieving the goal of a socially balanced implementation of the ETS2 – and it may not be the best one. Alternatives are conceivable with regard to (1) who should be eligible for compensation, (2) who should be responsible for compensation, and (3) who should control the spending.

7. The SCF’s goal of preventing excessive burdens from the ETS2 is unquestionably appropriate and important. Nevertheless, the proposal has sparked controversy because the distributional effects of climate change touches on very fundamental and sensitive issues at the heart of the EU, i.e. the value of solidarity (between member states) and the idea of the welfare state (within each member state). Furthermore, the principle of subsidiarity demands that the EU only acts if and insofar as the objectives of the proposed action cannot be sufficiently achieved by the member states.

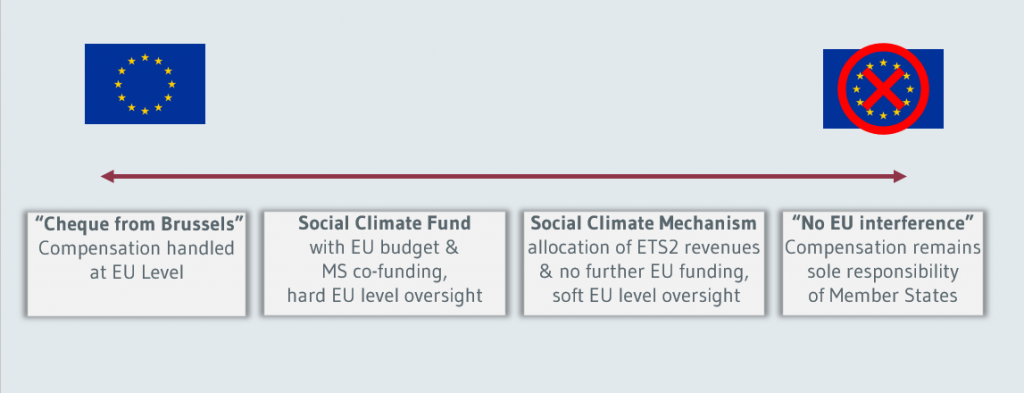

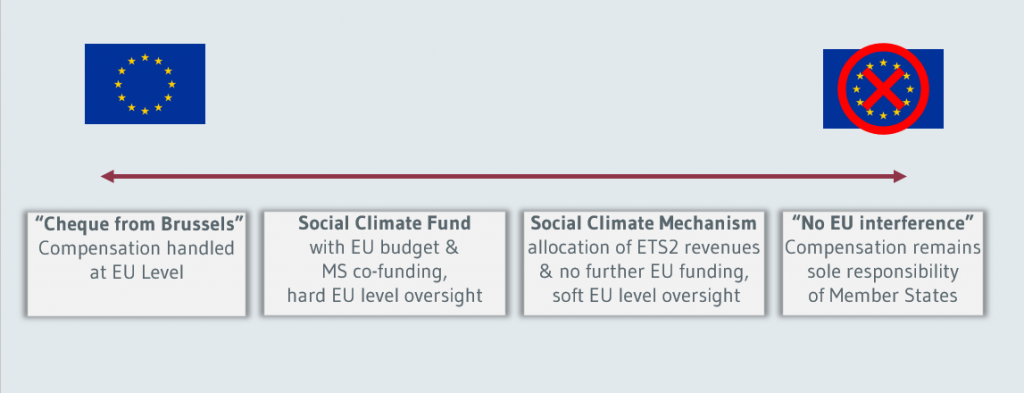

8. Given this tension, it is worth evaluating how the objective of “leaving no one behind” of the current SCF proposal can be achieved best by comparing four design options, each of which situates governance of the respective program at a different stage along the cooperation – subsidiarity spectrum. Figure ES1 illustrates these four options, ranging from extreme cooperation (“Cheque from Brussels”) to extreme subsidiarity (“No EU interference”), with two moderate options in between.

9. Based on eight guiding questions4(1) Where do funds originate? (2) Which criteria govern the allocation of resources? (3) Is member-state co-funding required? (4) Where are the funds held? (5) Who decides on spending? (6) Are the criteria for spending set at the EU level? (7) How is spending controlled and governed? (8) How are funds disbursed?, we describe the SCF proposal in terms of its institutional characteristics and compare it with the three alternative approaches depicted in Figure ES1. For the two “corner solutions”, our analysis points to severe deficiencies, both conceptual and practical, implying that they do not represent feasible solutions. Looking at these options is nevertheless useful since proposals in these directions are on the table. The second step of the analysis then contrasts the Commission’s proposal for a Social Climate Fund with an alternative option: a “Social Climate Mechanism” (SCM). A central idea of the latter approach is that the goal of social balancing can be achieved through clearly-defined rules and procedures, but without recourse to the EU budget – thus avoiding some political, legal and administrative hurdles.

10. A main result of our analysis is that the quality of implementation and the level of cooperation between the Commission and member states is crucial for the performance of both the SCF and the SCM. Assuming ideal implementation and sincere cooperation between the Commission and member states, the SCF may be the better option since it achieves its targets more reliably. The alternative proposal of an SCM is less ambitious in terms of precision and stability, but allows for a leaner structure and a higher degree of member-state ownership. It is ultimately a matter of policy preference that tilts the balance towards either the SCF or the SCM.

DESIGN CHOICE 2: ETS2 AND ESR INTERACTION

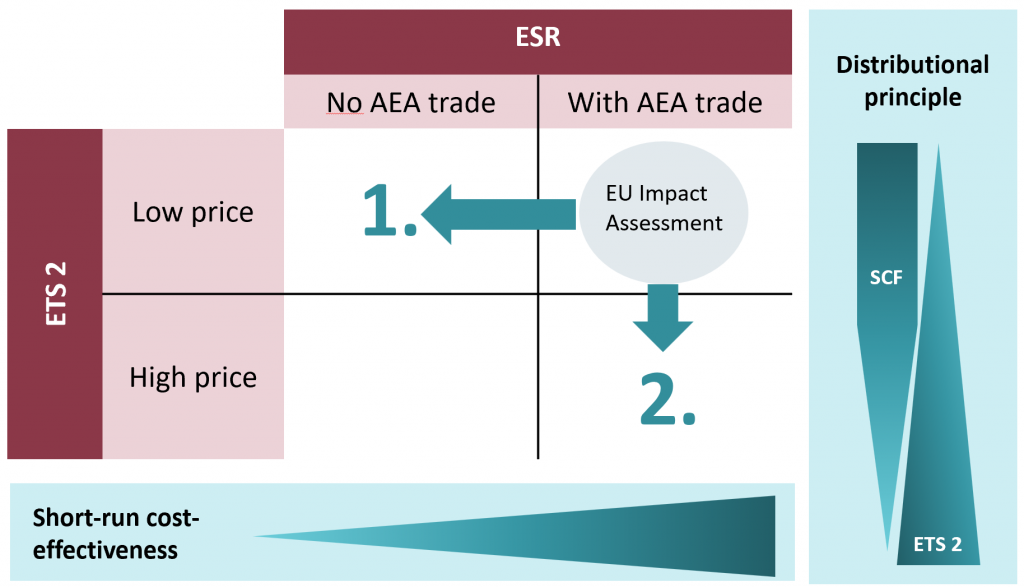

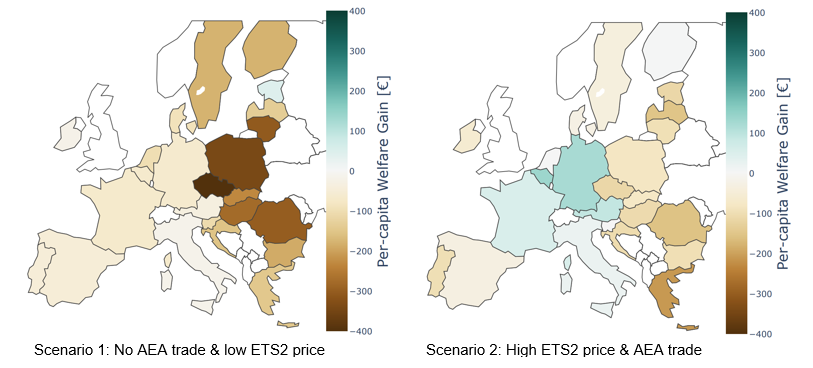

11. The interaction between the ESR and ETS2 in the Fit for 55 proposal entails uncertainty in three dimensions: AEA trade may remain limited; the ETS2 price is uncertain; and it is unclear how revenue allocation between member states will respond to changing ETS2 prices (Figure ES2).

trade and a low ETS2 price. Note: For a short description of the model see Box below;

individual scenarios are described in the subsequent sections.

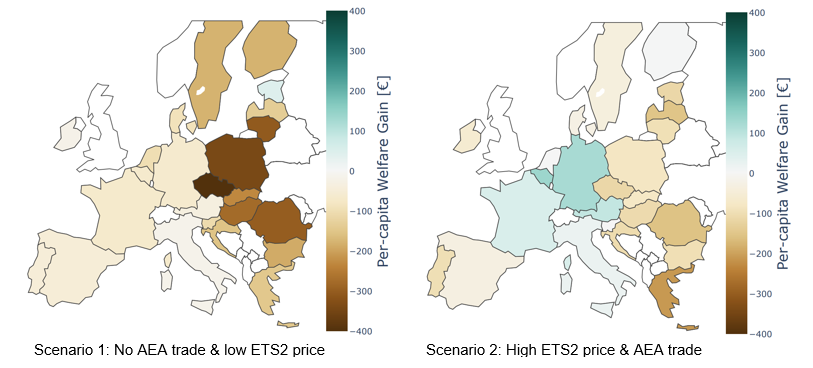

12. If not properly accounted for in policy design, these uncertainties might undermine the stability of EU climate policy architecture. Our analysis brings two main risks to light: First, an absence of AEA trade will increase the costs of climate policy for almost all member states (left-hand panel of Figure ES3) and thus make it more difficult to reach the EU’s emissions target. Second, a higher ETS2 price is likely to have an impact on the cost distribution across member states that is at odds with the ESR (right-hand panel of Figure ES3) if social transfer mechanisms are not scaled accordingly. In this case, (mostly) poorer member states would suffer from higher welfare costs whereas (mostly) richer member states would benefit from lower welfare costs. Both potentially undermine the political acceptability of the EU’s climate ambition.

13. To increase the political stability of the Fit for 55 package, we propose to (i) improve AEA trade and (ii) ensure that the relative distribution of ETS2 revenues between member states is independent of the ETS2 price, i.e. social transfer mechanisms need to be scaled accordingly.

DESIGN CHOICE 3: DISTRIBUTIONAL IMPACTS & TRANSFER

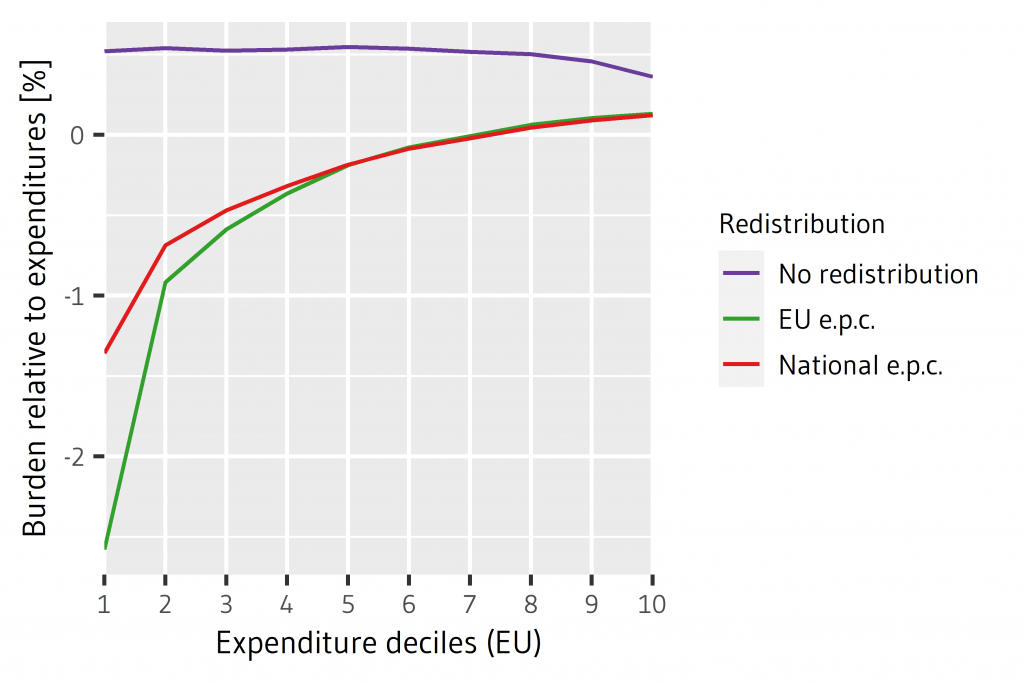

14. At the EU level, the impact of the ETS2 would be slightly regressive. That is, low-income households would, on average, spend a higher share of their disposable income to keep up their energy consumption. However, using the revenues from auctioning permits can make the ETS2 progressive.

15. Using revenues from carbon pricing in a way that benefits every EU citizen in an identical manner (e.g. by direct transfers, tax reductions or infrastructure investments) could provide benefits to low-income households that exceed their additional energy costs, so that they are better off with the ETS2.

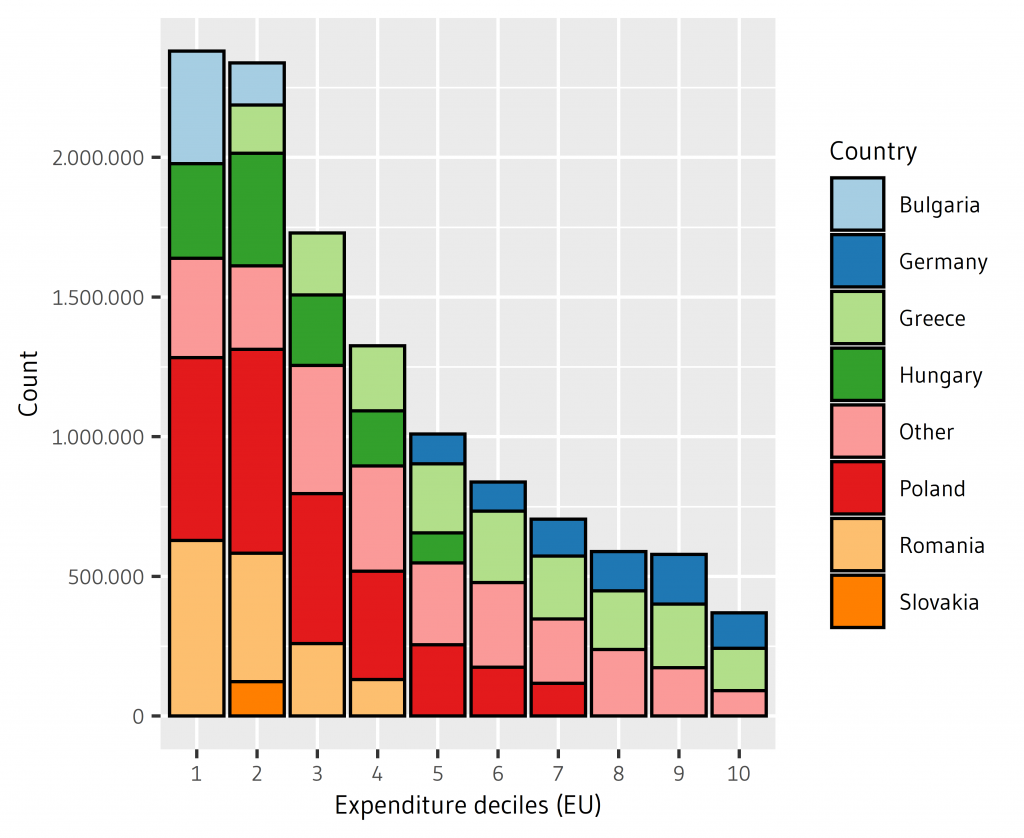

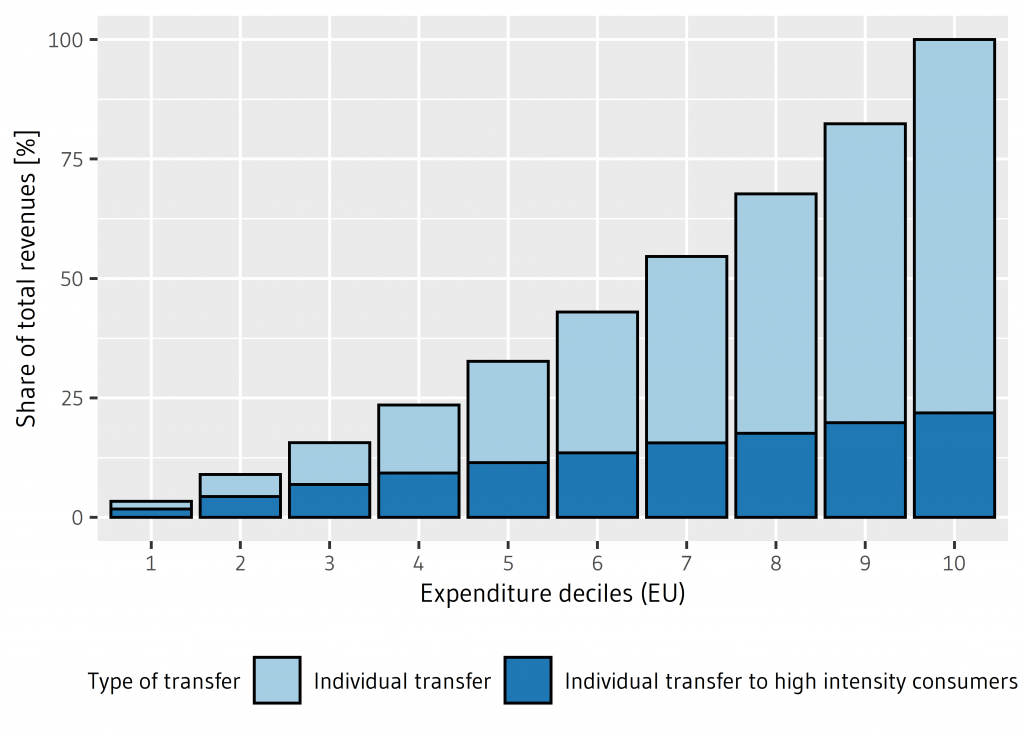

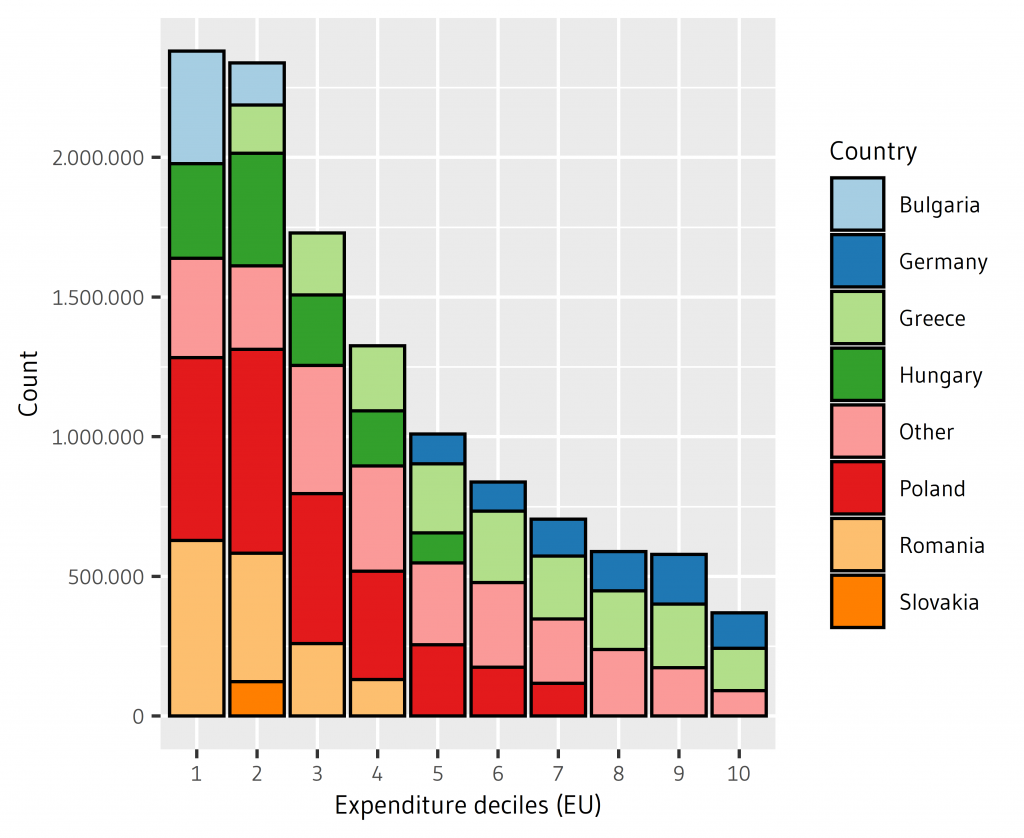

16. While low-income households would gain on average, a carbon price would put high-intensity energy consumers, for whom energy expenditure constitutes a large share of spending, at risk of energy poverty (Figure ES4). Households in Bulgaria, Hungary, Poland and Romania would be at greatest risk of experiencing energy poverty.

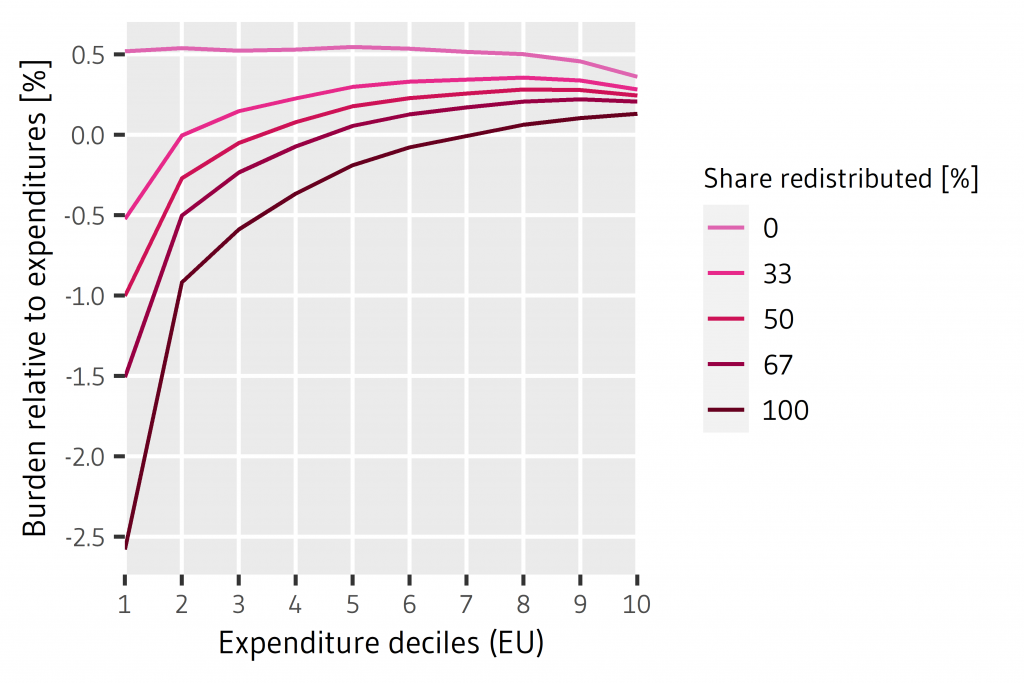

17. Targeted measures can prevent energy poverty for low-income households. Transfers amounting to slightly more than 10% of auction revenues would be sufficient to compensate all high-intensity energy consumers in the lower half of the income distribution for their additional energy costs (Figure ES5). However, transfer payments to all households in this income segment would require more than 30% of carbon-pricing revenues.

18. Relieving households by lowering energy prices does not make sense because it also weakens the incentive to reduce emissions. More sensible are measures that especially enable vulnerable groups to adjust to higher energy prices, since these are effective from an environmental as well as social perspective. This includes expansion of public transport or targeted support for heat pumps in low-income households. Starting to implement such measures before the ETS2 enters into force can help to cushion social hardships.

1. Introduction

The new emissions trading system for buildings and road transport – the socalled ETS2 – proposed as part of the Fit for 55 package is key for decarbonising these two sectors. It will oblige fuel suppliers to obtain emission allowances for the greenhouse gas (GHG) content of the fuels they supply to customers in those sectors. The ETS2 thus sets up a technology- neutral carbon price that provides incentives to decarbonise operations and foster investment and innovation towards the EU goal of GHG neutrality by 2050.5Furthermore, the ETS2 would represent an important milestone on the road to a uniform CO2 price within Europe, which should foster international cooperation in the form of a global carbon pricing regime (Edenhofer et al. 2021)

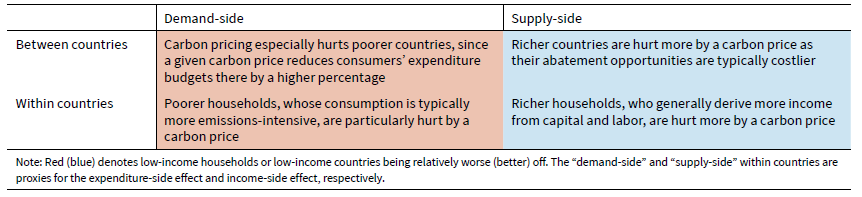

However, a uniform EU-wide carbon price will have distributional implications at the household level, both between and within EU member states (see Figure 1): Low-income households tend to spend a higher proportion of their disposable income on energy consumption. This raises the issue of social fairness and how to avoid a regressive effect of the carbon price on the income distribution (i.e. a higher relative burden on lowincome segments of society). Correspondingly, member states with a relatively high share of low-income households are disproportionally affected by a uniform carbon price – especially if they do not have the financial means or institutional capacity to compensate such households through social policy and transfers.

Source: Frederikkson & Zachmann (2021)

This suggests the need for a mechanism to balance the distributional effects of the ETS2 in a way that ensures social fairness within EU member states, and solidarity between them. Such a mechanism will make the ETS more acceptable upon its introduction, more robust in light of changing energy prices – and thereby more likely to politically durable, and deliver a stringent and credible carbon price. The use and (re)distribution of revenues from auctioning ETS certificates between and within member states will be key to achieving this. Correspondingly, the rules for the distribution of allowances between member states, and the criteria for spending the resulting revenues, are the central policy levers for which design options are being discussed.

The Commission has proposed to institutionalize these levers through the creation of a dedicated Social Climate Fund (SCF).6https://ec.europa.eu/clima/eu-action/european-green-deal/delivering-european-green-deal/social-climate-fund_en Its core features are: (1) A total financial envelope for the 2025–2032 period of 72.2 billion € in current prices – amounting to 25% of expected ETS revenues – to be financed through the EU’s Multiannual Financial Framework (MFF). This entails a “frontloading year” to ensure a smooth transition to the ETS2. (2) A formula for the maximum financial allocation from the SCF to each member state. (3) Social Climate Plans (SCPs), to be assessed by the Commission, in which member states articulate the measures to be financed through the SCF, their expected costs, milestones and targets. If approved, the SCF can finance up to 50% of the total SCP costs, with the remainder coming from member states’ national budgets.

While the proposal builds on evidence gathered by the Commission for related analysis7See the section titled “Collection and use of expertise” in the SCF proposal (COM(2021) 568 final)., no dedicated impact assessment of the SCF has yet been conducted. Other studies have analysed some design aspects – most notably the distributional effects of carbon pricing on households – but key design choices have yet to be systematically explored. In particular there needs to be an understanding of: (1) the advantages and disadvantages of different design options, and (2) interactions with other policies and regulations at the EU and member-state level. This study seeks to address three design choices which may have far-reaching consequences for the overall policy package:

The first design choice concerns the institutional structure and general governance level of the mechanism to manage the distributional implications of ETS2. While the SCF seems generally capable of performing this function, there are concerns whether redistribution should be handled at the EU level (as foreseen in the SCF proposal) or at the memberstate level. Against this backdrop, this report compares the SCF with three other design options that differ in terms of how they are situated between national and supranational levels.

The second design choice relates to the interaction between the ETS2 and the Effort Sharing Regulation (ESR), which establishes binding annual emissions targets for EU member states related to i.a. emissions from road transport and buildings.8https://ec.europa.eu/clima/eu-action/effort-sharing-member-states-emission-targets_en If the ETS2 allowance price is relatively high, member states with relatively unambitious ESR targets risk overshooting them. To maintain the distribution of efforts as agreed upon in the ESR, it is crucial to manage the distribution and flow of revenues resulting from the trade of annual emission allocations (AEAs) (which determines the number and distribution of ESR certificates) and ETS2 certificates among member states. This report therefore analyses how welfare would change if – in contrast to the European Commission’s assessment assumptions – AEA trade was limited, and/ or the ETS2 price were relatively high. On the basis of quantitative modelling results, we discuss various options for how ETS2 allocation and market rules could be adjusted to increase the robustness of effort sharing between member states in the face of an uncertain ETS2– ESR interaction.

The third design choice concerns the issue of how large a share of total auction revenues the SCF (or an alternative mechanism) needs to be to ensure adequate compensation for households across the EU, given varying criteria for social fairness. This is important because there is a trade-off between using revenues for compensation on the one hand, or for financing green investments and infrastructure on the other. Furthermore, alternative forms of compensation entail different administrative requirements and specific challenges. This report discusses these issues in light of the SCF spending criteria, specifically with a view to possible adjustments that would make compensation more targeted.

2. Institutional options to ensure solidarity and social fairness – Social Climate Fund and alternatives

Authors: N. aus dem Moore, B. Görlach, F. Pause, J. Nysten, J. Brehm

The SCF, as proposed by the European Commission, is only one of several different design options for achieving the goal of a socially balanced implementation of the ETS2 – and it may not be the best one. This section describes the SCF proposal in terms of its institutional characteristics and compares it to three alternative approaches. Two of these mark the theoretical extremes along a spectrum of conceivable options. The third is a proposed Social Climate Mechanism (SCM) – a moderate and viable alternative to the SCF.

Different paths to the same goal

There is a broad consensus that climate policy ought to be socially balanced; as Frans Timmermans observed, “either this will be a just transition – or there will be just no transition”9Remark by Executive Vice-President Frans Timmermans at the Informal Environment Council on Oct. 1, 2020.. But the concrete decisions on who should be eligible for compensation, who should be responsible for compensation and who should control the spending remain controversial. With its proposal for an SCF, the EU Commission has tabled its idea for a governance structure dedicated to this purpose. This proposal has attracted both praise and criticism, as it touches on a fundamental tension between basic values and principles of the EU:

- The EU relies on solidarity between member states, as stipulated in Article 2 of the Treaty on European Union (TEU), and within each member state, the idea of the welfare state may encompass the promotion of social protection and inclusion.

- At the level of regulatory intervention and implementation, Article 5 of the TEU specifies the principle of subsidiarity, stipulating that the EU shall only act within its non-exclusive competences if and insofar as the cannot be sufficiently achieved by the Emember states. However, under Article 4 (3) of the TEU, the EU and member states shall work together in sincere cooperation to achieve the goals of the Union.

Depending on the desired balance between subsidiarity and cooperation, governance can be concentrated more at the EU level or at the member-state level. Correspondingly, Figure 2 illustrates four possible design options for the social balancing of the new ETS2, ranging from extreme centralisation (“Cheque from Brussels”) to extreme subsidiarity (“No EU interference”), with two moderate options in between.

METHODOLOGY

The analysis compares institutions

based on considerations in law, political

science and economics. To structure

the analysis and make it transparent,

a unified framework was

constructed around the following

eight guiding questions:

- Where do funds originate?

- Which criteria govern the allocation

of resources? - Is member-state co-funding required?

- Where are the funds held?

- Who decides on spending?

- Are the criteria for spending set

at the EU level? - How is spending controlled and

governed? - How are funds disbursed?

Description and analysis of different options

The analysis of the four options followed eight guiding questions, presented in the “Methodology” Box.10See tables A2.1, A2.2 and A2.3 in the appendix for a detailed overview of the respective design features. It was conducted in two steps:

- The first step looks at the two “corner solutions”, i.e. the extreme positions. For these, the analysis points to severe (conceptual and practical) deficiencies, implying that they do not represent feasible solutions. Looking at these options is nevertheless useful since proposals in these directions are on the table.

- The second step zooms in on the two more balanced approaches – in a political, legal or administrative sense. This step contrasts the Commission’s SCF proposal with our alternative SCM option. A central idea of the latter approach is that the goal of social balancing can be achieved through clearly defined rules and procedures without recourse to the EU budget – thus avoiding some political, legal and administrative hurdles.

| Option | I “Check from Brussels” | II SCF | III SCM | IV “No EU Interference” |

|---|---|---|---|---|

| Description | Compensation is handled entirely at the EU level (implementation, administration and control) | Commissionproposal to compensate for effects of the ETS2 through a dedicated EU fund | Alternative proposal without recourse to the EU budget, organized instead via member-state budgets | Compensation takes place entirely at member-state level |

| Analysis | Step 1 | Step 2 | Step 2 | Step 1 |

Step 1: Comparing Option I (“Cheque from Brussels”) with Option IV (“No EU interference”)

The two corner solutions mark the extremes in terms of assigning responsibility for compensation entirely to Brussels compared to keeping it entirely within the member states.11Table A2.1 in the Appendix shows how these options play out in light of the eight guiding questions. In both cases, the revenue from ETS2 initially accrues at the member-state level; in Option I, these revenues would then be entirely transferred to the EU budget, while in Option II they would remain entirely at the national level. These two options inevitably imply further differences, for example regarding the decision-making authority for expenditures, the question of binding criteria, and alternative modalities of disbursement. The first option, “Cheque from Brussels”, is based on the premise that if the EU places a new burden on European households, the EU should grant compensation. Compensation from the EU would be analogous to solutions in other countries and jurisdictions (e.g. British Columbia, Canada or Switzerland)12See for instance Haug et al. (2018) and Santikarn et al. (2019)., where it is granted through a direct transfer payment to households or even by a cheque in the mail, with the aim of creating maximum visibility for the compensation payment. This option promises a number of advantages: It could help avoid the common “blame game” in which national governments credit themselves for success, but blame unpopular elements on Brussels. It would instead create a more positive perception of the EU. Furthermore, it could reduce the risk of misspending within member states and reduce the temptation for member states to use EU funds to crowd out domestic social assistance. Finally, by largely eliminating the member-state dimension in the distribution of funding, it would enable the targeting of funds to the most vulnerable groups in Europe – irrespective of the country in which they happen to live. There are, however, substantial disadvantages and risks associated with this option:

- Compensation for carbon pricing becomes part of the EU budget and the MFF, hence any spending decisions require unanimity. MFF negotiations are already extremely difficult and often result in delayed agreements; it seems risky to further increase the complexity of this process. Moreover, agreeing the criteria for spending at the EU level would be subject to the same extensive bargaining processes that currently characterize MFF deliberations, limiting the flexibility of the use of funds.

- Distributing funds directly from the EU to its citizens would require a very substantial (and capable) European bureaucracy for social policy, which does not yet exist. This problem is not trivial: even the authorities within member states do not necessarily have all the relevant information pertaining to all of their citizens (inter alia, current addresses and bank accounts). Gathering this information would thus likely involve 27 different approaches, with complex implications for data protection and privacy. Building up this bureaucracy at the EU level – apart from the substantial costs involved – may also be problematic under the subsidiarity principle, since there is no obvious advantage in having the EU achieve the overall objective of the revenue distribution. Furthermore, the EU lacks access to the necessary instruments to effect compensation by other measures, for example by lowering taxes or fees.

- Finally, the realization of this option requires some goodwill (or fantasy) with regard to the political-economic motivation of actors: It is an often- described phenomenon that national governments like to take credit for positively perceived (social) measures, but in return Brussels is made the scapegoat for unpopular developments. Against this backdrop, it is hard to imagine that national governments would simply concede the credit and the praise for the social balancing of the ETS2 to the EU.

The other extreme option – “No EU interference” – embodies the notion that social policy should be the sole responsibility of member states, without any input from the EU.13There are indeed those who argue against any EU-designed social compensation in the context of ETS2, calling for any engagement to bestrictly optional and at the member-state level (cf. Schmidt & Frondel 2022). Since the ETS2 creates new distributional impacts, according to this line of thought, these impacts can and should be addressed by the member states through existing national structures. All EU member states have developed social welfare arrangements and structures, but the degree of redistribution and social security they achieve differ considerably. This is not necessarily a problem, however; member states opt for the arrangements that best match the preferences of their electorate, and the EU has neither the mandate nor the tools to change this.14There is also a legal aspect to this option: While there is no mandate to provide harmonized welfare systems across the EU, the EU shares non-exclusive competences to support and complement the activities of the member states in the field of social policy (Art. 151, 153 of the Treaty on the Functioning of the European Union [TFEU]). However, where the purpose and focus of a measure is the protection of the climate, the EU’s non-exclusive environmental competence is primarily relevant. When the EU uses this competence and bases a measure on Art. 192 of the TFEU, the EU shall take into account social aspects when defining and implementing its policies and activities (compare also Art. 9 TFEU). Thus, when it comes to the EU’s environmental regulation, the EU shall consider the economic and social development of the Union as a whole and the balanced development of its regions (Art. 191 para. 3 of the TFEU).

Member states are presumed to know how best to use the revenues for effective compensation – including interactions with existing social programmes. They are also best positioned to identify vulnerable groups and know how they can be effectively supported. Where national funds for a just transition already exist, ETS2 revenue could be distributed through these channels: revenues from ETS2 allowance auctions would go directly to the member states that auctioned them, and remain there, much like existing arrangements for the current EU ETS.

However, it should be noted that even under this option, member states’ use of the revenues from the ETS2 would be subject to certain guidelines: while there would be no restrictions on linkage or co-financing through any additional national measures, the target areas for expenditure would at least be broadly defined.15Note that under the current ETS directive, member states should use at least 50% of ETS revenues to tackle climate change, social dimensionincluded (Art. 10(3); COM-Proposal revision ETS-Dir.). Nevertheless, such criteria would allow member states wide-ranging discretion in choosing what to fund, again similar to the current ETS.16This means that no tightening of conditions, compared to the status quo, is compatible with Option IV, and the set of criteria formulated in

the Commission’s SCF proposal must be rejected.

This approach would also have considerable risks and downsides:

- For some member states, at least, loosely defined criteria for spending would be ineffective for directing spending to where it is most needed. The greater room for manoeuvre at the national level could favour successful rent-seeking by influential interest groups, or exacerbate existing corruption problems, especially if the Commission adopts a loose mode of oversight of national spending.

- Second, if ETS2 revenues flow toward national compensation or welfare systems, there is a risk that revenues could crowd out national funding: if member states lower their own contribution in proportion to the EU funding, the (expected) social imbalances resulting from the ETS2 would remain unaddressed.

- Third, from a political–economic perspective, this arrangement would invite member states to continue the “blame game” described above, shifting the blame for carbon pricing to the EU while claiming credit for spending the revenues and providing social support. In sum, these factors constitute a significant risk of misspending (relative to the declared intentions), which could undermine the acceptance of carbon pricing as an instrument.

Taken together, therefore, Options I and IV represent outliers that could conceivably work if many improbable preconditions were fulfilled, but which also carry significant risks – political, legal, administrative and procedural. The next stage of analysis focuses instead on the two middle-ground options: the proposed SCF and an alternative arrangement, the SCM.

Step 2: Comparing Option II (Social Climate Fund) with Option III (Social Climate Mechanism)

The two options in the middle of Figure 2.1 – SCF and SCM – represent two moderate approaches for strengthening the social aspect of EU climate policy.17Tables A2.1, A2.2 and A2.3 in the Appendix depict how these options map onto the eight guiding questions.

Option II is the SCF proposed by the European Commission. It sees the distributional effects of ETS2 compensated for through a dedicated fund established at the EU level. Its specific objective would be to support vulnerable households, micro- enterprises and transport users through temporary direct income support and through measures and investments intended to increase the energy efficiency of buildings, to decarbonise heating and cooling in buildings, to integrate energy from renewable sources, and to improve access to zero– and lowemission mobility and transport.18Art. 1 SCF-Reg.

In the future, member states would be obliged to pay 25% of the revenues from ETS1 and ETS2 into the EU budget,19As Table A2.2 in the Appendix documents, exceptions are possible until 2030 (derogation), including deviations from the principle of a uniformtransfer ratio of 25%. allowing it to front-load the SCF. This additional funding would facilitate spending on measures at the very start, or even in advance, of implementing the ETS2. It would also protect funding against annual fluctuations in ETS2 revenues. The allocation of the SCF’s resources, and hence their availability for member states’ social programmes, would follow a calculation formula based on six measures of social vulnerability and energy poverty.20See Art. 13 with Annexes I and II in the proposed SCF-Regulation.

Since the SCF would be located at the EU level and managed by the European Commission, the use of funding by member states would be subject to an explicit five-step approval procedure, providing for strong Commission oversight: In the first step, each member state would have to submit a Social Climate Plan (SCP) with “a coherent set of measures and investments”, together with an updated version of its National Energy and Climate Plan. Once the SCP (or a revised version of it) has been assessed and approved, the Commission would conclude a legal agreement with the relevant member state and SCF funds would be distributed to the member state according to a pre-defined schedule, conditional upon achieving the milestones and targets set out in the SCP.21See Table A2.3 in the Appendix for further institutional details, e.g. on the governance of spending. Ex post, each member state would be obliged to report to the Commission on the implementation of its plan as part of its integrated national energy and climate progress reports.

Option III, the proposed SCM, is an alternative design that could still achieve the same objective of balancing the distributional effects of the ETS2, but without recourse to the EU budget. It thereby emphasizes the responsibility of member states for social policy and gives them more leeway to define and implement concrete measures.

One fundamental difference is that under the SCM, no new fund would be created at the EU level. Instead, ETS2 revenues would remain entirely with member states and frontloading and smoothing would need to happen at the national level, e.g. through existing funds.22In 2016, seven member states (Croatia, Germany, Hungary, Lithuania, Portugal, Slovenia and Slovakia) had dedicated national energy and/or climate funds into which EU ETS revenues would flow. See Velten et al. (2016), p. 20. To achieve a distribution of financial resources between member states that reflects social needs, the SCM would require the allocation of ETS2 allowances to member states to include an element of solidarity.23See the detailed discussion of this point in Section 3. The allocation of allowances would not simply be based on historical emissions (as in the SCF proposal) but would also have to be based on criteria of fairness, and on exposure and vulnerability to ETS2-induced price increases. Using the established allocation rules of the ESR, rather than devising an entirely new distribution key, could simplify the implementation of the SCM and make it easier to agree on.24See Table A2.2 in the Appendix for further details on the allocation of funds under the SCF and SCM proposals. Using the ESR allocation formula would have the additional benefit of keeping the distribution of the combined revenues from ETS2 and AEA trading (largely) the same, irrespective of how ETS2 and AEA prices evolve, i.e. irrespective of which share of total trading volume flows through which channel.

As member states hold the money under the SCM proposal, decision-making on spending is also leaner, with less supervision by the Commission. In contrast to the five-step approval procedure of the SCF, the SCM could entail a three-step consultation process: Member states would inform the Commission ex ante in writing of their planned programmes, and the related expenditure needs. The Commission would assess these proposals and, if necessary, issue recommendations for adjustments based on their assessment of whether the envisaged programmes are likely to meet the overarching social criteria; however, the final decision on the use of funds would rest with member states. The only constraint would be that a member state would have to declare its reasons, should it choose to deviate from the Commission’s recommendations.25See Table A2.3 in the Appendix for further details, e.g. on the governance of spending.

| Option | SCF | SCM |

|---|---|---|

| Financial allocation across member states | Realizes a targeted allocation of resources to member states on the basis of a calculation formula that takes social criteria like social vulnerability and energy poverty at the individual level into account | Requires that a social component (e.g. the established allocation key of the ESR) be taken into account in the allocation of ETS2 allowances to member states |

| Scope and stringency of EU oversight | Provides for institutionalized ex ante control by the Commission to ensure effective supervision | Establishes a higher degree of ownership and responsibility on the part of the member states, who can ultimately implement their own ideas |

| Possibilities for frontloading & smoothing | Coupling with MFF allows for frontloading and, during an ongoing budget period, funding is independent of fluctuating ETS2 revenues | Whether frontloading and smoothing are possible at the national level depends on the individual fiscal position of member states |

As shown in Table 1, the SCF and SCM differ mainly in terms of (i) the allocation of financial resources (SCF) or underlying allowances (SCM) across member states, (ii) the scope and stringency of EU-level oversight, and (iii) the possibilities for frontloading spending and smoothing revenue flows. The juxtaposition illustrates that the SCF is characterised by a high degree of financial stability: Coupling with the MFF allows for frontloading and, during an ongoing budget period, funding is therefore independent of fluctuating ETS2 revenues. Under the SCM, a comparable level of financial security can only be achieved in fiscally sound member states whose budgets have the necessary scope and flexibility for frontloading and revenue smoothing.

Through a higher degree of control on the part of the Commission (accompanied by a greater administrative burden on both the EU and individual member states) and a higher degree of collective resource mobilization in the form of joint frontloading and smoothing, the SCF can achieve greater homogeneity of social cushioning across member states than the SCM. Because the SCM depends more on the resources and capabilities of individual member states, it carries the risk of widening the differences between member states in terms of the speed and extent of social compensation. It is worth noting, however, that the financial burdens to be offset (due to the ETS2) are quite limited in relation to the size of national budgets.

Discussion and recommendations

From the broad range of options available for mitigating the distributional impacts of extended EU emissions trading, this analysis isolated four ways of organizing the social component. It started with the two endpoints of the spectrum: one in which the processes are concentrated to the maximum degree at the EU level (and hence Brussels would be sending cheques to all eligible EU citizens), and one that reserves maximum discretion for member states, in terms of both decision-making and implementation. In sum, these extreme solutions fail to convince: they could conceivably work if many preconditions were fulfilled, but they also carry significant risks – political, legal, administrative and procedural. In addition, Option I is based on very optimistic assumptions about the EU’s administrative capacities and the readiness of member states to hand over responsibility to the EU, while Option IV is based on flawed assumptions about the EU’s lack of competence in the area of social policy – if indeed this competence is even relevant in this case.

This leaves two alternatives: the Commission’s proposal for an SCF and an alternative option, namely the SCM. These options can briefly be characterized as follows:

- The proposed SCF is characterized, on the one hand, by a high degree of stability in terms of financial flows and, through stricter oversight and more extensive planning, has a lower risk of resource misspending. On the other hand, it is more complex in terms of procedures and carries a higher administrative burden.

- The SCM option, by contrast, has a comparatively light structure in terms of procedures and associated administrative burdens, but also entails a higher degree of uncertainty and volatility regarding financial flows. By giving more leeway to member states, it provides for more room to experiment with different approaches, but also carries a higher risk that the use of funds will be poorly aligned with EU objectives.

In summary, both the SCF and SCM offer benefits and risks, and deciding which is preferable depends on two specific questions: First, are member states willing and able to provide adequate social compensation on their own? Second, to what extent do the Commission and member states share an understanding of “just” climate policy, which is a necessary condition for sincere cooperation?

If the capabilities of individual member states, and their commitment to social balancing, are considered to be high, then the SCM appears to be the preferred option as it allows for a leaner structure and a higher degree of memberstate ownership. However, if there is agreement on the interpretation of a just transition combined with sincere cooperation between the Commission and member states, the SCF may be the superior option: In principle, it allows for a better achievement of the targets, especially in member states that cannot frontload expenditures and smooth fluctuating ETS2 revenues via their national budgets.

Another important factor is the Commission’s and member states’ capacity for rational policymaking. This is important for judging whether a higher degree of ownership and responsibility at state level, as within the SCM framework, would be advantageous. Yet, any doubt about the ability or will of member states to use funds appropriately would favour the SCF, since it provides for effective supervision by the Commission.26In particular, the fact that disbursement is made in stages after verifying progress against agreed-upon milestones ensures intertemporal incentivecompatibility: if a member state deviates from its SCP, it risks losing funding for the next stages of its plan.

Another consideration is the desirability of using funds uniformly across member states (pro SCF) or whether a higher degree of national fit is seen as more advantageous (pro SCM). It is ultimately a matter of the appraisal and weighting of these aspects, together with policy priorities, and that will determine the preference for either the SCF or SCM.

3. Distributional implication between member states (solidarity)

Authors: M. Kosch, K. Umpfenbach, J. Abrell, M. Pahle

Considering the interaction between the ETS2 and the ESR is essential for the robustness of the social compensation mechanism

The ESR is a main distributional element of the EU’s climate policy architecture. Based on their GDP per capita and – to a lesser extent – their abatement potential, some countries have more stringent targets than others; these range from –50% for richer countries to –10% for poorer countries, relative to 2005 levels. For all member states to fulfil their respective targets, richer countries need to undertake more mitigation and therefore spend more on abatement measures.

The ESR also foresees several flexibility options, including the option for countries that overshoot their annual targets to sell their excess AEAs to countries that miss their targets. The resulting revenues can be used to finance abatement measures or cushion the distributional impacts of climate policies. The current Commission proposal retains ESR targets as a national compliance mechanism, and extends the ETS to impose a uniform EU-wide carbon price on the buildings and road transport sectors. While the scopes of the ESR and ETS2 are not identical, they do overlap: the ETS2 will cover emissions from buildings and road transport, while the ESR covers all emissions that are not subject to the ETS1, and thus includes emissions from land use, agriculture, waste, domestic navigation and small industries, as well as emissions from buildings and road transport covered in the ETS2 (European Commission 2021b, p.2).27According to calculations by Fraunhofer ISI for the European Commission, based on EU emissions for 2017, 56 % of emissions covered by the ESR in this year would fall under the new ETS2 (European Commission 2021a, p. 367). In its impact assessment for the revised ESR, the Commission states that “about half” of current ESR emissions would be subject to the ETS2 (European Commission 2021a, p. 8). While it may seem appealing to complement the efficiency of a second ETS with the distributional principles of the ESR, the interaction between the two systems increases uncertainty in three dimensions:

(i) AEA trade will likely be limited

The impact assessment does not contain a detailed analysis of AEA trade, but the Commission appears to assume that it will take place, since several member states are expected to generate a substantial surplus of AEAs28In the impact assessment for the ESR proposal, the Commission estimated that Bulgaria, Sweden, Luxemburg, Romania, Slovenia, Italy, Czechia, Spain, Slovakia, Poland, Portugal, Hungary, Croatia and Greece would generate surplus AEAs ranging from 1 %–29 % of their 2030 emissions budget (presented in order of increasing surplus). A gap is expected for Lithuania, France, Latvia, Finland, Cyprus, Belgium, the Netherlands, Germany, Estonia, Austria, Denmark, Ireland and Malta, ranging from 3 %–55 % of the 2030 emissions budget. This distribution correlates – but does not completely match – with the GDP per capita distribution: Luxembourg and Sweden would generate a surplus despite being above-average income, while Estonia, Cyprus, Latvia, Lithuania and Malta are expected to face a gap despite being below the average for EU states (European Commission 2021b, p. 156). (European Commission 2021b, p. 59). This would result in a financial transfer from (mostly) richer to (mostly) poorer member states. However, in the compliance period to 2020, AEA trade has been extremely limited; so far, the only example of such a trade was when Malta used AEAs purchased from Bulgaria for compliance (European Commission 2021d, p. 8).

In practice, AEA trade faces significant barriers: First, the limited number of market participants, in combination with the penalty payments for non-compliance, will likely lead to monopoly rents, where member states with excess AEAs use their position to set excessively high AEA price levels. Second, there is no transparent market with a price signal. Member states thus have to find out the abatement costs of all firms and households to derive the “fair” exchange price. Relatedly, in the absence of a liquid market, member states have high transaction costs for negotiating bilateral contracts. Third, governments may prefer national mitigation measures over AEA trade, even if they come at a higher cost, because domestic climate policy measures are seen as having more domestic benefits, especially job creation. Moreover, a majority of member states’ national climate targets are fixed in national climate laws, which typically require emissions to be reduced domestically.

(ii) The ETS2 price is uncertain

In its impact assessment, the Commission considered two main carbon pricing scenarios, both with relatively low ETS2 prices. In the MIX scenario, the ETS2 carbon price reaches 48 €/tCO2 in 2030, and in the MIX-CP scenario with less ambitious companion policies (and hence a stronger role for the carbon price), it increases to a maximum of 80 €/tCO2 (European Commission 2021d, p. 121).

Other analyses (e.g. Abrell et al. 2022b; Pietzker et al. 2021) suggest it might be much higher. The ETS2 price is highly uncertain and hard to predict because it depends on various factors such as the marginal abatement costs in the buildings and road transport sectors, price elasticities and the behaviour of financial actors. These are less well understood than the abatement options and costs, as well as the preferences of relevant actors, in the energy, manufacturing and aviation sectors covered by ETS1. Finally, the price depends on the stringency and effectiveness of national companion policies targeting the ETS2 sectors and thus interacts with the ESR, i.e., if more stringent national policies are implemented to fulfill individual ESR targets, the ETS2 price will likely be lower.

(iii) Revenue allocation is volatile

According to the Commission’s proposal, around 9 billion euros29According to the proposal, the SCF would be fixed in size (Art 9): 23.7 billion euros for 2025–2027 and 48.5 billion euros for 2028–2032. would be allocated to the SCF annually. For the assumed price of 48 €/tCO2 (in the MIX scenario), this corresponds to 25% of total ETS2 revenues. The SCF allocates these revenues to member states based on socioeconomic indicators such as energy and transport poverty levels and gross national income per capita (European Commission 2021c, Annex I). The remaining ETS2 revenues would be distributed among member states based on their historic emissions in the period 2016–2018.

Unfortunately, the proposal does not foresee an automatic adjustment of the revenue allocation in response to changing ETS2 prices. For the extreme case, where the SCF is fixed at around 9 billion € per year, the SCF share of total funds available for redistribution between and within member states decreases with an increasing carbon price. This means less funds to support low income and vulnerable households relative to the carbon price, and consequently less progressive effects from revenue recycling.30In practice, it is likely that SCF revenues will be adjusted depending on the carbon price. However, under the current proposal, it cannot be easily adjusted because it would be funded through the MFF which has already been set to 2028; any adjustments could only be made thereafter

Scenario analysis to explore the effects of AEA trade and ETS2 price levels

MODEL & ASSUMPTIONS

The scenario analysis is based on a static global CGE model (ZEW-CGE; see Abrell and Rausch (2021) and Abrell et al. (2022a) for more details).31Consequently, ESR prices should be interpreted as implicit carbon prices, i.e., marginal abatement cost, of energy-related ESR emissions. This analysis implicitly assumes that the remaining ESR emissions (mostly non-CO2 emissions from agriculture) fall under a separate regulatory approach that is not affected by the policies implemented here.

The model covers only energy-related CO2 emissions and assumes a complete overlap of ESR and ETS2 sectors. We apply a cap on emissions and allow trading in order to calculate the carbon prices necessary to reach 2030 targets.32We apply two individual caps: one on the ETS1 sectors and one on the ETS2 sectors. However, in this study we focus on the ETS2 sectors and do not further report on ETS1 prices which are nearly constant across our scenarios presented. Apart from these carbon prices, no further policies are included. Since, in reality, carbon trading is likely to be supplemented by accompanying measures such as renewable support schemes, energy efficiency measures and transport policies – which reduce explicit carbon prices but also incur other costs – the prices in this model should be regarded as implicit carbon prices or, likewise, as the marginal abatement cost.

Relationship between ETS2 price levels and the value of AEAs

Given their sectoral overlap, substantial interactions between the ESR and the ETS2, and their respective prices, are to be expected.

In theory, AEA and ETS2 prices always add up to the same total carbon price:33Choosing their abatement level, firms adjust their marginal abatement cost to the (implicit) carbon price. Facing two prices for the same unit of emissions, they adjust to the sum of these prices. Since neither the abatement technology nor the abatement target changes, the sum of the prices must be constant to achieve the same amount of abatement. the higher the ETS2 price rises, the lower the AEA price must fall (and vice versa).34We simulate the interaction between the two systems by fixing the ETS2 price and allowing the AEA price to arrive at the level necessary to reach the target. In the base case, we fix the ETS2 price to 50€/tCO2 and observe a relatively high AEA price of 174 €/tCO2; in Scenario 2 with a higher

ETS2 price of 150€/tCO2, the AEA price drops to 74 €/tCO2. The sum of the two prices thus corresponds to the uniform carbon price in the case of an ETS2-only scenario without individual ESR targets.

On a more intuitive level, that means the following:

- If – for political or other reasons – the ETS2 price is low, it will have little impact on abatement. Stricter national mitigation measures are therefore needed to reach the targets, implying high (implicit) national carbon prices, creating the potential for AEAs to be traded at higher prices.35Of course, the argument also goes the other way: If member states implement stringent national measures (high value of AEAs), the ETS2 price will be low. In contrast, if member states implement lax national measures (low value of AEAs), the ETS2 price will be high.

- A high ETS2 price induces substantial abatement in most member states. Thus, fewer national measures are necessary. This implies lower (implicit) carbon prices and thus a lower value of AEA certificates.36There is probably no uniform AEA price, as certificates are traded through non-transparent bilateral agreements, which might include other kinds of political or economic negotiation between two member states. Nevertheless, with increasing ETS2 carbon prices, AEA “prices” are likely to decrease. As a consequence, countries that overshoot their national target would fetch a lower price for their excess AEAs.

This relationship implies that a high ETS2 price is likely to undermine the distributional mechanism defined under the ESR: poorer countries would still overshoot their targets and bear a large share of abatement cost, while also receiving a low return on their excess allowances. The revenue allocation of the ETS2 can either reinforce or counteract this impact, depending on its exact specification (see Scenario 2).

AEA trade volumes and ETS2 price levels will affect the cost-effectiveness and equitable distribution of SCF funds. In the following analysis, three scenarios are explored using a static global Computable General Equilibrium (CGE) model (see “Model & Assumptions” Box). The “base case” scenario is drawn from the EUs own impact assessment and two additional scenarios (discussed in detail below) are added to disentangle the impacts of AEA trade from ETS2 price levels, as illustrated in Figure 3:

- Base case (upper right quadrant): We assume the coexistence of AEA trade and the ETS2. For the ETS2, we assume a moderate price of 50 €/tCO2 with 25% of revenues allocated to the SCF for distribution among member states, according to SCF criteria. The remaining 75% is distributed among member states according to historic emissions from 2016–2018. We assume a functioning AEA trade between member states, exploiting all possible efficiency gains from trade. Member states achieve their individual ESR targets through national abatement measures and trade. In this case, the total AEA trade volume amounts to around 15% of total ESR emissions.37The highest demand for AEA trade comes from Germany (50 Mt) and France (27 Mt), whereas the highest supply comes from Poland (62 Mt)and Romania (32 Mt).

- Scenario 1 (upper left quadrant): No AEA trade.

- Scenario 2 (lower right quadrant): A higher ETS2 price of 150 €/tCO2.

All scenarios are geared towards the 2030 target of at least a 55% greenhouse gas reduction compared to 1990. For 2030, 64% of emissions are allocated to the ESR sectors, with the rest being allocated to the sectors covered under ETS1.

In all scenarios, the allocation to the SCF is fixed at the (absolute) base case level.

Summary of results

Figure 4 shows the changes in welfare per capita for the two additional scenarios compared to the base case:

- In Scenario 1 (no AEA trade), welfare is substantially lower in almost all member states with the highest losses for eastern member states.

- Scenario 2 (high carbon price) sees no impact on total welfare, but leads to a shift in per-capita welfare away from Spain, Portugal and eastern member states towards Germany, France, Italy, Austria and Belgium. This is because the revenue allocation to member states through the SCF does not automatically scale with the ETS2 price.

In the following sections, we discuss each scenario in detail.

Scenario 1: No AEA trade & low ETS2 price

Scenario description

The first scenario explores the implications of no AEA trade, at the one extreme, and compares them to the implications of full trade (the base case). This scenario assumes that each country individually fulfils its ESR target and there are no monetary transfers between member states through AEA trade. In practice, a middle option is more likely, where some limited AEA trade occurs.

Results

The left-hand panel of Figure 4 shows the difference in per capita welfare for Scenario 1 (without AEA trade) compared to the base case. The analysis provides two main insights:

First, if there is no AEA trade, almost all countries incur substantial welfare losses of up to 400 € per capita. These impacts are highest for eastern member states, whereas western and northern countries are less affected. Put differently: almost all countries see substantial welfare gains from AEA trade. This is because abatement is cheaper for poorer countries with low ESR targets, and they therefore abate more than richer countries. So while they face a higher absolute cost for these emissions reductions, this is more than compensated for by the revenues they get from trade.38It should be noted that compensatory revenues are transferred at the states level, but higher ETS2 abatement means higher carbon costs for (poor) consumers. It is therefore crucial that there are well designed revenue allocation mechanisms within member states to realize these “percapita gains”. Richer countries also benefit because they abate less, with some of the abatement cost savings used to buy additional allowances, which are cheaper than abatement measures. Therefore a net benefit remains. Without AEA trade, then, the overall economic efficiency of abatement is reduced. The average abatement cost per tonne of CO2 increases by almost 40 €/tCO2, from 185 €/tCO2 in the base case to 228 €/tCO2 in Scenario 1 (without AEA trade).

Second, some (poorer) member states overshoot their annual targets,39Some countries already achieve their targets without a carbon price. Thus, any additional incentive leads to over-achievement. resulting in an AEA surplus. But without AEA trade, these member states cannot profit from these excess emissions reductions. Nor can richer member states benefit from purchasing relatively low-cost AEAs, and must instead initiate additional, more costly national mitigation measures to comply with their targets.40The reason is that they have more stringent targets and are also likely to have higher abatement costs. As a consequence, in the short-run, the EU as a whole overachieves relative to its reduction target: In the base case, we assume a reduction target for ESR sectors of –40% relative to 2005; in Scenario 1 (without AEA trade), reduction in ESR sectors amounts to –44%. However, the abatement comes at a disproportionate cost.

Implications for robustness and policy recommendations

The results show that AEA trade is crucial for the short-run cost effectiveness of EU climate policy. Without AEA trade, almost all member states are worse off than with trade, and the total cost of achieving the EU’s climate target increases substantially. Given the more stringent targets in the coming years, it becomes ever more important to keep abatement costs as low as possible.

The European Commission presents the proposed ETS2 as a tool to “provide for increased incentives to effectively achieve this cost-efficient abatement level and increase the likelihood that surpluses of AEAs will be available” (European Commission 2021b, p. 59). This implies that the ETS2 would be the main driver of emission reductions, giving the covered firms – and their customers – an incentive to lower emissions. After the ETS2 has incentivised the necessary emission reductions in a cost-effective way, governments merely retrace the results delivered by the market by trading the corresponding amount of AEAs, as long as AEA trade is possible and there is a sufficiently liquid market – neither of which are assured under current regulations. In other words: the EU can only fully reap the benefits of the ETS2 if AEA trade is functioning.

Consequently, a scenario where the EU is on track to overachieve its target, but – due to limited AEA trade – several member states are not in compliance with their national ESR targets, will likely result in political pressure to adjust or dis card the ESR and controversy over the distributional implications. Addressing the shortcomings of AEA trade is therefore crucial to making EU climate policy work in practice.

Scenario 2: High ETS2 price with AEA trade

Scenario description

Under Scenario 2, the ETS2 price is triple the base case (50 €/tCO2), taking it to 150 €/tCO2. In both the base case and Scenario 2, we assume perfect AEA trade and that SCF revenues are fixed at the absolute level of the base scenario. This again represents an extreme case and implies that only 8% of revenues are allocated to the SCF in Scenario 2, with the remaining 92% being distributed among member states based on historic emissions from 2016–2018.

Results

The right-hand panel of Figure 4 shows the difference in per capita welfare for Scenario 2 (High ETS2 price) relative to the base case.41 The results provide two main insights:

- Average abatement costs are the same as in the base case because a higher ETS2 price ceteris paribus decreases the AEA price (see “Model & Assumptions” Box above) and firms continue to see the same price. Assuming full AEA trade, then, higher ETS2 prices do not affect total cost-effectiveness.

- Welfare increases by up to 130 € per capita in Germany, Belgium and other (mostly) rich member states but decreases by up to 210 € per capita in Greece and other (mostly) poor member states. There are two reasons for this. First, the share of ETS2 revenues allocated to the SCF declines as the ETS2 carbon price rises (assuming a fixed absolute contribution). Consequently, poorer countries with a higher risk of energy poverty receive lower revenues. Second, the AEA price decreases from 174 €/tCO2 in the base case to 74 €/tCO2, meaning surplus allowances fetch a lower price, again leading to lower revenues for poorer member states. This weakens the distributional principles of the ESR.

Implications for robustness and policy recommendations

The current proposal is too vague about how the revenue allocation will change as the ETS2 price increases. In the extreme case, it could be assumed that the SCF allocation will remain fixed in absolute terms and additional revenues from higher ETS2 prices would then only benefit member states in proportion to their historical emissions. In relative terms, this would be least beneficial for those countries the SCF aims to benefit the most – those with a high share of their population at risk of energy poverty.

The revenue allocation needs to be adjusted in response to the ETS2 price. This ensures that, on a per-capita basis, richer countries assume a higher share of total abatement costs, so as to deliver on the solidarity principle of the ESR. To this end we propose three possible solutions:

- Fix the share of total revenues allocated to the SCF (e.g. to 25%). The allocation needs to be clearly rulebased and should not be subject to negotiations.

- Allocate ETS2 revenues to member states according to their ESR emission targets. This would maintain the distributional principle of the ESR, independent of ETS2 price levels.

- Set an ETS2 price corridor mechanism to reduce uncertainty.

Uncertainties might lead to an unstable system and need to be addressed

The interaction between ESR and ETS2 in the Fit for 55 proposal increases uncertainty in three dimensions: AEA trade may remain limited; the ETS2 price is uncertain; and it is unclear how revenue allocation between member states will respond to changing ETS2 prices.

If not properly accounted for in policy design, the uncertainties identified in this report may undermine the stability of the EU climate policy architecture. Two main risks are highlighted: First, an absence of AEA trade will increase the costs of climate policy for almost all member states and thus makes it more difficult to reach the EU’s emissions target (Scenario 1). Second, a higher ETS2 price is likely to have an impact on the cost distribution across member states that may be at odds with the ESR (Scenario 2), such that (mostly) poorer member states would suffer from higher welfare costs whereas (mostly) richer member states would benefit from lower welfare costs. Both potentially undermine the political acceptability of the EU’s climate ambition.

The Fit for 55 package is therefore not sufficiently robust with regard to the distributional implications of the two scenarios presented here. This can be solved by improving AEA trade and ensuring that the relative distribution of ETS2 revenues between member states is independent of the ETS2 price.

4. Distributional Implications within member states (social fairness)

Authors: M. Jakob, S. Feindt, T. Konc, M. Pahle

This section analyses the distributional effects of the ETS2 at the individual household level and elaborates on the role of redistribution schemes. It also identifies consumers at risk of energy poverty and discusses measures to shield the most vulnerable households from rising energy prices.

METHODOLOGY

A microsimulation model analyses the loss of disposable income to maintain current use of heating and transport fuels with a higher price resulting from the ETS2. This is a static approach that does not take into account the possibility of consumers adjusting their usage. Based on Feindt et al. (2021), data on the use of transport and heating fuels are drawn from Eurostat’s HBS national expenditure survey. This approach has the advantage of being easily tractable and having a direct economic interpretation as a “compensated variation”.41The “compensated variation” measures the welfare effect of price changes by assessing the additional income that would need to be spent to

maintain current consumption patterns. It presents a plausible approximation of effects in the short run, before people are able to adjust their behaviour or switch to low-carbon options.

Several studies have analysed the distributional implications of the proposed ETS2 and SCF. Held et al. (2022) assess the impacts of the ETS2 on a range of effectiveness and social justice criteria, including just distribution between EU member states and distributional impacts on households. In contrast with our study, which uses EU-wide income deciles as the level of analysis, they assess costs for different income groups across EU member states. They find that overall distributional impacts would be roughly neutral within each member state, but that in poorer member states, all households would on average pay a higher share of their income compared to richer ones. Unlike our study, Held et al. do not assess horizontal distribution, i.e. the costs borne by the most vulnerable households within a given income group. Nevertheless, they echo some of our recommendations to recycle revenues to low-income households and adopt a price corridor for the ETS2. Gore (2022) conducts an analysis of the distributional implications of the Commission’s proposals at the level of EU-wide income deciles. They assess the differences in distributional outcomes within individual income groups that can be attributed to other characteristics such as demographics, area of residence and whether households are homeowners or renters. However, they do not explicitly identify households at risk of energy poverty. Their analysis indicates that from an EU-wide perspective, the ETS2 would have a regressive effect, but that the proposed reform of the Energy Tax Directive would partially alleviate this effect, and that recycling auction revenues and SCF funds can achieve progressive outcomes, with households in the lowest income deciles the net beneficiaries. Our analysis goes beyond previous studies by providing a fine-grained analysis of energy poverty and compensation schemes to support vulnerable households.

One price, but very different financial burdens

The proposed ETS2 would not only have distributional implications across EU member states (see previous section); it would also affect different social groups in different ways. Carbon prices raise the price of fossil fuels, so that, for instance, 50 €/tCO2 would raise the price of petrol by about 10 euro cents per litre and the price of Diesel by about 12 euro cents per litre (if fully passed on to final consumers). The aim of higher fuel prices is to provide incentives for emission reductions. These can be achieved by switching to lower-carbon alternatives (such as electric vehicles or heat pumps) or by adjusting behaviour (e.g. switching from a private car to public transport). But higher energy prices also have distributional impacts, with low-income households most affected by higher energy prices because they spend a higher share of their disposable income on energy. One way to resolve this is to recycle revenues from carbon pricing for compensation. The question is then how much compensation is needed, and for whom? The following analysis develops two distinct scenarios for how auction revenues may be recycled and assesses how each would affect the distributional impacts of the ETS2.

Description and analysis of scenarios

In Scenario 1, there is an equal-per-capita redistribution (either directly, or by means of investments that benefit everyone in an identical way), which would be relatively straightforward to implement. This approach follows an egalitarian equity perspective, which assumes that everyone has an equal stake in the revenues generated by climate change mitigation. Scenario 2 entails targeted compensation for vulnerable households, which would be more challenging to implement as it requires bureaucracies to identify potential beneficiaries. This approach is grounded in a needs-based equity perspective.

| Scenario | Description |

|---|---|

| (1) Equal per-capita compensation | Revenues from the auctioning of emission permits are distributed equally to all citizens. Revenues can be recycled in the form of direct financial transfers, tax reductions or in-kind provisions of public goods and services. Consider two cases: (i) redistribution takes place at the national level and all revenues resulting from the carbon price are redistributed equally across citizens, and (ii) revenues from carbon pricing are redistributed so that all EU citizens receive identical amounts, regardless of their nationality. The first case is more advantageous for countries with high per-capita emissions; the second is more beneficial for countries with low per-capita emissions. |

| (2) Targeted compensation for vulnerable households | Revenues from auctioning emission permits are only made available for vulnerable households. Consider two cases: (i) only low-income consumers that spend a high share of their income on energy receive compensation, and (ii) all consumers in a certain income group are compensated, regardless of their energy expenditure. |

Scenario 1: Equal per-capita compensation

For this analysis, EU households (regardless of member state) are grouped into ten deciles: the first decile denotes the lowest income, the tenth decile the highest. Adjusted for differences in costs of living (i.e. at “purchasing power parity”), the average EU household spends a total of about 25,000 € per year. For households in the lowest and second-lowest deciles, annual expenditures amount to roughly 9,000 € and 12,000 € respectively. For the richest decile, it amounts to roughly 60,000 €. Figure 5 (below) analyses how a carbon price of € 50/tCO2 would affect these different income groups.

To clearly isolate the effects of the ETS2, it does not consider other energy price changes in the Fit for 55 package (e.g. a reform of the Energy Tax Directive) that might alleviate the distributional impacts of the ETS2. The uncompensated effects of such a carbon price would be slightly regressive (purple line). Households in the poorest decile would lose about 0.5% of their income, whereas for those in the richest decile, the loss would be about 0.35%.42However, within some low-income EU member states where poorer households spend relatively little on energy, on average, the ETS2 would be progressive even without revenue recycling. We consider two ways of returning the resulting revenues to the population to alleviate these regressive effects. Both assume that carbon pricing revenues are fully recycled, for instance in the form of financial transfers, tax re ductions, or investments that provide direct benefits to users, such as investment in public transport or financial support for home insulation. The green line depicts the case in which the revenues are distributed on an equal per-capita basis across all EU citizens; the red line depicts the outcomes if each member state distributes its respective share of the revenues on an equal per-capita basis at the national level. In both cases, carbon pricing and revenue recycling would clearly be progressive. In fact, the lower six deciles would become net beneficiaries. As indicated by the negative cost burden, the compensation they receive would exceed the additional costs resulting from higher energy prices. For the national recycling case (red line), the net gains for the poorest decile of the EU population would amount to almost 1.5%. In the case of EU-wide revenue recycling (green line), average incomes in the lowest decile would increase by, on average, about 2.5%.

However, the question arises whether, and to what extent, revenue recycling should actually produce “winners” that are overcompensated, especially in view of the need to invest in low-carbon infrastructure, and the expected decline in revenues from other carbon taxes (such as fuel taxes) as the economy transitions to net zero. For this reason, we also examine scenarios in which only a fraction of revenues accrues to households (see Figure 6).

This analysis is based on equal per-capita recycling at the EU level. The results demonstrate that recycling one third of the revenues would already yield a progressive outcome and net gains for the lowest income decile. As the recycled share increases, the effects on the income distribution become more progressive, and additional low-income deciles become net beneficiaries.

Scenario 2: Targeted compensation for vulnerable households

A crucial issue regarding the distributional consequences of carbon pricing is horizontal equity – the spread of costs within a given income group. Even a recycling scheme that is highly progressive on average runs the risk of leaving some low-income households worse off. This may be the case for households that spend a relatively large share of their income on energy because of long commutes or badly insulated homes, for example. To assess the number of households at risk of energy poverty,43The European Commission defines energy poverty as “a combination of low income, high expenditure of disposable income on energy andpoor energy efficiency”. See https://energy.ec.europa.eu/topics/markets-and-consumers/energy-consumer-rights/energy-poverty_en we consider high-intensity consumers in the lowest two or three deciles whose spending on energy, as a share income, is more than one standard deviation (about 1.8%) above the median. As shown in Figure 7 (below), the majority of high-intensity consumers are in the lowest income deciles, although there are a considerable number of people in the highest income deciles who spend a large share of their income on fuels for heating (especially in Germany) and transport (especially in Greece).

Across the EU, there are about 4.5 million people in the lowest two income deciles, and about 6.2 million people in the lowest three deciles, who are high-intensity consumers and can thus be considered at risk of energy poverty. They are primarily located in Bulgaria, Hungary, Poland and Romania. To shield these vulnerable households from rising energy prices, dedicated measures are required. EU member states have reacted to the recent energy price hike by implementing new measures and/or expanding existing programmes against energy poverty. But appropriate targeting of these measures is crucial (see “Better targeting for energy poverty policies” Box).

BETTER TARGETING FOR ENERGY POVERTY POLICIES

Energy poverty is a growing policy concern in Europe, especially with the recent precipitous increase in petrol and gas prices, which have disproportionately impacted the budgets of energypoor households. The policy challenge is to allocate compensation funds to those at risk of missing out on basic energy services, but the EU has so far not been up to the task. In France, only 9.3% of total relief spending will benefit the lowest income decile, despite some targeted measures (such as energy vouchers). In Germany, richer households benefit more from fuel subsidies because fuel consumption increases with income.