Table of Contents

Key Messages

- The competitiveness gap of hydrogen needs to be addressed outside the EU ETS, as the pricing of emissions and the free allocations for hydrogen production do not provide sufficient additional revenue to significantly narrow the cost disparity between renewable or low carbon hydrogen on one side and natural gas on the other.

- To create cost parity and foster a fuel-switch from natural gas to renewable or low carbon hydrogen, CO2 prices in the range of 300-500 €/tCO2 are necessary.

- Switching from emission-intensive gas-based low carbon hydrogen with CCS (blue hydrogen) to renewable hydrogen requires exceptionally high CO2 prices of 2500 €/tCO2 if only downstream emissions are priced.

- Extending the EU ETS to cover upstream emissions would more accurately internalize the climate impacts, leading to a fairer comparison between low carbon and renewable hydrogen.

- Introducing a gradual lowering of the emission intensity threshold (28.2 gCO2eq/MJ) in the standard for low carbon hydrogen could foster innovation and investment in technologies with higher emission reductions and lower residual emissions.

1. Introduction

The use of renewable hydrogen is considered an important element for the decarbonization of sectors that are hard to electrify, such as the steel and chemical industry or aviation (European Commission 2020, Ferrario et al. 2022). However, the volume of renewable hydrogen produced by electrolysis with renewable electricity is relatively small in comparison to conventional fossil-based hydrogen production (IEA 2023, European Hydrogen Observatory 2024, Odenweller & Ueckerdt 2025). This is mainly due to the high costs of renewable hydrogen production (IEA 2023). Until the availability and competitiveness of renewable hydrogen improves, the use of non-renewable low carbon hydrogen is discussed in the EU and among researchers as a transitional solution to accelerate the market ramp-up of renewable hydrogen (European Commission 2020, European Commission 2021, Talus et al. 2024). This is because the production of low carbon hydrogen, for example in the form of gas-based hydrogen with subsequent carbon capture and storage or utilization (referred to as blue hydrogen) will likely be cheaper than renewable hydrogen, while still less emission intensive than conventional fossil hydrogen (Hermesmann & Müller 2022, Bauer et al 2022, Ueckerdt et al 2024).

A regulatory framework has been adopted at EU level for the production of renewable fuels of non-biological origin (RFNBOs), which includes renewable hydrogen produced in line with the required RFNBO criteria (see below), and the framework for low carbon hydrogen is awaiting the adoption of a delegated act specifying a methodology for assessing greenhouse gas emissions savings (European Commission 2024). Those technology-specific rules stand next to the EU Emissions Trading System (EU ETS) as the central market-based instrument to decarbonise the EU industry and energy sectors. The use of the EU ETS and its challenges for the development of a hydrogen economy have already been discussed for over a decade (Bleischwitz & Bader 2010). Previous studies have highlighted the potential of CO2 prices to improve the competitiveness of blue hydrogen against conventional fossil-based hydrogen, but also note that upstream emissions contributing significantly to the embedded emissions of blue hydrogen are not covered by the EU ETS, and that a switch from blue to renewable hydrogen requires a significant increase of CO2 prices (George et al. 2022, Odenweller et al. 2022, Alonso et al. 2024, Ueckerdt et al. 2024).

The latest reform of the EU ETS introduces the inclusion of all types of hydrogen production. Previously, only conventional fossil-based hydrogen produced via reformation and partial oxidation was covered. As a reason for the inclusion, the EU Commission mentioned that the rules on free allocation, as they currently still exist in the EU ETS, could otherwise “lead to unequal treatment of industrial installations and effectively act as a barrier to the use of decarbonisation techniques such as green hydrogen” (European Commission 2021a, p. 44). Accordingly, all installations with a production capacity exceeding five tonnes of hydrogen per day receive free allocations with the EU ETS reform. This can provide an additional source of revenue for renewable and low carbon hydrogen installations, as they can fully cover their emissions with free allocations and still have a surplus of certificates to trade on the market. This raises the question of how the reformed rules of the EU ETS impact the development of the hydrogen scale up. Is the reform capable of achieving a more equal treatment between hydrogen production methods in the regulatory framework? What implications has the reform on the competitiveness of renewable hydrogen compared with low carbon hydrogen, and in particular blue hydrogen? And what are the implications for emissions reductions?

To answer these questions, this study first describes the characteristics of hydrogen production in the European Union. It then assesses the rules of the EU ETS, which now apply to all forms of hydrogen. Thereafter, an economic analysis is performed, assessing the effects of the reformed EU ETS on competitiveness and incentives for emission reductions of renewable and blue hydrogen. Finally, the results are discussed in context of the research questions posed above and conclusions are drawn.

2. Hydrogen Production

Hydrogen is a secondary energy carrier that can be produced by a variety of processes with different sources of energy. Before assessing the impacts of the EU ETS, the characteristics of fossil, low carbon and renewable hydrogen production methods, its current shares of pro-duction in the EU, the associated emissions and costs in the European Union are described. Table 1 gives an overview of these attributes, while the subchapters will go into more detail.

| Energy Source | Share | Emission Threshold | Cost (2025-2030) | |

| Fossil Hydrogen | Natural Gas, Coal, Oil | 91% Reforming 8.6% By-Product | No emission thresh-old | 60-90 EUR/MWh |

| Low-Carbon Hy-drogen (Blue Hydrogen) | Natural Gas | 0.3% | 28.2 gCO2eq/MJ | 100 EUR/MWh |

| Renewable Hydrogen | Renewable Elec-tricity | 0.2% | 28.2 gCO2eq/MJ REDII-DA = 0 gCO2eq/MJ | 150 – 200 EUR/MWh |

2.1 Production Methods and Shares

Conventional, fossil-based hydrogen production comprises multiple methods with different feedstocks. The most common method in the EU is fossil-based production via steam methane reforming (SMR) of natural gas, although there are various other methods, such as autothermal reforming (ATR), partial oxidation of oil or coal gasification. Together, 91 % of hydrogen in Europe was produced by natural gas reforming in 2022. Conventional production also comprises hydrogen produced as a by-product of different industrial processes, representing an additional share of 8.6 % of fossil hydrogen production in Europe (European Hydrogen Observatory 2024).

Low carbon hydrogen projects are still in their early stages and only account for 0.3 % of hydrogen production in Europe (European Hydrogen Observatory 2024). Low carbon hydrogen can also be produced by a variety of methods, e.g., by SMR or ATR equipped with carbon capture technology to reduce the emission intensity of hydrogen. The captured CO2 can either be stored (carbon capture and storage – CCS) or used for other purposes (carbon capture and utilization – CCU). Hydrogen produced this way is also referred to as blue hydrogen. Low carbon hydrogen also includes hydrogen production using nuclear energy, waste energy or non-renewable electricity to power water electrolysis. To be considered as low carbon hydrogen within the EU legal framework, all production methods have to comply with the requirements the Gas and Hydrogen Markets Directive (EU) 2024/1788, including a general definition of low carbon hydrogen requiring GHG emission reductions of at least 70 % compared to a fossil fuel comparator (Art. 2, pt. 11). This general definition will be supplemented by a delegated act (European Commission 2024) providing more detailed requirements and a methodology clarifying which factors are included in the 70 % emission reduction threshold (Bruch & Knodt 2024).

Renewable hydrogen is produced by using renewable energy, with the most prominent method being water electrolysis powered by renewable electricity. A hydrogen market based on renewable hydrogen is communicated in the EU as a central element for the decarbonization of hard to abate sectors and to achieve climate neutrality (see Directive (EU) 2024/1788, Recital 13; European Commission 2020). Under EU law, renewable hydrogen falls under the term renewable fuels of non-biological origin (RFNBO) and has to achieve GHG emissions savings of at least 70 % (Renewable Energy Directive (EU) 2018/2001, Art. 29a). While the threshold for GHG emissions savings is identical to low carbon hydrogen, additional requirements for the production of RFNBOs are established in Delegated Regulation (EU) 2023/1184. Although renewable hydrogen should be the primary source of the emerging hydrogen economy, only 0.2 % are currently of renewable origin in Europe (European Hydrogen Observatory 2024).

2.2 Emissions

Hydrogen production on the basis of fossil sources is characterized by a high emission intensity, but can vary significantly depending on the source and technology. For SMR, the direct emissions account to around 75 gCO2eq/MJ (IEA 2023). Yet, not only are emissions caused by the reforming process itself, but additional emissions occur upstream and midstream, e.g., during natural gas production and transport. While the global median upstream and midstream emissions of natural gas production are estimated to be around 15 gCO2eq/MJ (IEA 2023), the European Commission set a substantially lower standard value for upstream emissions of natural gas at 9.7 gCO2eq/MJ (see Commission Delegated Regulation (EU) 2023/1185). Empirical measures show that upstream and midstream emissions vary greatly depending on the gas field and the technical measures against methane leakages. In Norway, upstream and midstream emissions cumulate to around 0.8 gCO2eq/MJ of natural gas, while in the Caspian region the emissions cumulate to 27 gCO2eq/MJ of natural gas. However, a recent study on the case of the US estimates that methane leakages are higher than reported, highlighting the need for more comprehensive measuring and monitoring (Sherwin et al. 2024). Including upstream and midstream emissions during natural gas production increases the global average emission intensity of SMR hydrogen production to around 91 gCO2eq/MJ (IEA 2023). In the EU, the emissions intensity for fossil-based hydrogen is set slightly higher, at 94 gCO2eq/MJ according to Commission Delegated Regulation (EU) 2023/1185. This value is also used as a fossil-fuel comparator to define the thresholds for low carbon and renewable hydrogen.

In the case of gas-based low carbon hydrogen, downstream emissions can be reduced; yet, upstream and midstream emissions occur. Downstream emission reductions can be achieved during the production of hydrogen via carbon capture technology. However, the production process has a significant impact on the capture rates that can be achieved. With SMR and ATR, capture rates of >90 % will likely be possible (IEA 2023). Further research suggests that ATR has more suitable attributes to achieve higher carbon capture rates, theoretically up to 100 % with more advanced technology (Riemer & Duscha 2022). In the EU, instead of carbon capture rates, the emissions intensity of hydrogen is used to determine the eligibility of hydrogen as low carbon. The requirement of the Gas and Hydrogen Markets Directive to achieve a 70 % emissions reduction compared to the fossil fuel comparator of fossil-based hydrogen sets a threshold of 28.2 gCO2eq/MJ. As mentioned above, the exact methodology clarifying which factors are included in the calculation of the emission savings is yet to be defined by a delegated act (European Commission 2024).

In the case of renewable hydrogen, the requirements of Delegated Regulation (EU) 2023/1184 seek to ensure that renewable hydrogen is not associated with substantial emissions during electricity production for the electrolysers. Therefore, in case of compliance with the EU framework, renewable hydrogen is attributed zero emissions.

2.3 Costs

The levelized costs of hydrogen (LCOH) from unabated fossil sources were very volatile during the last five years, as the LCOH is mainly composed of operational expenditures (OPEX) in the form of energy costs that were subject to significant price spikes caused by the Russian invasion of Ukraine. Coming from an EU-average of 36-45 EUR/MWh 1Units were converted from EUR/kg to EUR/MWh to ensure consistency., the prices rose up to 171 EUR/MWh in 2022 (Hydrogen Europe 2023). With falling gas but increasing CO2 prices, the IEA estimates the LCOH of unabated fossil hydrogen (e.g., grey hydrogen) between 60-90 EUR/MWh in 2030 (IEA 2023). While other OPEX, emission allowances and capital expenditures (CAPEX) also constitute costs for hydrogen production, their share on the overall LCOH is comparably low (European Hydrogen Observatory 2024).

Similarly, the LCOH of blue hydrogen depends significantly on natural gas prices; it is estimated at around 100 EUR/MWh between 2025 and 2030 (Ueckerdt et al. 2024), while costs depend on the CO2 capture rate and process (SMR or ATR). In general, CAPEX is higher for blue hydrogen production, as investments in the carbon capture installations have to be financed. The additional technological complexity also leads to higher OPEX besides energy costs, but also lower expenditures for emission allowances.

Although the energy source for renewable hydrogen is typically renewable electricity and not natural gas, the LCOH for renewable hydrogen also increased significantly during the energy crisis (Hydrogen Europe 2023). In general, OPEX has the most significant share of LCOH for renewable hydrogen in the form of electricity costs, but the share of CAPEX is also higher in comparison to other production methods (European Hydrogen Observatory 2024). As the energy crisis also caused inflation, the investment costs for electrolyzers and renewable energy installations increased and in turn led to higher LCOH for renewable hydrogen and are estimated to be around 150-200 EUR/MWh between 2025 and 2030 (Odenweller & Ueckerdt 2024).

As this chapter outlined, the production of renewable hydrogen does not cause any direct GHG emissions and low carbon hydrogen may cause significantly less emissions compared to the production of conventional, fossil hydrogen and natural gas. This might have further implications for the cost competitiveness, as all hydrogen types have been included in the latest reform of the EU ETS and are required to purchase and surrender emission allowances according to their emitted CO2. Yet, hydrogen will also receive free allocations, which begs the question whether the rules on free allocation and the possibility to trade those freely allocated allowances under the ETS Directive may offer an opportunity for additional revenues for the respective operators (see the Box ‘Regulation of Hydrogen in the EU ETS’ for an overview of the EU ETS and its free allocation mechanism). In the following, it will thus be examined how much revenue operators of installations producing renewable hydrogen, and low carbon hydrogen respectively could expect from free allocation under the EU ETS, and what that means for the competitiveness of those projects.

Regulation of Hydrogen in the EU ETS

Author: Jana Nysten, Stiftung Umweltenergierecht

With the latest reform of the EU emissions trading system (EU ETS) for industry and energy installations, all types of hydrogen production have been included, provided that the produc-tion capacity of the installation exceeds 5 tonnes per day (Art. 2(1) jo. Annex I ETS Directive).

The EU ETS functions as a cap-and-trade system for GHG emissions.2 On the basic principles of such cap-and-trade systems, see the theories of Dales (1968). The functioning of the EU ETS is (briefly) ex-plained in e.g., Faure & Partain (2019), p. 124ff. That being the case, operators of installations covered by the system need to obtain a permit and purchase GHG emission allowance for the GHG emissions caused in the installation. 3Note that the EU ETS attaches to the GHG emissions caused by the installation, i.e. the electrolyser producing hydrogen, while the EU CBAM attaches to the product hydrogen itself. This is due to the fact that the production of imported hydrogen takes place outside the EU, meaning that the production itself can hardly be regulated by the EU. However, the import of the product can. For more on the EU CBAM and the choices the EU legislator had to make when designing the instrument, e.g. Jana Viktoria Nysten (2023). “Der EU-Grenzausgleichsmechanismus als logische Folge des EU-Emissionshandels”, KlimaRZ 04/2023, S. 95-102. Most of those allowanc-es will need to be purchased, as the production of hydrogen has (so far) not been included on the carbon leakage lists. 4The current carbon leakage list for the period from 2021-2030 has been adopted by the EU Commission in 2019; it is based on the criteria mentioned in Art. 10a(1) ETS Directive for sectors and subsectors to be deemed at risk of carbon leakage. See: Commission Delegated Decision (EU) 2019/708 of 15 February 2019 supplementing Directive 2003/87/EC of the European Parliament and of the Council concerning the determination of sectors and subsectors deemed at risk of carbon leakage for the period 2021 to 2030, OJ L 120, 8.5.2019, p. 20–26. Free allocation of allowances is supposed to be phased out anyways. 5When the EU ETS was first introduced, operators of installations covered by the system received the allowances they needed to cover their emissions for free. However, the idea was to progressively, reduce and at some point, end such transitional free allocation (Art. 10a ETS Directive). For some industries, i.e. those which are so exposed to international competition that paying the price for GHG emissions under the EU ETS would lead them to relocate their operations, a special regime was introduced under which they (still) receive the allowances for free (Art. 10b ETS Directive). However, that regime is going to change as well: when the EU CBAM starts and introduces a carbon price for imports into the EU, those free allocations will also be phased-out (Art. 10a(1a) ETS Directive).However, operators still receive some free allocation of allowances under the transi-tional regime of Art. 10a ETS Directive. The amount of free allowances is thereby calculated based on specific product benchmarks, multiplied with the historic activity levels of the instal-lation. The benchmarks are thereby based on the average emissions from all types of hydro-gen production, and do not distinguish between renewable, low carbon and conventional, fossil hydrogen production, according to Annex I of Commission Delegated Regulation (EU) 2019/331. The amount is adjusted by a so-called “bonus/malus” system. This system essen-tially punishes the least energy efficient companies by reducing the amount of free allocation they can get by 20 % while rewarding the most efficient ones by increasing the amount of free allocation they can get by 10 %. The amount is also adjusted by the phase-out factor for free allocation (Art. 16, Commission Delegated Regulation (EU) 2019/331). Since hydrogen is included in the CBAM, for hydrogen, that phase-out factor is the CBAM-factor, and free allocation will end 2034. 6Art. 10a(1a) ETS Directive: “The CBAM factor shall be equal to 100 % for the period between the entry into force of that Regulation and the end of 2025 and, subject to the application of provisions referred to in Article 36(2), point (b), of that Regulation, shall be equal to 97,5 % in 2026, 95 % in 2027, 90 % in 2028, 77,5 % in 2029, 51,5 % in 2030, 39 % in 2031, 26,5 % in 2032 and 14 % in 2033. From 2034, no CBAM factor shall apply.”

3. Economic Assessment

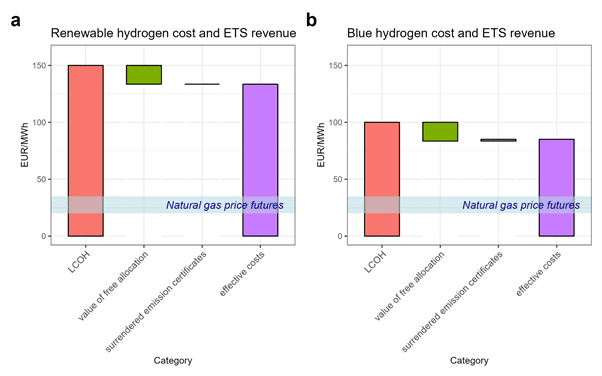

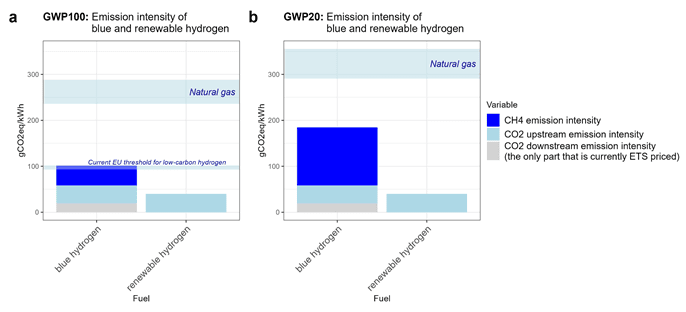

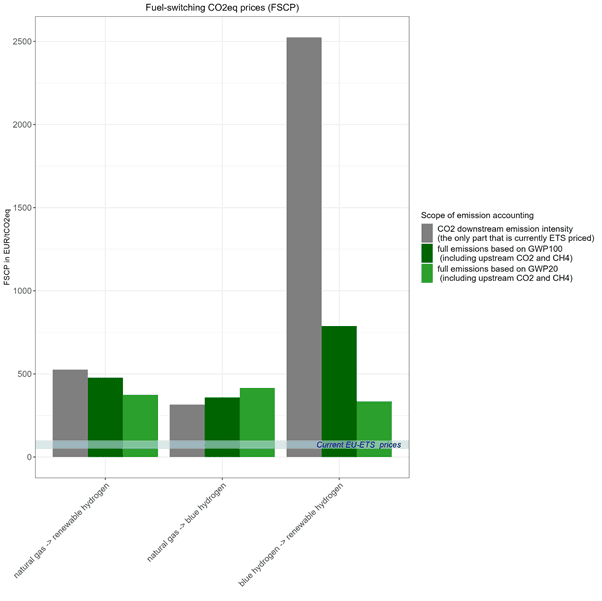

In an economic assessment, the cost competitiveness of blue and renewable hydrogen with one another and with natural gas is compared. First, the near-term costs are assessed based on the current EU ETS including the impact of free allocations given to hydrogen pro-ducers (Figure 1). Then the question is asked: How would the cost competitiveness change if upstream emissions of CO2 and methane (compare Figure 2) were included in the EU ETS? For this purpose, the required CO2 prices – so called fuel-switching CO2 prices – to switch from more emission-intensive to cleaner options (e.g., from blue to renewable hydrogen) are calculated (Figure 3).

Both renewable and blue hydrogen production costs will likely be dramatically higher than those of natural gas (Figure 1). Natural gas is the main competitor in many important hy-drogen applications, for example in the energy-intensive industry or energy supply sectors. 7In applications such as industrial process heat and the power sector, hydrogen and natural gas can generally be considered perfect substitutes on a per MWh basis. However, in the case of iron ore reduction, substitutability must be assessed per molecule, as slightly less hydrogen is required per MWh of natural gas to achieve the same reduction effect. In 2025 to 2030, renewable hydrogen costs are estimated to be about six times as high as those of natural gas. Low carbon blue hydrogen will likely be about four times as expensive as natural gas.

These cost gaps are only slightly reduced by the value of freely allocated emission certifi-cates (green part in Figure 1) for hydrogen production in the EU ETS. The current CO2 prices are simply too low to create much of a difference in the very high hydrogen costs. While the EU ETS provides incentives to reduce emissions where it is the most cost-efficient, it is not designed to support a specific technology or industry transformation option. Instead, innova-tion market failures such as knowledge spillovers related to both renewable as well as blue hydrogen require technology-specific policies, e.g., subsidies or regulation such as end-use quotas (compare Ueckerdt et al. 2024, and Odenweller & Ueckerdt 2025), directly pushing the scale-up or compensate the economic risks inhibiting private investments in hydrogen technology.

With respect to emissions, as there is no strong incentive from the EU ETS, we assume here that blue hydrogen just meets the EU emissions threshold for low carbon hydrogen in their life-cycle emissions. This threshold accounts for life-cycle emissions including i) upstream (and midstream) CO2 emissions, ii) upstream (and midstream) non-CO2 emissions (methane) and iii) downstream CO2 emissions . Note again that the EU threshold requires low carbon hydrogen to reduce emissions by 70 % compared to a fossil fuel comparator that is parame-terized with respect to grey hydrogen. Importantly, this translates to only ~60 % emission reduction compared to natural gas (Figure 2a). As a result, upstream emissions (both CO2 and methane) can be quite high, while still complying with EU thresholds for low carbon hy-drogen set in the Gas and Hydrogen Markets Directive (EU) 2024/1788.

For upstream emissions we assume 1.65 % methane leakage, which is the global average calculated based on IEA data (IEA 2022). This is in line with recent estimates for the US, based on new measurement techniques (Sherwin et al. 2024), and much higher than close-to-zero rates typically reported for Norway or the Netherlands. Unless blue hydrogen is pro-duced in countries with such clean supply infrastructures, methane leakage together with upstream CO2 emissions are accumulating to an extent that leaves little room for down-stream emissions, to not exceed the emission threshold. Applying global average upstream emissions, to still achieve EU thresholds, producers in the EU need to implement very high CO2 capture rates (~93 %) such that downstream CO2 emissions are low. For renewable hy-drogen, we assume that the electrolyser runs 100 % on renewable electricity either via a direct connection to renewable plants or in a grid-connected case via hourly matching in accordance with Delegated Regulation (EU) 2023/1184.

In the comparison of effective costs of renewable and blue hydrogen, the emissions certifi-cates that need to be surrendered for blue hydrogen production are negligible. This is due to a low CO2 price (here 80 €/tCO2) and a result of the assumption of a high CO2 capture rate to achieve the EU threshold. As the EU ETS is blind for upstream emissions, the differences in associated emissions are not translated into costs or competitiveness differences. As a result, there is a substantial cost gap between the cost of renewable hydrogen, and the cost of more emissions-intensive blue hydrogen (Figure 2).

Given these cost gaps at current CO2 prices, we determine the future CO2 prices that would be required to create cost parity between emissions-intensive natural gas and renewable or blue hydrogen. These fuel-switching CO2 prices (FSCPs) are very high (Figure 3), i.e., in the range of 300-500 €/tCO2. Switching from emission-intensive blue to cleaner renewable hydrogen even requires CO2 prices of 2500 €/tCO2 if only downstream emissions are priced. Including upstream emissions would lower the FSCPs to ~750 €/tCO2 for GWP100 and ~300 €/tCO2 for GWP20.

GWP100 and GWP20 are both metrics used to express the climate impact of greenhouse gases like methane (CH₄) relative to carbon dioxide (CO₂), but they differ in the time horizon over which this impact is assessed. GWP100 uses a 100-year time frame and assigns methane a global warming potential of 28 to 30, meaning that over 100 years, one tonne of methane causes approximately 28 to 30 times more warming than one tonne of CO₂. This long-term perspective is widely used in climate reporting and policy, making GWP100 the standard metric for life cycle assessments and strategies focused on long-term climate stabilization.

GWP20, in contrast, uses a 20-year time frame and assigns methane a much higher GWP of 84 to 87, reflecting its strong but short-lived climate impact. Methane remains in the atmosphere for only about 12 years, so GWP20 captures its disproportionate contribution to near-term warming. This makes GWP20 especially relevant when the goal is to reduce short-term climate effects such as limiting the global peak temperature in the coming decades.

Note that Figure 2 evaluates a scenario where upstream emissions of natural gas and blue hydrogen are not reduced. As associated marginal abatement costs can be comparatively low (<100 €/tCO2), high carbon prices that include those emissions or ambitious regulation (low thresholds) could incentivise low-emissions supply chains for blue hydrogen, even though there remains high uncertainty in the deployment speed and depths of associated measures.

4. Discussion

After assessing the legal and economic dimension, the impacts of the EU ETS reform on hy-drogen are discussed from different perspectives. Namely, what are the implications of the EU ETS reform for: a) the EUs regulatory framework of hydrogen, and b) emissions reduc-tions. On the basis of the discussion, recommendations for the development of the regulato-ry framework are outlined.

4.1 Implications for the Regulatory Framework

From a legal perspective, the question arises if the reform of the EU ETS provides more coherence and clarity for the regulatory framework of hydrogen. With the reform, the European Commission aimed to create an equal free allocation framework for hydrogen by extending the EU ETS from installations producing conventional, fossil-based hydrogen to hydrogen independent of the production method. The EU ETS reform therefore accomplished more internal coherence when it comes to hydrogen, as the exclusion of other production methods is hardly justifiable and the new integration of low carbon hydrogen guarantees the pricing of residual emissions (downstream CO2 only), closing a gap in the coverage of the EU ETS.

Going beyond the assessment of the internal coherence of the EU ETS, the general purpose and suitability of the EU ETS and free allocations as an instrument for the hydrogen scale-up has to be discussed. It is important to note that the EU ETS is not designed as a support instrument for specific industries or specific options towards decarbonisation such as hydrogen. Its purpose is to cost-effectively reduce emissions throughout all the sectors it covers. Accordingly, this analysis highlights that the competitiveness gap of hydrogen needs to be addressed outside the EU ETS. Across all EU ETS sectors, a switch from natural gas to renewable or low carbon hydrogen is not the most cost-effective measure to reduce CO2 emissions yet. But it is already clear today that the use of hydrogen is necessary to achieve climate neutrality by 2050 and that the development of a hydrogen economy requires significant long-term efforts and fundamental transformations that cannot be achieved overnight. Therefore, policy instruments, such as standards, targets, quotas, EU level funding, state aid and sustainable financing rules should ensure a functioning hydrogen market will be in place.

4.2 Implications for Emissions Reductions

The EU standards require a 70 % reduction in emission relative to fossil-based hydrogen (without CCS) as a fossil fuel comparator, which is equivalent to a 60 % reduction compared to natural gas. Accordingly, compared to natural gas, blue hydrogen is allowed to emit 40 % as residual life-cycle emissions. This induces a high emissions intensity threshold of 28.2 gCO2eq/MJ, showcasing an unambitious approach towards the standards of low carbon hydrogen and its impact on emissions reductions.

But can the EU ETS reform compensate for the lack of ambition by pricing the emissions caused by hydrogen production? In regards to the emissions from low carbon hydrogen production effectively falling under the EU ETS, significant effects of the carbon pricing on hydrogen production cannot be expected any time soon. The carbon price is too low and only a small fraction of the residual emissions is covered. As a result, the fuel switch from high-emission blue hydrogen, which just meets the threshold, to cleaner blue or renewable hydrogen would require exceptionally high CO2 prices. Consequently, there is a minimal incentive, both under the current standards and the EU ETS, to reduce emissions beyond the unambitious threshold set for low carbon hydrogen or to invest in renewable instead of low carbon hydrogen.

In practice, the production of blue hydrogen by standard SMR with CCS is only possible using natural gas with low upstream emissions, e.g., from Norway (Agora Industry & Agora Energiewende 2024). Natural gas from other countries has such high leakage rates that innovations in technologies with higher CO2 capture rates, such as ATR, are required to comply with the existing threshold.

Since methane emissions and CO2 upstream emissions are not priced under the EU ETS, the overall carbon footprint of gas-based hydrogen production is not fully accounted for. This undermines the effectiveness of the EU ETS in reducing the climate impact across the hydrogen value chain. To address methane emissions in the EU regulatory framework, the Methane Regulation (EU) 2024/1787 introduces reporting, monitoring and reduction obligations for fossil fuel producers. While this is a first step to close the regulatory gap, it falls short on directly pricing methane emissions, which would be necessary to fully integrate these emissions into the EU ETS framework. Furthermore, the obligations laid out in the Methane Regulation will be fully introduced and enforced in 2030, leaving methane emissions insufficiently regulated until then. For example, a draft delegated regulation specifying the calculation of GHG emission reductions required for low carbon fuels is proposing to use standard values for upstream methane emissions that do not represent the site-specific emissions (European Commission 2024) and are low compared to recent measurements (Sherwin et al. 2024).

4.3 Policy Recommendations

In principle, the EU ETS and CBAM are suitable instruments to provide incentives for emis-sion reductions of blue hydrogen and the uptake of renewable hydrogen, but only under certain conditions. Positive effects would likely occur if the following points are addressed:

- Upstream emissions, including methane, should be priced for a full internalisation of the climate change externality through carbon pricing. An extension of the EU ETS and CBAM to upstream emissions would provide a more accurate representation of emissions caused in the EU, as well as embedded in imported goods, and strengthen the EU ETS as the central market-based instrument to cost-effectively reduce emissions. For blue hydrogen in particular, it would provide both incentives for using clean natural gas supply chains and investing in technologies that can achieve higher carbon capture rates, such as autothermal reforming;

- Policymakers need to commit to maintain a very high CO2 price for two reasons. First, switching from natural gas to hydrogen requires high CO2 prices both for blue and green hydrogen. Second, switching from blue hydrogen with residual emissions to zero-emission green hydrogen requires very high CO2 prices even in case all upstream emissions are covered by the EU ETS.

One element to increased political commitment was the adjustment of the linear reduction factor of the cap through the revision of the ETS Directive to 4.3 % per year over the period of 2024 to 2027, and 4.4 % per year from 2028. This facilitates a cost-effective path towards climate neutrality in the EU (Zaklan et al. 2021). But an additional measure to ensure a high price level in the case of market distortions would be the introduction of a price floor for the EU ETS (Flachsland et al. 2020). Long-term political commitments that are mirrored in the design of the EU ETS, for example by a price floor, also enhance policy credibility (Nemet et al. 2017) that directly affect investment decisions in green technologies (Sitarz et al. 2024). - The use of Global Warming Potential over 20 years (GWP20) – instead of GWP100 – would factor in more of the short-term climate effects of methane, i.e., the increasing impact on global peak temperatures. The right choice of metric is a challenging task and open research question. From an economic perspective, the metric should reflect the economic damages caused by methane emissions compared to CO2 emissions. If peak warming is the main driver of economic damages, GWP20 is more meaningful and would lead to a reduction in short-lived methane emissions. If long-term climate stability is more important, then GWP100 is more meaningful and the relative im-portance of CO2 emission reduction increases.

- Moreover, and in particular if the above-mentioned ETS reform faces implementation barriers, greater credibility in an effective hydrogen emission reduction could be achieved by gradually lowering the emission intensity threshold of low carbon hydro-gen. The current approach of a fixed and rather high emission threshold fails to sup-port sufficient innovation and investments in technologies achieving higher emission reductions (e.g., further developing ATR), as producers have no incentive to go below the fixed threshold of 28.2g CO2eq/MJ. An iterative reduction of the emission threshold could provide a predictable pathway to secure positive effects of blue hy-drogen on climate mitigation.

- Finally, the EU ETS is not intended to support specific technologies. To promote the long-term transition from fossil-based and low carbon hydrogen to renewable hydrogen, other instruments need to be used, such as targets for RFNBOs in the Renewable Energy Directive, the ReFuelEU Aviation Regulation and FuelEU Maritime Regulation. These sector-specific targets are crucial to create incentives for the production of renewable hydrogen compliant with the RFNBO criteria and the uptake in key end-use sectors, fostering a fuel switch from low carbon to renewable hydrogen.

5. Conclusion

In conclusion, while the EU ETS reform improved the internal coherence for CO2 pricing of hydrogen production, it falls short in driving significant long-term emission reductions and supporting the widespread ramp-up of renewable hydrogen. The current policies for low carbon hydrogen remain unambitious, allowing substantial residual emissions to prevail in production. The EU ETS only has a limited coverage of emissions and the prices are insuffi-cient to significantly impact the hydrogen market or incentivize innovations in cleaner tech-nologies delivering emissions reductions beyond existing thresholds.

To effectively support the market ramp-up of renewable hydrogen and achieve higher emis-sions reductions, additional policy measures are necessary. Besides already existing target-ed support programs for renewable hydrogen, an iterative reduction of emissions thresh-olds for low carbon hydrogen and the integration of upstream emissions (including me-thane) into the EU ETS framework are valid options that safeguard a path towards climate neutrality.

Literaturangaben

Agora Industry / Agora Energiewende (2024): Low-carbon hydrogen in the EU – Towards a robust EU definition in view of costs, trade and climate protection, https://www.agora-energiewende.org/fileadmin/Projekte/2024/2024-11_EU_Low_Carbon_H2/A-EW_334_Low_Carbon_H2_WEB.pdf.

Alonso, A. Martinez / Naval, N. / Matute, G. / Coosemans, T. / Yusta, J.M. (2024): Phasing out steam methane reformers with water electrolysis in producing renewable hydrogen and ammonia: A case study based on the Spanish energy markets, in: International Journal of Hydrogen Energy, Vol. 52, Part A, pp. 1472-1487, https://doi.org/10.1016/j.ijhydene.2023.07.347.

Bauer, Christian / Treyer, Karin / Antonini, Cristina / Bergerson, Joule / Gazzani, Matteo / Gencer, Emre / Gibbins, Jon / Mazzotti, Marco / McCoy, Sean T. / McKenna, Russell / Pietzcker, Robert / Ravikumar, Arvind P. / Romano, Matteo C. / Ueckerdt, Falko / Vente, Jaap / van der Spek, Mijndert (2022): On the climate impacts of blue hydrogen production, in: Sustainable Energy Fuels, Vol. 6, pp. 66-75, https://doi.org/10.1039/D1SE01508G.

Bleischwitz, Raimund / Bader, Nikolas (2010): Policies for the transition towards a hydrogen economy: the EU case, in: Energy Policy, Vol. 38 (10), pp. 5388-5398, https://doi.org/10.1016/j.enpol.2009.03.041.

Bruch, Nils / Knodt, Michèle (2024): Low carbon hydrogen in the European Union: A coherent regulatory framework, Kopernikus project Ariadne, Potsdam, https://doi.org/10.48485/pik.2024.012.

Dales, John Harkness (1968), Pollution, Property and Prices, University of Toronto Press, 1968.

European Commission (2020): A hydrogen strategy for a climate-neutral Europe, COM (2020) 301 final, Brussels, 8.7.2020, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0301.

European Commission (2021): Proposal for a Directive of the European Parliament and of the Council on common rules for the internal markets in renewable and natural gases and in hydrogen, COM (2021) 803 final, Brussels, 15.12.2021, https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021PC0803.

European Commission (2021a): Commission Staff Working Document, Impact Assessment Report, Accompanying the document Directive of the European Parliament and the Council, amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union, Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and Regulation (EU) 2015/757, SWD(2021) 601 final, Part 1/4, Brussels, 14.07.2021, https://eur-lex.europa.eu/resource.html?uri=cellar:7b89687a-eec6-11eb-a71c-01aa75ed71a1.0001.01/DOC_1&format=PDF.

European Commission (2024): Methodology to determine the greenhouse gas (GHG) emission savings of low-carbon fuels, Have your say – Public Consultations and Feedback, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/14303-Methodology-to-determine-the-greenhouse-gas-GHG-emission-savings-of-low-carbon-fuels_en.

European Hydrogen Observatory (2024): The European hydrogen market landscape, November 2023 (Report 01), Updated February 2024, https://observatory.clean-hydrogen.europa.eu/tools-reports/observatory-reports.

Faure, Michael G. / Pertain, Roy A. (2019): Environmental Law and Economics, Cambridge, Cambridge University Press.

Ferrario, Andrea Monforti / Cigolotti, Viviana / Ruz, Ana Marìa / Gallardo, Felipe / García, Jose / Monteleone, Guilia (2022): Role of Hydrogen in Low-Carbon Energy Future, in: Graditi, Giorgio and Di Somma, Marialaura (Eds.): Technologies for Integrated Energy Systems and Networks, https://doi.org/10.1002/9783527833634.ch4.

Flachsland, Christian / Pahle, Michael / Burtraw, Dallas / Edenhofer, Ottmar / Elkerbout, Milan / Fischer, Carolyn / Tietjen, Oliver / Zetterberg, Lars (2020): How to avoid history repeating itself: the case for an EU Emissions Trading System (EU ETS) price floor revisited, in: Climate Policy, Vol. 20 (1), pp. 133-142, https://doi.org/10.1080/14693062.2019.1682494.

George, Jan Frederick / Müller, Viktor Paul / Winkler, Jenny / Ragwitz, Mario (2022): Is blue hydrogen a bridging technology? – The limits of a CO₂ price and the role of state-induced price components for green hydrogen production in Germany, Energy Policy, Vol. 167, 113072, https://doi.org/10.1016/j.enpol.2022.113072.

Hermesmann, M. / Müller, T.E. (2022): Green, Turquoise, Blue, or Grey? Environmentally friendly Hydrogen Production in Transforming Energy Systems, in: Progress in Energy and Combustion Science, Vol. 90, 100996, https://doi.org/10.1016/j.pecs.2022.100996.

Hydrogen Europe (2023): Clean Hydrogen Monitor 2023, https://hydrogeneurope.eu/wp-content/uploads/2023/10/Clean_Hydrogen_Monitor_11-2023_DIGITAL.pdf.

IEA (2022): Global Methane Tracker – Documentation, IEA, Paris, https://iea.blob.core.windows.net/assets/b5f6bb13-76ce-48ea-8fdb-3d4f8b58c838/GlobalMethaneTracker_documentation.pdf.

IEA (2023): Global Hydrogen Review 2023, IEA, Paris, https://www.iea.org/reports/global-hydrogen-review-2023.

Nemet, Gregory F. / Jakob, Michael / Steckel, Jan Christoph / Edenhofer, Ottmar (2017): Addressing policy credibility problems for low-carbon investment, in: Global Environmental Change, Vol. 42, January 2017, pp. 47-57, https://doi.org/10.1016/j.gloenvcha.2016.12.004.

Nysten, Jana Viktoria (2023): Der EU-Grenzausgleichsmechanismus als logische Folge des EU-Emissionshandels, in: KlimaRZ, Vol. 2, pp. 95-102.

Odenweller, A., Ueckerdt, F. The green hydrogen ambition and implementation gap. Nat Energy 10, 110–123 (2025). https://doi.org/10.1038/s41560-024-01684-7.

Odenweller, Adrian / George, Jan / Müller, Viktor Paul / Verpoort, Philipp / Gast, Lukas / Pfluger, Benjamin / Ueckerdt, Falko (2022) : Analyse : Wasserstoff und die Energiekrise – fünf Knackpunkte, Ariadne-Analyse, 08.09.2022, https://ariadneprojekt.de/publikation/analyse-wasserstoff-und-die-energiekrise-funf-knackpunkte/.

Oni, A.O. / Anaya, K. / Giwa, T. / Di Lullo, G. / Kumar, A. (2022): Comparative assessment of blue hydrogen from steam methane reforming, autothermal reforming, and natural gas decomposition technologies for natural gas-producing regions, in: Energy Conversion and Management, Vol. 254, 115245, https://doi.org/10.1016/j.enconman.2022.115245.

Pause, Fabian / Nysten, Jana / Harder, Kimberly (2023): Das neue EU-Emissionshandelssystem für Gebäude und Straßenverkehr und die Abfederung von Belastungen durch den EU-Klima-Sozialfonds, in: Zeitschrift für Europäisches Umwelt- und Planungsrecht, Vol. 21 (2), pp. 196-207, https://eurup.lexxion.eu/article/EURUP/2023/2/11.

Riemer, Matia / Duscha, Vicki (2022): Carbon Capture in Hydrogen Production – Review of Modelling Assumptions, Energy Proceedings 2022, Fraunhofer Institute for Systems and Innovation Research ISI, ISSN 2004-2965, https://publica-rest.fraunhofer.de/server/api/core/bitstreams/77ec29e5-4af8-4812-9793-8501f92a6f8d/content.

Sherwin, Evan D. / Rutherford, Jeffrey S. / Zhang, Zhan / Chen, Yuanlei / Wetherley, Erin B. / Yakovlev, Petr V. / Berman, Elena S. F. / Jones, Brian B. / Cusworth, Daniel H. / Thorpe, Andrew K. / Ayasse, Alana K. / Duren, Riley M. / Brandt, Adam R. (2024): US oil and gas system emissions from nearly one million aerial site measurements, in: Nature, Vol. 627, pp. 328-334, https://doi.org/10.1038/s41586-024-07117-5.

Sitarz, Joanna / Pahle, Michael / Osorio, Sebastian / Luderer, Gunnar / Pietzcker, Robert (2024): EU carbon prices signal high policy credibility and farsighted actors, in Nature Energy, Vol. 9, pp. 691-702, https://doi.org/10.1038/s41560-024-01505-x.

Talus, Kim / Pinto, Jaqueline / Gallegos, Francisca (2024): Realism at the end of the rainbow? An argument towards diversifying hydrogen in EU regulation, in: Journal of World Energy Law & Business, jwae007, https://doi.org/10.1093/jwelb/jwae007.

Ueckerdt, Falko / Verpoort, Philipp C. / Anantharaman, Rahul / Bauer, Chistian / Beck, Fiona / Longden, Thomas / Roussanaly, Simon (2024): On the cost competitiveness of blue and green hydrogen, in: Joule, Vol. 8 (1), pp. 104-128, https://doi.org/10.1016/j.joule.2023.12.004.

Zaklan, Aleksandar / Wachsmuth, Jakob / Duscha, Vicki (2021): The EU ETS to 2030 and beyond: adjusting the cap in light of the 1.5°C target and current energy policies, in: Climate Policy, Vol. 21 (6), pp. 778-791, https://doi.org/10.1080/14693062.2021.1878999.