Energy tax reform and the development of an environmental tax

Short- and long-term adaptation of climate taxation

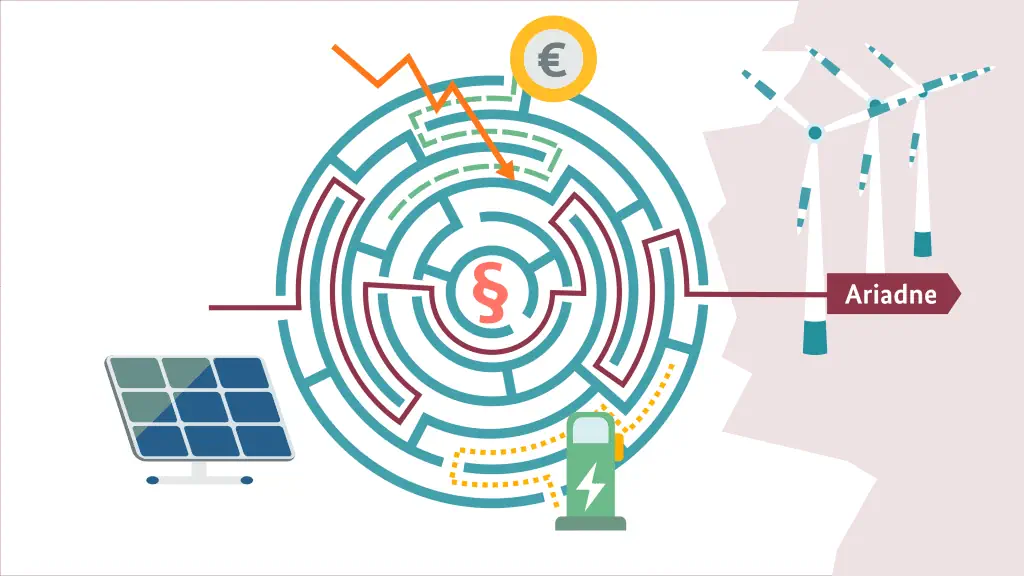

The German system of taxes and levies as an instrument of control is not sufficient to reduce emissions, increase the price of environmentally harmful behaviour, nor to provide incentives for sustainable development. Environmental taxes and levies have great potential to pave the way for climate neutrality. In addition to directing the use of energy, the revenues can also create scope for action, resolve distributional conflicts, or target economic development by lowering other taxes.

Ariadne examines the fiscal aspects of the energy transition and addresses various issues. Using modelling and calculations to assess the long-term effects of lower energy tax revenues, to identify how shortfalls can be compensated for, and how to fairly distribute the burden on CO2-pricing and other environmental taxes. At the same time, the Ariadne experts deal with the climate impact of taxes on the environment and on the electricity and transport sectors. The aim is to compile options and instruments that fiscal policymakers can use to stabilise the economy and simultaneously steer investments towards climate protection.

News from the project

Hydrogen, Europe & Green Deal, Governance & Institutions, Scenarios, Tax reform, Industrial transition, Heating transition, Electricity Transition, Transport transition, Distributive justice |

New Ariadne paper highlights EU climate policy from 2030 onwards

The EU is in the midst of a debate on new climate targets for 2040 and how the competitiveness of industry can be linked to decarbonization. In a new background paper, Ariadne researchers analyze the historically evolved energy and …

to NewsEurope & Green Deal, Governance & Institutions, Scenarios, Tax reform, Industrial transition, Heating transition, Electricity Transition, Transport transition, Hydrogen |

Working together toward climate neutrality

In a new short video, the Kopernikus project Ariadne shows why research into climate policy measures is so important for achieving climate neutrality.

to News